HodlX Guest Post Submit Your Post

Bitcoin

It’s rumored that institutional investors are accumulating Bitcoin through OTC markets despite bearish market sentiment. Whilst retail investors are panicking, institutional investors are said to be acquiring Bitcoin – an assumption that leaves many wondering as to why markets have not yet shown many signs of recovery when a.k.a smart money is flowing into the space.

Professional traders and institutional investors are highly cautious about accumulating new assets and are experts at acquiring them without affecting the market. There are a variety of hedge funds that are solely focused on investing in Bitcoin and venture capital funds that have begun to provide the necessary financial support for upcoming startups that have dedicated themselves to building applications and services for the Bitcoin ecosystem.

During bear markets, institutional investors prefer bitcoin over altcoins due to positive sentiment and because BTC is the most established cryptocurrency.

The SEC has denied multiple Bitcoin exchange-traded fund applications as cryptocurrency enthusiasts eagerly await the approval of the first Bitcoin ETF. Many are betting on the institutionalization of Bitcoin once new yet traditional investment vehicles are made available to investors.

Ripple

Unlike most decentralized projects, Ripple is focused on connecting banks, payment service providers, digital asset exchanges and corporates through blockchain technology. Although XRP, the cryptocurrency used by Ripple’s xRapid, is accused of being centralized, it remains popular due to the fact that investors recognize the compelling value proposition of connecting existing financial institutions and remittance services using distributed ledger technology.

Originally released in 2012, Ripple has managed to build up an extensive list of clientele that consists of public banks, central banks, tech companies and corporations. The value here is the Ripple network that provides a reliable solution to moving assets quickly around the world, which is being utilized by banks to shift money between different foreign countries.

Ethereum

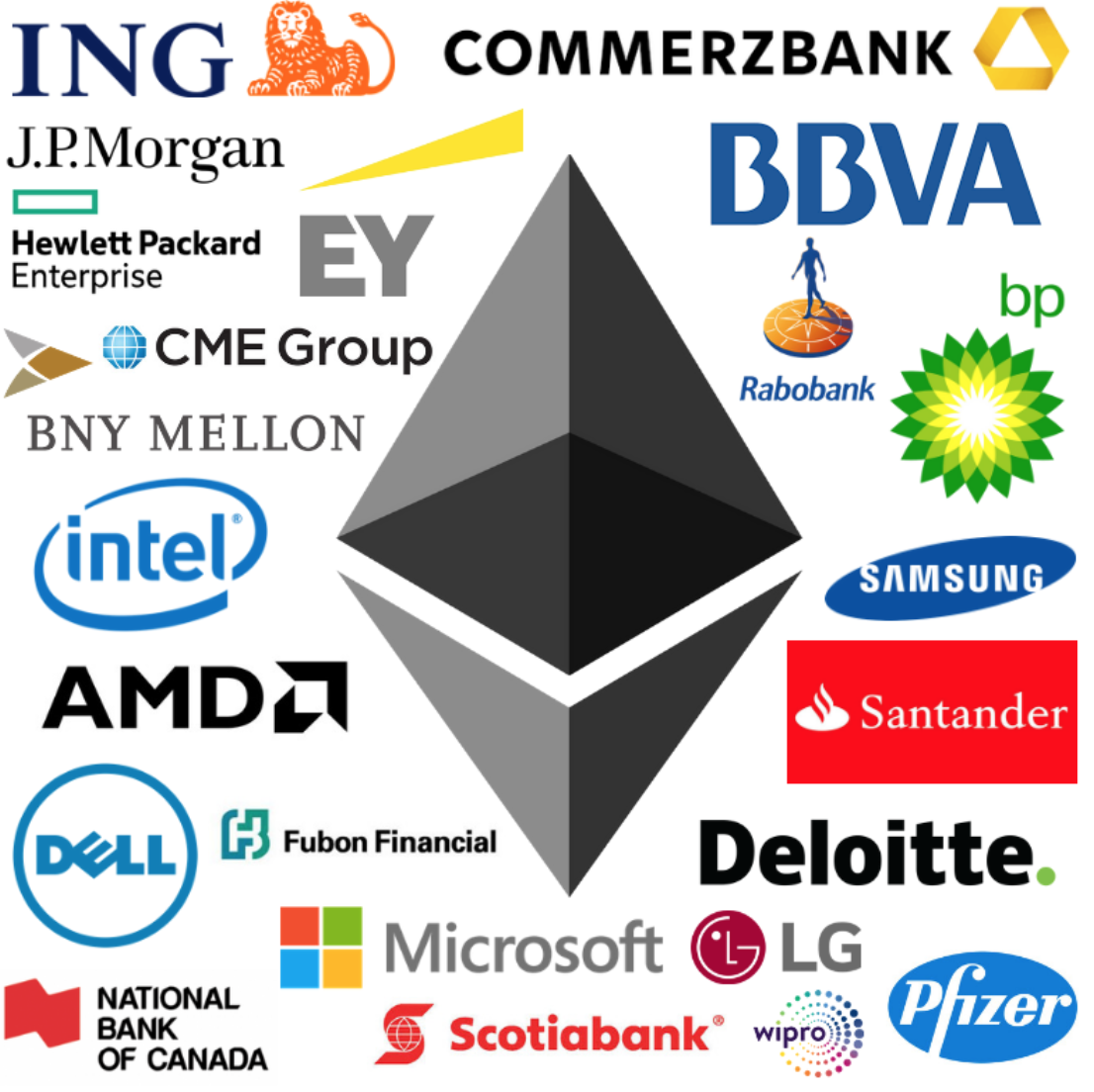

By far the most utilized blockchain protocol for businesses to issue their own native digital currency token, Ethereum allows smart contract functionality that has managed to get the attention of large institutions and corporations. Whilst Ethereum is classified as a decentralized project, it has managed to attract companies like Microsoft, Samsung, LG, Intel, AMD, BP and financial institutions like JP Morgan, CME group, Scotiabank and Commerzbank. Due to the sheer popularity of the project, Ethereum Enterprise Alliance (EEA), consisting of over 300 members, was formed to help connect established organizations with blockchain developers interested in building applications on top of Ethereum.

Aergo

An upcoming fourth generation blockchain project that plans to help enterprises make use of distributed ledger technology, Aergo is based on the proprietary software known as Coinstack. Aergo is a hybrid blockchain that is open to the public and designed to help large-scale enterprises deploy their own preferred blockchain. Renowned VC fund Sequoia Capital, known for focusing on the technology industry and backing Forbes 500 companies, is one of many VC firms investing in Aergo, along with FBG, GBIC, Arrington XRP, Dekrypt, Rockaway, Neo Global and Divergence Digital.

The project will help enterprises adopt blockchain technology by making it easy to design and build decentralized applications on private or public chains or a mix of both. Aergo plans to provide Blocko, Korea’s number one blockchain infrastructure provider, with a more decentralized solution to service its existing clients including Shinhan Bank, Samsung, Lotte Card, KRX and the South Korean government.

OmiseGo

A decentralized payment solution provider as well as a bank, exchange and blockchain gateway for businesses, OmiseGo was created by parent company Omise, a venture-backed payment service company operating in Japan, Singapore, Indonesia and Thailand.

Omise is a popular payment gateway solution in Asia, well-established in Thailand and backed by large corporations such as McDonald’s, Burger King, Allianz, Axxa and SCG. The company has been showing impressive growth since its inception in 2013. It’s expected that once OmiseGo is fully operational with its mainnet release, Omise merchants will switch over to the decentralized blockchain network

Vechain

A project aiming to disrupt the supply management industry by leveraging a blockchain-based platform that digitizes the supply chain and tackles goods counterfeiting, Vechain is essentially a Blockchain-as-a-Service company that plans to build a trust-free network for businesses to collaborate and track inventory in a decentralized ecosystem.

By deploying a public distributed ledger, Vechain hopes to enhance supply chain management by combining the Internet of Things (IoT) with blockchain technology. Manufacturers can easily track and manage supplies, as all the information is made available on Vechain’s public blockchain. Consumers will also have the ability to determine the quality and authenticity of the products sold. The project has secured a few high-level partnerships with PricewaterhouseCoopers, the government of Gui’an, Shanghai Waigaoqiao’s Direct Imported Goods Sales Centre, DNV GL, BMW and China Unicom.

Icon

![]()

A project dedicated to helping enterprises deploy their own distributed ledgers, ICON is an independent chain that connects multiple community sidechains, enabling cross-platform data and value communication.

Positioned in South Korea, a country that is considered to be the most crypto friendly nation in Asia, ICON has established a variety of strategic partnerships with large corporations such as Line, Samsung Electronics, Smilegate and SK Planet. The project is diversifying its reach by collaborating with the Korean government on numerous initiatives in the healthcare, education, insurance and customs sectors.

Vasilios Filip

Vasilios Filip got into Bitcoin back in 2015, believing that distributed ledger technology will disrupt traditional financial services and banks. With a background in law and economics, he has since kept his eye on blockchain applications whilst dedicating his time writing about anything crypto-related.

Follow Us on Twitter Facebook Telegram