Bitcoin is currently down 3.25% after a 4.8% drop in the past 24 hours. Monday’s price decline marks a 6-week low for the world’s largest cryptocurrency.

Mati Greenspan, senior market analyst at eToro, says,

“The cryptoasset movement today is nothing more than technical.”

Speaking to Business Insider, Greenspan says there’s no need for overreaction.

“Bitcoin is continuing to trade within the core area of support between $3,000 and $3,500, within the broader range of $3,000 – $5,000, where it’s been since November 2018.”

Crypto exchange Kraken showed Bitcoin trading at an intraday low of $3,396.80 on Sunday, Bitcoin’s lowest level since mid-December. Dragging all of the major altcoins with it, Bitcoin’s slide triggered a crypto sell-off that shaved $5.7 billion from the total crypto market cap, which dropped to $113.1 at time of writing, from $118.8 billion.

Hedge fund manager and economist Mark Dow says Bitcoin’s current price action is a bearish sign that will play out in the short run with more pain ahead.

#bitcoin has been dead quiet for several weeks around about 3,600. Last time bitcoin was quiet like this was when it was up at 6,500, it ended disastrously. Based on the pattern. odds are we get a similarly sharp drop again soon–may even have started tonight. $BTC $XBT

— Dow (@mark_dow) January 28, 2019

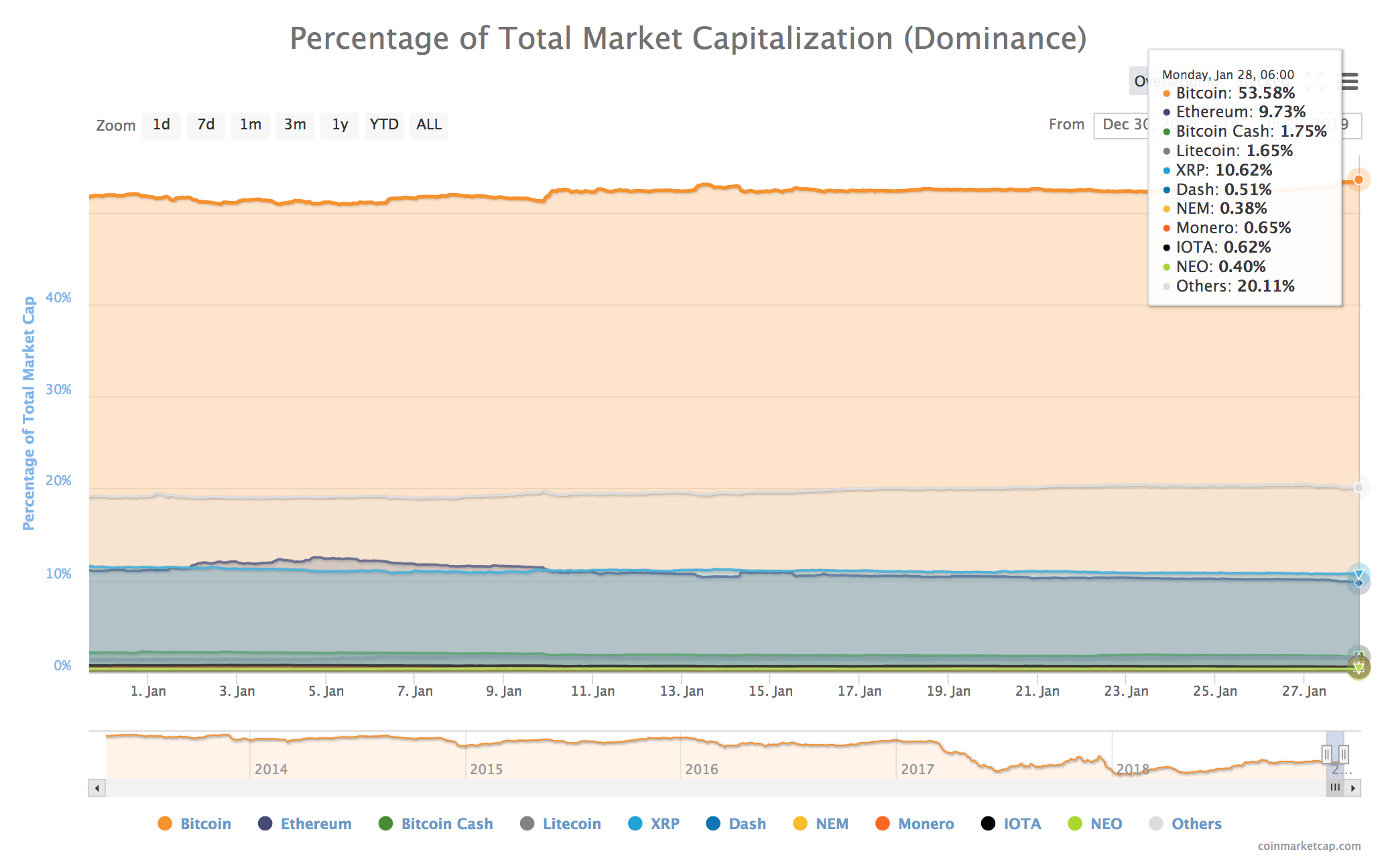

Despite BTC’s decline, Bitcoin dominance stands at 53.6%, up from 51.7% at the start of the year, and up from 52.4% one week ago.

Bitcoin Dominance