The Bitcoin halving countdown has reached the one-month mark with estimates targeting 29-31 days left to go. The halving event will reduce the amount of new Bitcoin entering the circulating supply by dropping mining rewards by 50%. The event has triggered increasing interest as central banks resort to money printing to counter the economic blow of coronavirus.

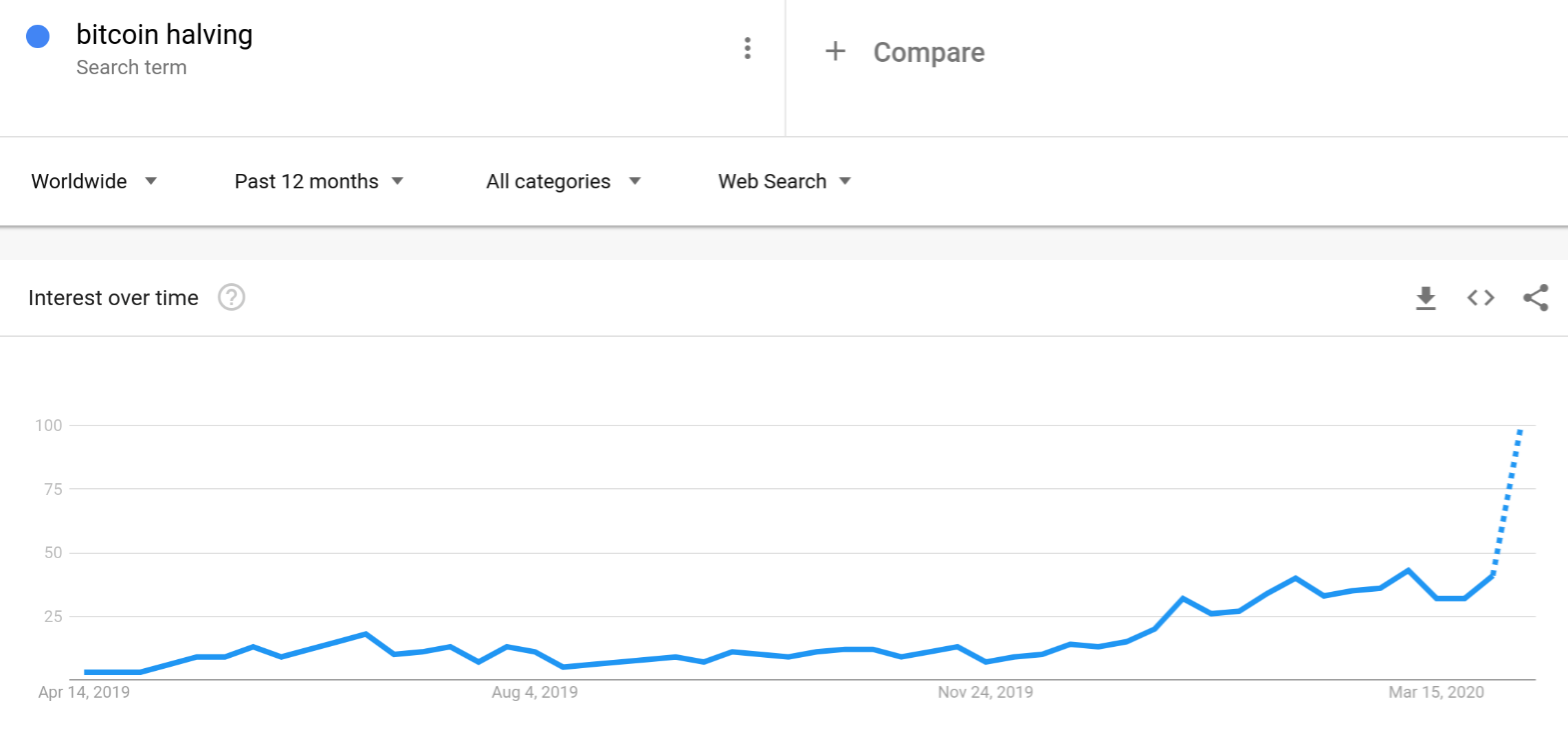

“Bitcoin halving countdown”, “Bitcoin halving price chart” and “Bitcoin halving clock” are all currently trending on Google as breakout searches in the US. “Bitcoin halving prediction”, “Bitcoin halving price prediction” and “Bitcoin halving 2020” are all breakout searches worldwide.

Around the globe, Slovenia, St. Helena, Switzerland, Singapore and the Netherlands lead the world in “Bitcoin halving” searches, according to Google Trends, with South Africa and Venezuela rounding out the top 10.

Bitcoin has a fixed supply of 21 million units. That number can’t be adjusted by any central authority. Minus the monetary policy levers that central banks can change at will to maintain objectives and control the financial system, the Bitcoin network, which relies on mathematics and cryptography to secure transactions, stands in stark contrast to the status quo.

Supporters say Bitcoin will prove itself as a viable alternative to world currencies, central bankers and politicians by creating a sound form of money. Against a backdrop of quantitative easing, the highly volatile and decentralized asset remains resistant to a supply surge.

With an uptick in interest, the Bitcoin halving is expected to add supply pressure when it begins next month around May 11th. How the halving will affect price is largely disputed with some analysts saying that the halving will have little to no impact since the event has already been priced in.

James Todaro, head of research at TradeBlock, anticipates a price rise.

“Following the bitcoin halving, miners’ estimated breakeven costs will rise from ~$7,000 today to ~$12,000-15,000 per BTC after. I would not be surprised if we see bitcoin prices rise above these levels so that miners remain profitable.”

Crypto analyst PlanB, who popularized the stock-to-flow model to predict the price of Bitcoin, breaks down why he believes BTC is on a trajectory to the upside.

“To maintain $7000 since Oct 2017, bitcoin must have had about $400M new cash inflow every month last 2.5 years! (30d x 24h x 6blocks x 12.5btc x $7k assuming all trading is zero sum game)

After the halving, we only need $200M per month to keep $7k level. If $400M stays, then rocket.”

In the long term, the founder of Social Capital and former Facebook executive Chamath Palihapitiya says Bitcoin will either moon or die, giving the king coin a 5 to 10% chance of soaring to millions of dollars.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Ellerslie