A joint report was just released by participating central banks – Bank of Canada, Bank of England and the Monetary Authority of Singapore (MAS) – and commercial banks HSBC, TD Bank, OCBC Bank and UOB. Entitled “Cross-Border Interbank Payments and Settlements – Emerging opportunities for digital transformation,” the report, compiled by KPMG, is a broad overview of how fintech solutions and digital currencies could overhaul the financial services industry.

The report references a 2016 McKinsey paper that estimates the average cost for a US bank to execute a cross-border payment via the correspondent banking network.

According to McKinsey, the payment “is in the range of US$25 to US$35, more than 10 times the cost of an average domestic payment.”

The authors note,

“Correspondent banking remains the most ubiquitous model for interbank payment and settlement globally. The complexity of this model accompanied by the divergence in regulatory standards across jurisdictions adds to the overall costs – explicit and implicit – associated with cross-border payments.”

The report makes no mention of cryptocurrencies, blockchain payment rails or networks such as Bitcoin, Ethereum, Dash, XRP, Ripple, Stellar or other blockchain-based digital asset that is being used or piloted to transfer value across borders at a fraction of the cost of existing legacy systems.

Key drawbacks of the current payment infrastructure are highlighted in the report.

- Cross-border payments subject to cut-off times, limiting chances of same-day settlements

- Limited-to-no weekend processing

- No transparency for end-users and banks to see the status of the payment in the value chain

- Obscured payment routes that are not determined by the originating bank but by correspondent banks along the chain

- High payment costs due to “trapped liquidity” from operating diverse messaging standards, dealing with complex infrastructure and complying with regulatory requirements

According to the report, banks are exploring various types of central bank digital currencies (CBDCs). One particular model, Wholesale CBDC (or Wholesale Central Bank Digital Currencies) are “limited-access tokens representing legal tender for wholesale, interbank payment and settlement transactions (within the scope of this report).”

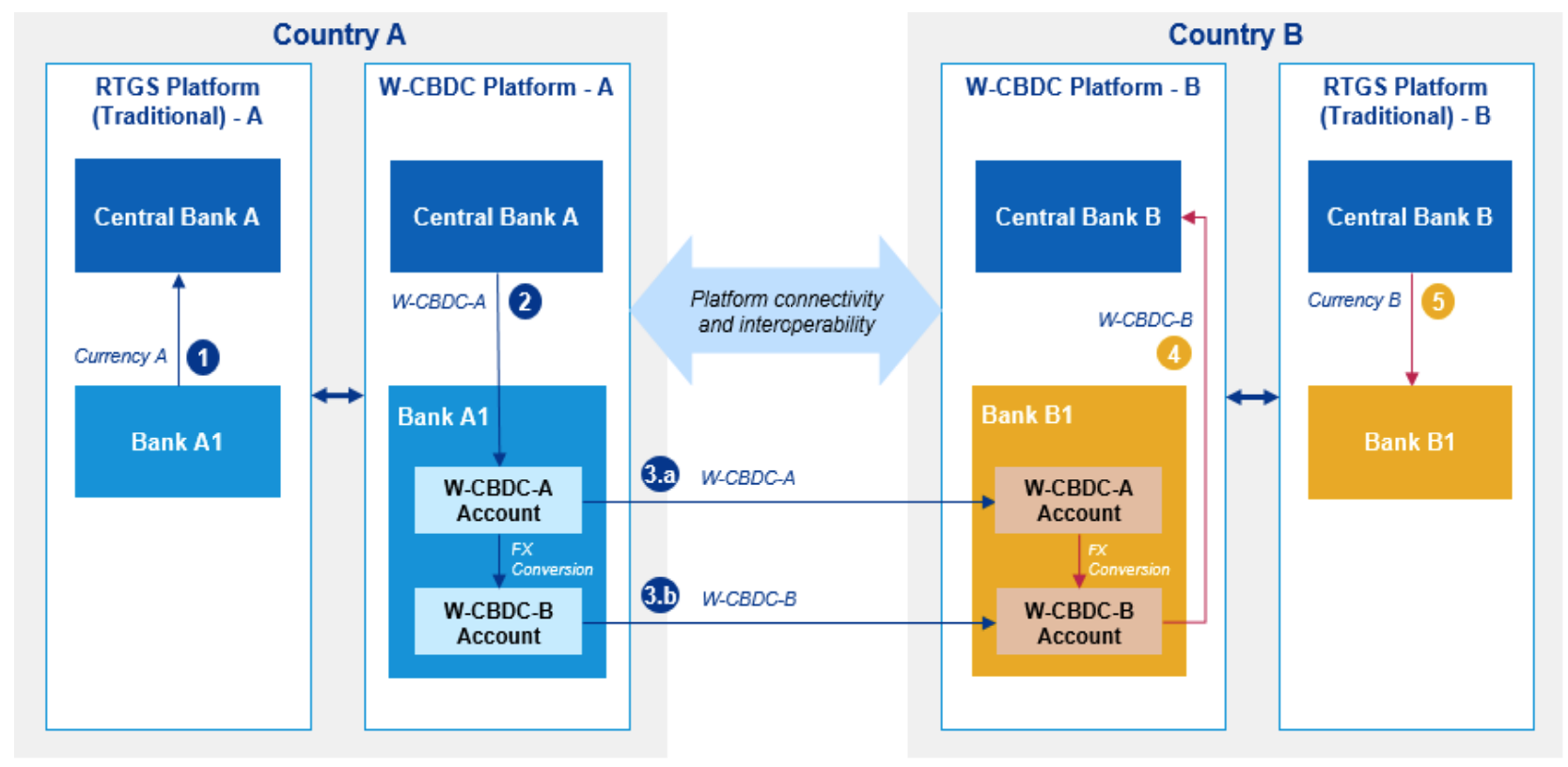

Model 3b of the report outlines how W-CBDCs can be held and exchanged beyond their home jurisdictions, essentially mimicking some of the functionality of borderless cryptocurrencies.

“Each participating bank maintains W-CBDC accounts (or wallets) for different currencies with the central bank of its own jurisdiction to allow payment and receipt of different W-CBDCs as part of cross-border transactions with other banks.

In the illustration above, Bank A1 maintains WCBDC-A and W-CBDC-B in one or more wallets on W-CBDC platform A – and likewise for Bank B1 with Central Bank B. The conversion of W-CBDCs denominated in different currencies could take place through a new W-CBDC-specific FX market.

W-CBDC platforms may be designed to be operational 24 hours a day, seven days a week and operate in parallel with the existing RTGS platform for the purpose of transacting in W-CBDCs between banks and central banks within a certain jurisdiction and between banks across jurisdictions.”

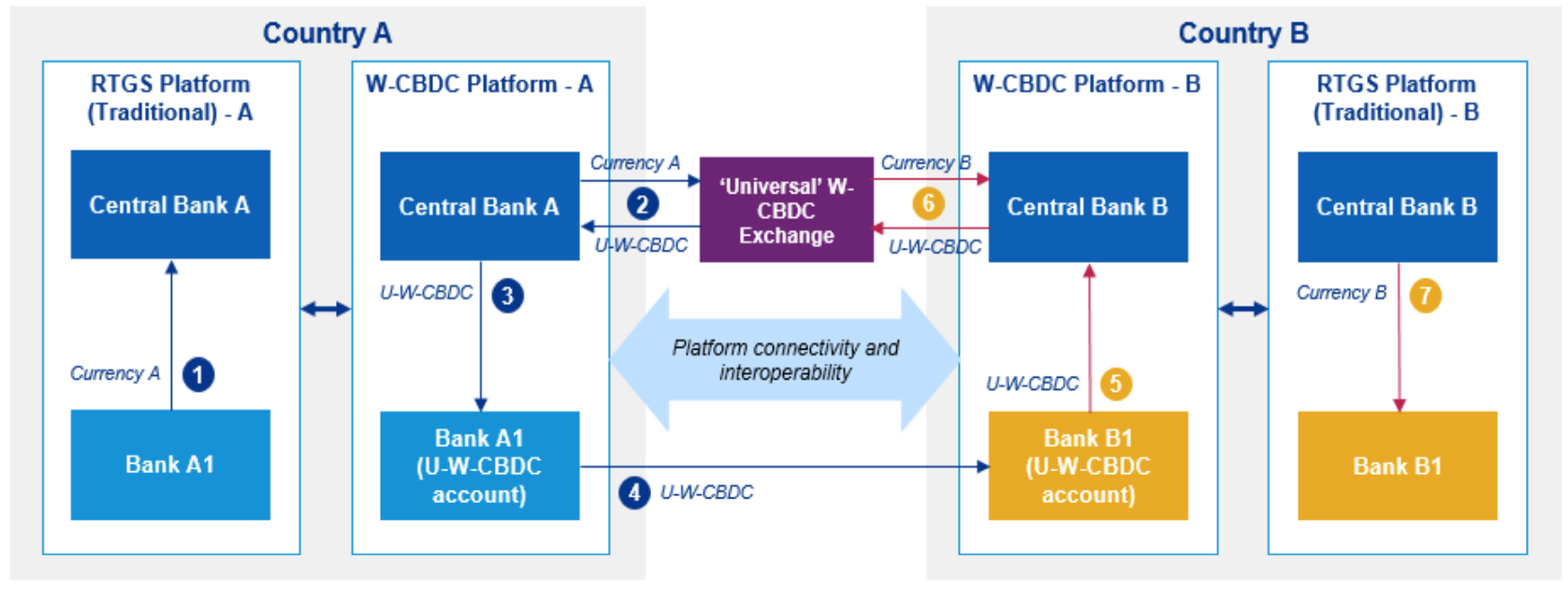

Model 3c of the report details how a “single, universal, wholesale central bank digital currency” could be backed by a basket of currencies.

“Several participating jurisdictions, through either their respective central banks or a global multilateral institution, agree to create a “universal” Wholesale CBDC (U-W-CBDC). This U-W-CBDC will be backed by a basket of currencies issued by the participating central banks. This U-W-CBDC would be issued via an exchange specifically created to allow for issuance and redemption of such U-WCBDCs.

The conversion of a jurisdiction’s currency into the U-W-CBDC would create an exchange rate between that currency and the U-W-CBDC. A framework for how this is managed would need to be collectively determined by the participating central banks.

Banks can use these U-W-CBDCs with other banks to settle peer-to-peer cross-border transactions.

W-CBDC platforms could be designed to be operational 24-7 and to operate in parallel with the existing RTGS platform to transact in U-W-CBDC between banks and central banks within a certain jurisdiction and between banks across jurisdictions.”

The digital currency model detailed in the report is a centralized banking system of intermediaries, as opposed to being a truly peer-to-peer decentralized network of interoperable cryptocurrencies.

As for blockchain implementation, the report states,

“It is possible that the underlying technology for these W-CBDC models could be DLT [digital ledger technology]. However, DLT remains an unproven technology from the standpoint of a wide-scale, live system implementation. It is also possible that these models could be implemented using technologies that are not dependent on DLT. It is outside the scope of this report to compare the various technology options that could enable any of these models.”

You can read the full report here.