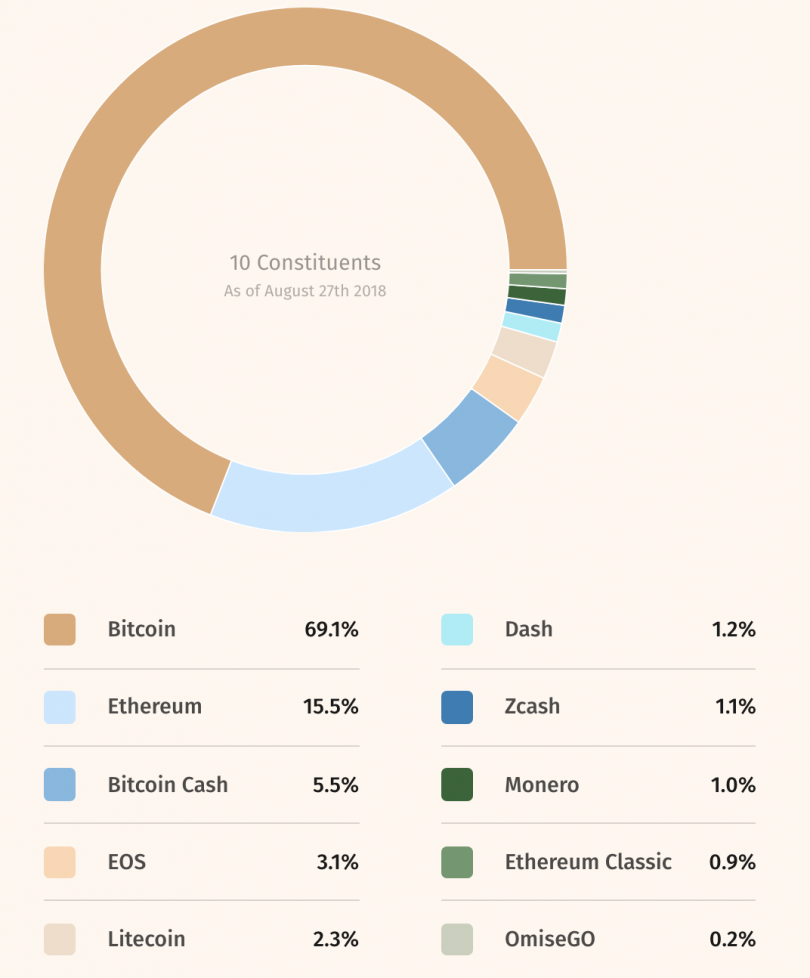

Launched by Morgan Creek Capital Management, a global asset manager that offers access to blockchain technology and digital assets for institutional clients and wealthy family offices, the fund will include several altcoins, including Litecoin, Ethereum, Ethereum Classic, Bitcoin Cash, EOS, Dash, Zcash, Monero and OmiseGO.

CEO of Morgan Creek Mark Yusko says, “Every investor should be considering an allocation to digital assets right now.” Yusko, who is also president of the Investment Committee of The Hesburgh-Yusko Scholars Foundation at the University of Notre Dame, affirms that interest in cryptocurrency from institutional investors is real. He says they’re asking for exposure to the space and that the Digital Asset Index Fund is a response to demands and is tailored specially for high-net investors.

Morgan Creek Capital Management, a multi-billion dollar investment advisor, tapped Bitwise as a partner for the new fund due to its strength in quantitative index rules and professional fund management.

We feel the same way @MarkYusko! It's an honor to partner with the #MorganCreekDigital team to launch the #DigitalAssetIndexFund. https://t.co/ggR0Pio7Mp https://t.co/0LQR5hIYiy

— Bitwise (@BitwiseInvest) August 29, 2018

The fund will track the Morgan Creek Bitwise Digital Asset Index comprised of “the top 10 cryptocurrencies”, giving a big institutional boost for nine altcoins in addition to Bitcoin. Yet several top coins by market cap are excluded. These include non-mineable coins Ripple aka XRP (#3), Stellar (#6), Cardano (#8), IOTA (#9) and Tron (#10), with respective rankings by market cap, according to WorldMarketCap.

While the top excluded coins all have some percentage of pre-mined coins which were first created when their blockchain launched, so does Ethereum. EOS and OMG are also not mineable.

[the_ad id="42537"] [the_ad id="42536"]“If there’s a central party that owns 30% or more of supply, then we withhold those from the index,” said Morgan Creek Digital partner Anthony Pompliano, reports Forbes. “Because we think that introduces a lot of additional risk that may not be there if it was a more decentralized network.”

According to the announcement, included coins passed a set of requirements.

“Assets must pass rigorous, rules-based eligibility requirements including custody qualifications, trade concentration limits and pre-mine restrictions to qualify for inclusion. All assets are kept in 100% cold storage—the best practice for security—and are audited annually.”

My share of the premine was 0.7% of current supply. Not sure what model that has me as a profit-maximizing agent would predict that, esp in contrast with top Ripple holders and basically every other recent cryptocurrency.

— vitalik.eth (@VitalikButerin) January 18, 2018

By contrast, Ripple owns 60% of XRP, which was pre-mined; Stellar has distributed 8.1 billion of its native coin Lumens, which has a supply of 104.24 billion; and Tron has locked 33.25 billion TRX in 1,000 addresses on the Tron mainnet out of total supply of 99 billion.

The new crypto fund covers approximately 75% of the market — with Bitcoin in the dominant position at 69.1% of the composition.

Digital Asset Index Fund

Bitwise has been a leader in the space, launching the first cryptocurrency index fund, the Bitwise HOLD 10 Private Index Fund, on November 22, 2017. In July, Bitwise filed the first publicly-offered cryptocurrency index exchange-traded fund (ETF). The US Securities and Exchange Commission has not yet issued a decision.