A new document from Ripple shows the company plans to give all of its banks and financial institutions using xCurrent a way to “seamlessly access” the company’s XRP-powered xRapid.

The revelation comes straight from a pamphlet Ripple is distributing at the FinTech Festival 2018 in Singapore, which was promptly posted on Twitter.

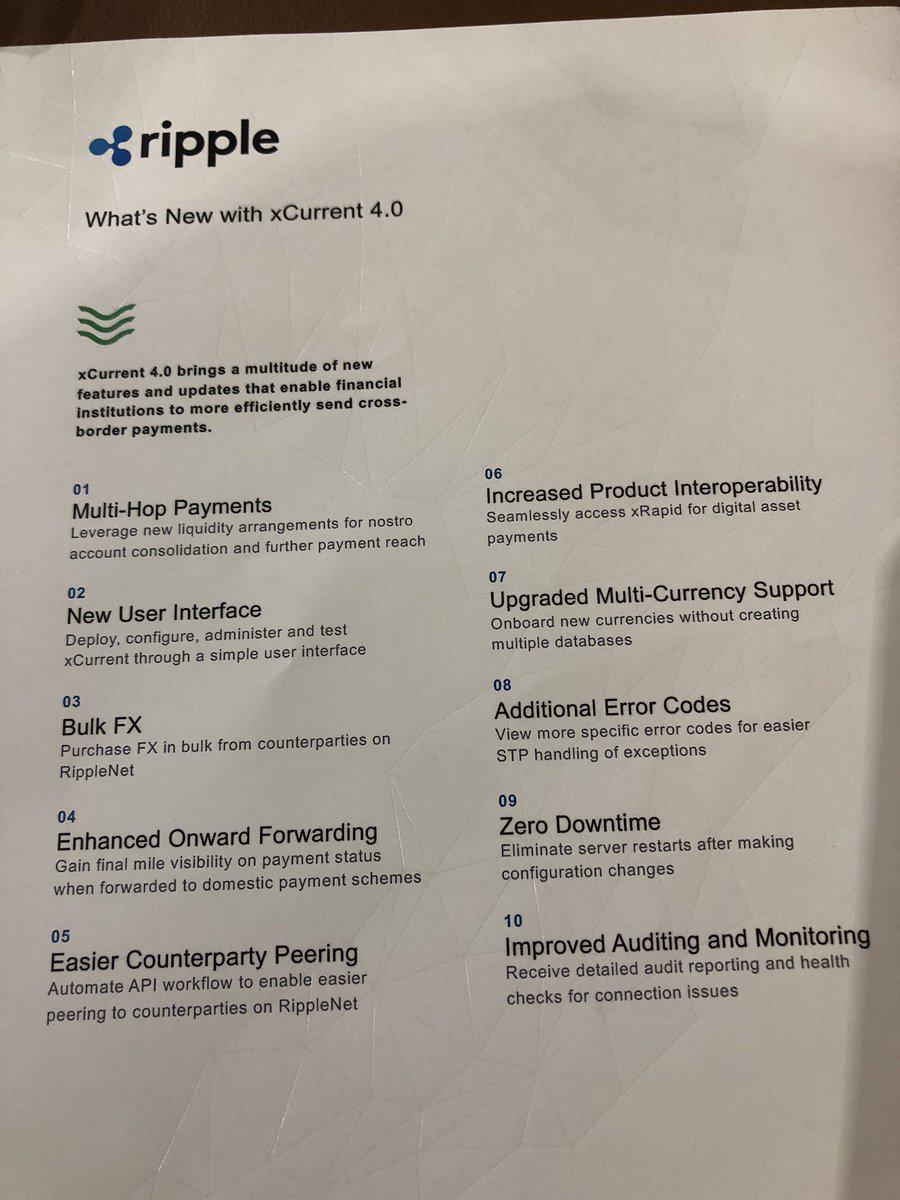

Item number six on the list, called “Increased Product Interoperability” says banks and financial institutions using xCurrent will be able to “seamlessly access xRapid for digital asset payments.”

This essentially means every financial institution on RippleNet – Ripple’s network of banks and payment providers that use Ripple’s technology to process payments – will have seamless access to xRapid, which utilizes XRP to increase the speed and liquidity of cross-border payments.

Ripple currently has about 200 banks and financial institutions on RippleNet, including Bank of America, Santander, and Mizuho Financial Group.

For clarity, here’s a look at how xCurrent works, as explained by Ripple:

“All members of RippleNet are connected through Ripple’s standardized technology, xCurrent. xCurrent enables banks to message and settle their transactions with increased speed, transparency and efficiency with RippleNet members. xCurrent is built around Interledger Protocol (ILP), an open, neutral protocol, that enables interoperation between different ledgers and payment networks. The solution offers a cryptographically secure, end-to-end payment flow with transaction immutability and information redundancy.

Rather than a constellation of disparate technologies, unstandardized communications and centralized networks, RippleNet is a decentralized, global network of banks that send and receive payments via Ripple’s distributed financial technology.”

Here’s a look at how xRapid works, as explained by Ripple founder Chris Larsen in a recent speech in Half Moon Bay, California.

xRapid, that’s a component of RippleNet. That allows payment providers to lower the cost and liquidity for their global payments. So it allows, for example, a bank that’s trying to send money to Mexico to use XRP as the intermediate currency. They don’t necessarily have to hold XRP, but it’s used to make things very efficient.

So in this example, a customer’s going to a remittance company in the US. Those dollars are now exchanged into XRP through Bittrex, which is a great exchange. It’s immediately settled in XRP in seconds. Bitso, an exchange, then provides the exchange between XRP and Mexican peso that can now be delivered to a Mexican bank, which, because they have a real-time system in Mexico, allows that to go into the customer’s account very quickly.

This now allows payment providers, banks and their customers to move value in one to two minutes versus days or a process that might mask those days but have to charge for the settlement risk and costs.”

Ripple officially launched xRapid for commercial use on October 1st.

The Crypto Beat

Confirmed: Ripple Partner TransferGo Exploring XRP-Powered xRapid for Cross-Border Payments

Breakthrough XRP Fiat-to-Crypto Platform Launches Beta, Works Without a Crypto Exchange

The Ripple Effect: Developers Bring XRP to Amazon Alexa

Swift Denies Ripple Rumors, Says Platform Will Not Integrate With RippleNet, xRapid or XRP

[the_ad id="42537"] [the_ad id="42536"]