Binance CEO Changpeng Zhao says crypto traders may be wise to use the mainstream crypto news cycle as a counter indicator for the market.

Zhao responded to a tweet from Josha Davis that calls out two very different crypto headlines in the New York Times. One, with beaming Bitcoin and Ethereum traders, appeared on January 13th. The other, with a somber looking crypto investor, appeared on August 20th.

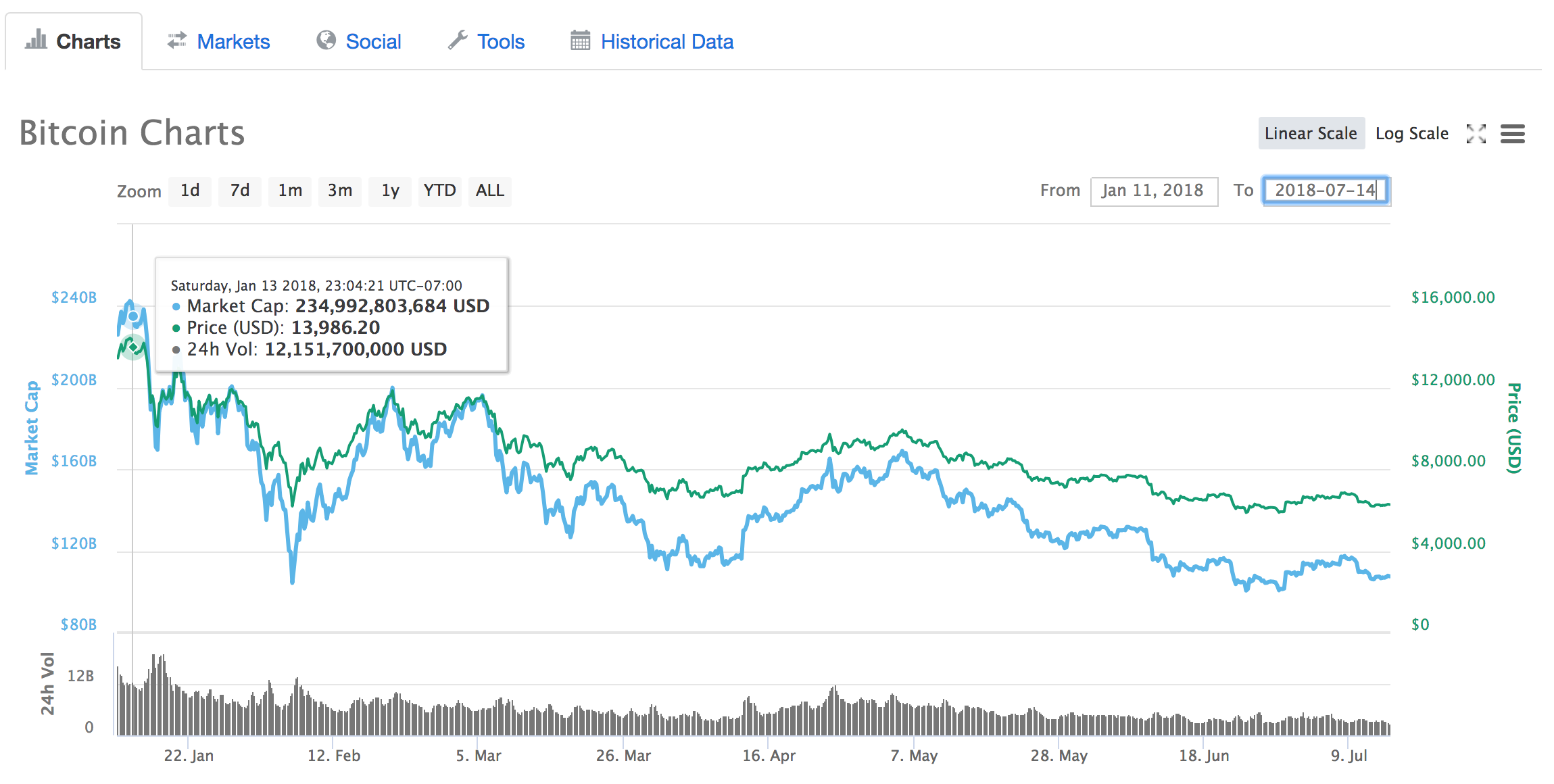

January 13, 2018

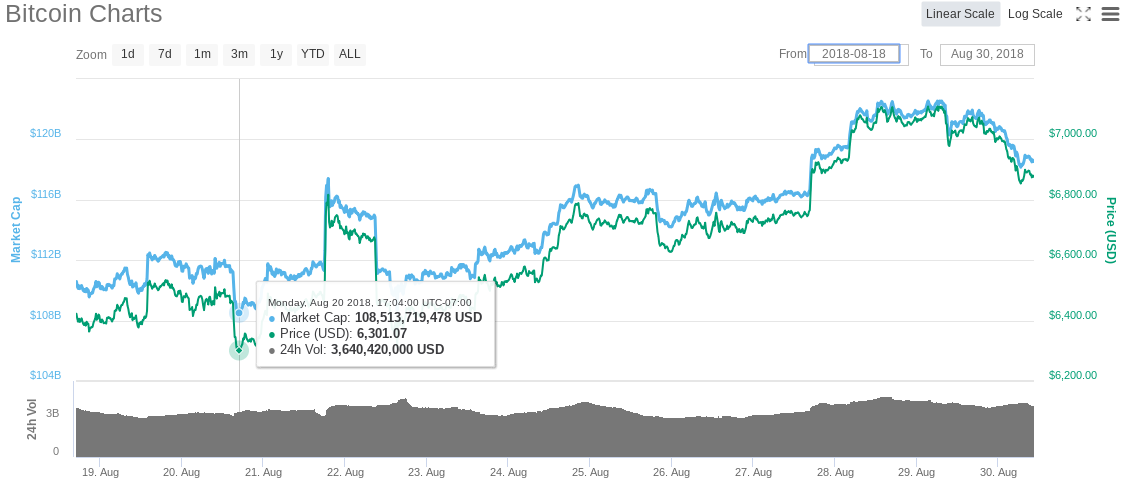

August 20th, 2018

After January 13th, the date of the bullish article, Bitcoin continued to slide from $13,986 all the way to $5,886 by in late June.

Since August 20th, the date of the negative article, Bitcoin is up 9.34%, from $6,301 to $6,890, according to the latest data from CoinMarketCap.

As Zhao points out, a “counter-news strategy would have worked nicely” back in January. So when the mainstream news is driving a narrative that crypto is the next big thing and that everyone who invests is getting rich, that may be a sign it’s time to sell. And when the sentiment from big news outlets is all gloom and doom, that may be the right time to buy.

A new Bitcoin (BTC) indicator is using CNBC as a barometer for crypto in a similar way. It analyzes bullish and bearish tweets from CNBC’s Fast Money to predict Bitcoin price action.

[the_ad id="42537"] [the_ad id="42536"]