October 27, 2025 – Singapore, Singapore

StableStock, the on-chain stock-liquidity infrastructure, has partnered with Native, a next-generation DEX (decentralized exchange), to bring real US equities onto BNB Chain.

The first batch worth nearly $10 million includes ‘Mag7’ tech giants (sTSLA, sNVDA, sAAPL), mid-cap favorites (sCOIN, sGLXY, sINTC, sCRCL) and DAT stocks (sBMNR, sSBET, sBNC, sALTS), alongside the debut of sQQQ, sCOPX and sBLSH thematic assets offering investors broad on-chain exposure from leading tech equities to commodities and alternative markets.

For the first time, users can buy and trade fully backed US stock tokens on-chain, 24 hours a day, directly with stablecoins, either through the ‘Swap’ page on StableStock’s official website or via integrated wallets such as Native Swap and OKX Wallet.

Each token follows StableStock’s sToken standard, maintaining a one-to-one peg with the underlying share while remaining freely composable across DeFi.

StockFi A new chapter in the financialization of equities

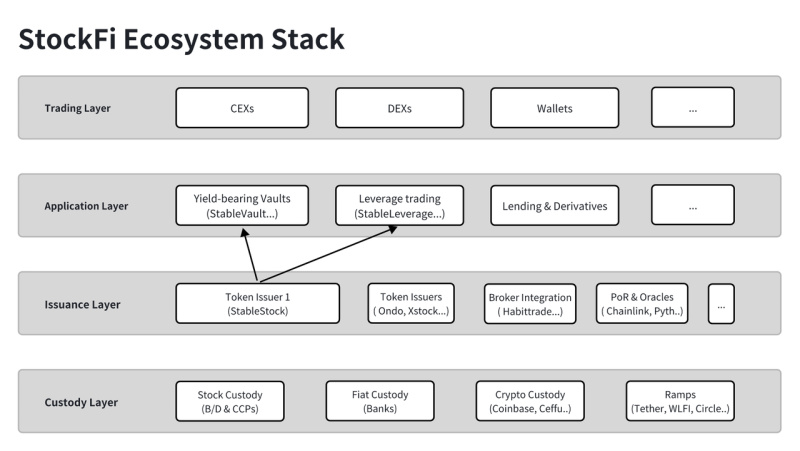

StableStock calls this new frontier StockFi tock plus DeFi the financialization and decentralization of global equities.

Over the past decade, crypto has put currencies, commodities and credit on-chain. Stocks, one of the world’s largest asset classes, have remained offline.

StableStock aims to change that through a multi-layered system linking custody, issuance and trading.

From vision to reality StableStock’s three-phase roadmap

To bring its StockFi vision to life, StableStock has outlined a clear three-phase strategic roadmap.

- Infrastructure connects TradFi rails and enables stablecoin purchases of real stocks (underway with the Native launch)

- Ecosystem products launching StableVault (November 2025) to let users earn yield on sTokens, and StableLeverage (early 2026) to bring margin trading on-chain

- Open collaboration upports builders to create stock-backed stablecoins, perpetuals and options once the foundation is live

Zixi Zhu, CEO of StableStock, said,

“Stocks will become the next great on-chain asset class after stablecoins.

“StockFi isn’t just a concept it’s a structural shift already underway.

“As real equities gain on-chain liquidity and programmability, the boundaries of global finance are being redrawn.”

About StableStock

StableStock is an on-chain stock-liquidity infrastructure bridging regulated brokers and DeFi protocols.

It enables global users to buy, trade and earn yield on tokenized equities 24/7 making real stocks as liquid, composable and programmable as stablecoins.

Incubated by YZi Labs Easy Residency and backed by top-tier VCs, StableStock has raised a multi-million USD seed round with participation from YZi Labs, MPCi and Vertex Ventures.

About Native

Native is another form of DEX, PMM DEX, that utilize a RFQ-based pricing system, and on-chain DEX pool for settlement to provide efficient on-chain maker liquidity.

Contact

Johnson Li, StableStock

This content is sponsored and should be regarded as promotional material. Opinions and statements expressed herein are those of the author and do not reflect the opinions of The Daily Hodl. The Daily Hodl is not a subsidiary of or owned by any ICOs, blockchain startups or companies that advertise on our platform. Investors should do their due diligence before making any high-risk investments in any ICOs, blockchain startups or cryptocurrencies. Please be advised that your investments are at your own risk, and any losses you may incur are your responsibility.

Follow Us on X Facebook Telegram