HodlX Guest Post Submit Your Post

July 08–14 Weekly Report: Improvement in market sentiment has translated to a slow recovery

Market Sentiment

The short-term outlook for the segment is positive. South Korea’s loosening restrictions of cryptocurrency trading served as a short-term catalyst to the segment’s recovery. This was in line with Coinbase Custody going live that brought a sudden upward pressure. As a result, net longs return, with mid/low caps outpacing performance relative to perceived systematic risk. In addition, there is a convergence in the performance as on average, 3 out of 5 altcoins have returned a better 7-day return than the top ten majors.

Here at Caviar, as of July 8th our aggregate exchange volume scrapper shows a BTC/USDT/JPY consensus probability of 41.2%. This real-time hourly indicator incorporates 1) cumulative bid/ask exchange volume across North America/Asia exchanges and 2) leading technical analysts sentiment across major crypto social medias with a 35% weight on GitHub activity. The tool provides a scenario analysis of the probability of a reversal in the dominant market trend. The outcome of our analysis registered an “upturn” reading with the suggestion that retail investors are returning back to trading.

Technical Analyses (https://www.tradingview.com/x/pfj3n0Bl)

Weekly candle closed above the trendline indicating a start of a potential uptrend.

Trendline are broken, nearest support — 6500, next resistance — 8000.

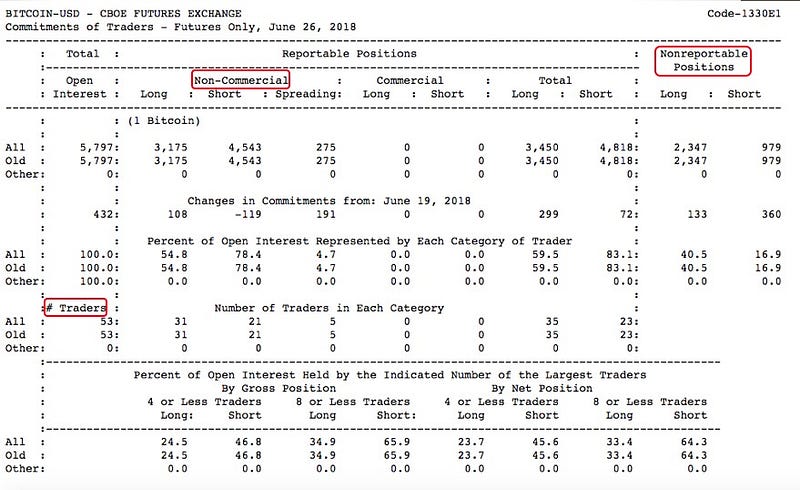

Futures Markets, COT Report

The release of the COT report on each Tuesday serves as a tool to identify crowded speculative trades as it provides insights to institutional positioning. Above is the most recent COT report which was issued last Friday July 6th but is based on data from Tuesday July 3rd. As of Tuesday of last week there were 4,543 short bitcoin futures positions and 3,175 long bitcoin futures positions held by what is defined as non-commercial traders. Non-commercial traders are those who are betting on the speculating on the price of Bitcoin and are NOT using the futures market for hedging purposes. As such, non-commercial traders were 59% net short. Here at Caviar, we are analyzing the gradual convergence in the number of shorts relative to longs as a short-term market bottom. That is, there is a higher chance that a bottom has occurred as we expect non-commercial to increase their net-long positions.

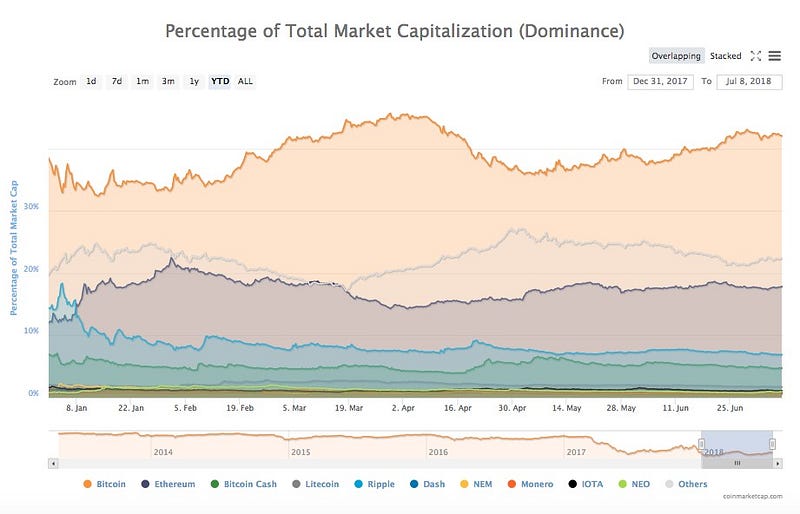

Market Cap Year-to-Date

The recent positive news-cycle coming out of Asia has lifted the segment. Many investors are using the average cost to mine a single bitcoin with the extrapolation that BTC historically trades at 2.5x of its mining cost to justify higher valuations.

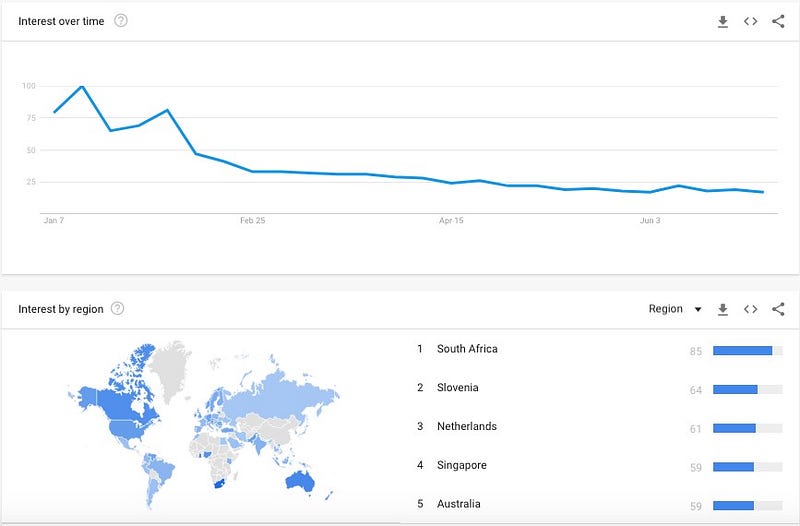

Google Trends (bitcoin)

Interest in Bitcoin searches have remained modestly stagnant in the past few weeks relative to the large January decline in bitcoin searches. For the past two weeks, the stagnation in bitcoin searches coincides with a time horizon in which Bitcoin traded primarily in a sideways channel of $6,800 to $5,800 on marginally higher exchange volumes. In turn, retail investors are seeing the recent news on custody solutions and regulatory reform as an improvement in the market environment.

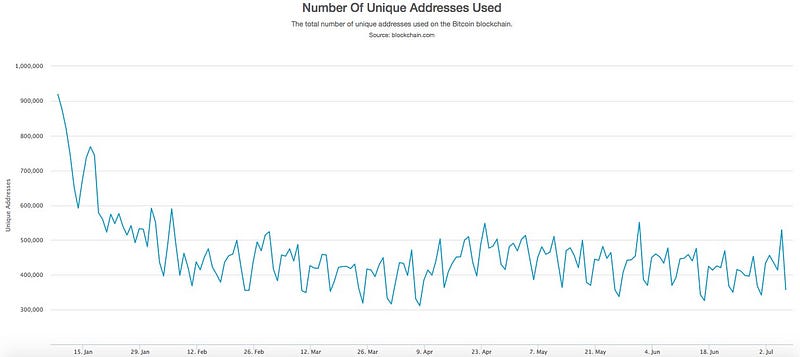

Number of new BTC and ETH wallets

The number of new wallets being created re?ects the decrease in the rate of new market entrants. The number of new wallets being created continues to be mixed. The fickle growth in new wallets relative to market cap implies a much larger decline in the rate of new wallets. Here at Caviar, we interpret widening spreads to be leading indicators on the continuation of the market trend, exercising caution on forecasts outside of 3–4 days.

Bitfinex BTC/USD Shorts from June 5th to July 8th

BTC shorts have largely come down. A new trend is emerging as traders reduce their shorts as BTC continues to show relative strength. We expect BTC/USD shorts to continue declining as signals of a bull-run continue to drive both retail and institutional investors back to the asset class.

July 08–14 Recommendation: Long ETC as July 13th Hard fork will see the emergence of Ethereum Emerald. On the new coin front, long GoChain on potential partnership announcement.

Disclaimer

This report has been compiled by Caviar for informational purposes only. The views expressed within are Caviar’s in its entirety. The information within this report is our own opinion only and is not to be used in making a decision for investment. We are not financial advisers, you should consult your own investment adviser before taking any action to acquire or deal in, or follow a recommendation (if any) in respect to any of the financial products or information mentioned in this report. Whilst Caviar believes everything contained in this report is based on information which is considered to be reliable, its accuracy and completeness are not guaranteed and no warranty of accuracy or reliability is given or implied, and no responsibility for any loss or damage arising in any way for any representation, act or omission is accepted by Caviar or by any officer, agent or employee of Caviar or its related entities. Caviar makes no judgements or representations about the legal status and/ or compliance of any company, cryptocurrency or token mentioned in this report. Caviar may at this time, or at any time in the future, without further notice, open positions in any of the cryptocurrencies or tokens discussed in this report.

Follow Us on Twitter Facebook Telegram