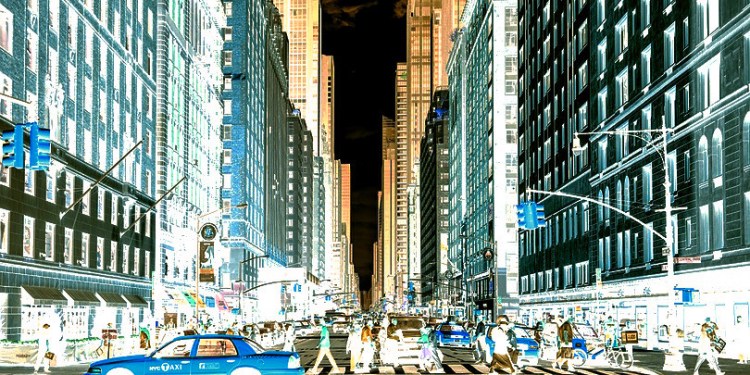

Blockchain startup Fluidity has partnered with broker-dealer firm Propellr to tokenize a piece of prime Manhattan real estate on the Ethereum network.

Fluidity, a Brooklyn-based crypto technology company, offers works with FINRA-registered broker-dealers and issuers to help them incorporate blockchain technology into their SEC-compliant offerings.

By using smart contracts, Fluidity has tokenized a $36.5-million property of luxury condominiums in Manhattan, allowing investors to purchase a stake. Investors can either hold the tokens or sell them to other buyers.

“Literally 25-30 million people can own a piece of this at $1 a pop. When has that ever been possible?” asks Ryan Serhant of Nest Seekers International, one of the real estate agents involved in the deal.

Khurram Dara, a lawyer for Fluidity, says, “We’re taking private securities and we’re putting a digital wrapper around them which makes them easier to track and easier to transfer.”

The groundbreaking model for the investors also gives real estate agents an alternative way to fund their investments. Says Serhant explains,

“If we have a bank deadline on us, where we have to sell a certain amount of units or repay the entire loan by a certain date – if construction has been delayed, if the market turns, if competition pops up, and we’re not going to be able to hit that deadline, what do you do?

By tokenizing the debt, it gives everyone breathing room to sell at a normal pace, with the market instead of against it…

We don’t need banks anymore. If there’s another downturn and banks say, ‘Oh we have a hard time lending now,’ ok, well I don’t need you. Because I can tokenize my loan.”

Fluidity co-founder, Michael Oved, says the new platform is a game changer in the real estate industry.

“When we started looking at the real estate industry, it’s probably one of the most inefficient industries that exists currently. A lot of middlemen, a lot of lawyers, a lot of bankers, and just being able to create something that has real impact on an industry like that, I think you’re looking at significant disruption.”