[the_ad id=”36860″]

CNBC contributor and founder of crypto investment firm BKCM, Brian Kelly, says the fact that Cboe has pulled the plug on Bitcoin futures indicates the retail sellers are exhausted.

“This tells me that retail traders are out of the picture, because these Cboe futures were one contract, so about $3,900, versus CME were five [contracts], so about $20,000. So I think retail is exhausted. You’re starting to see sellers being exhausted.

And institutions are coming in. Fidelity is a catalyst coming up in Q2. I think with all those things combined, we might look back and say, ‘You know what? In the $3,000s was a great place to buy Bitcoin.'”

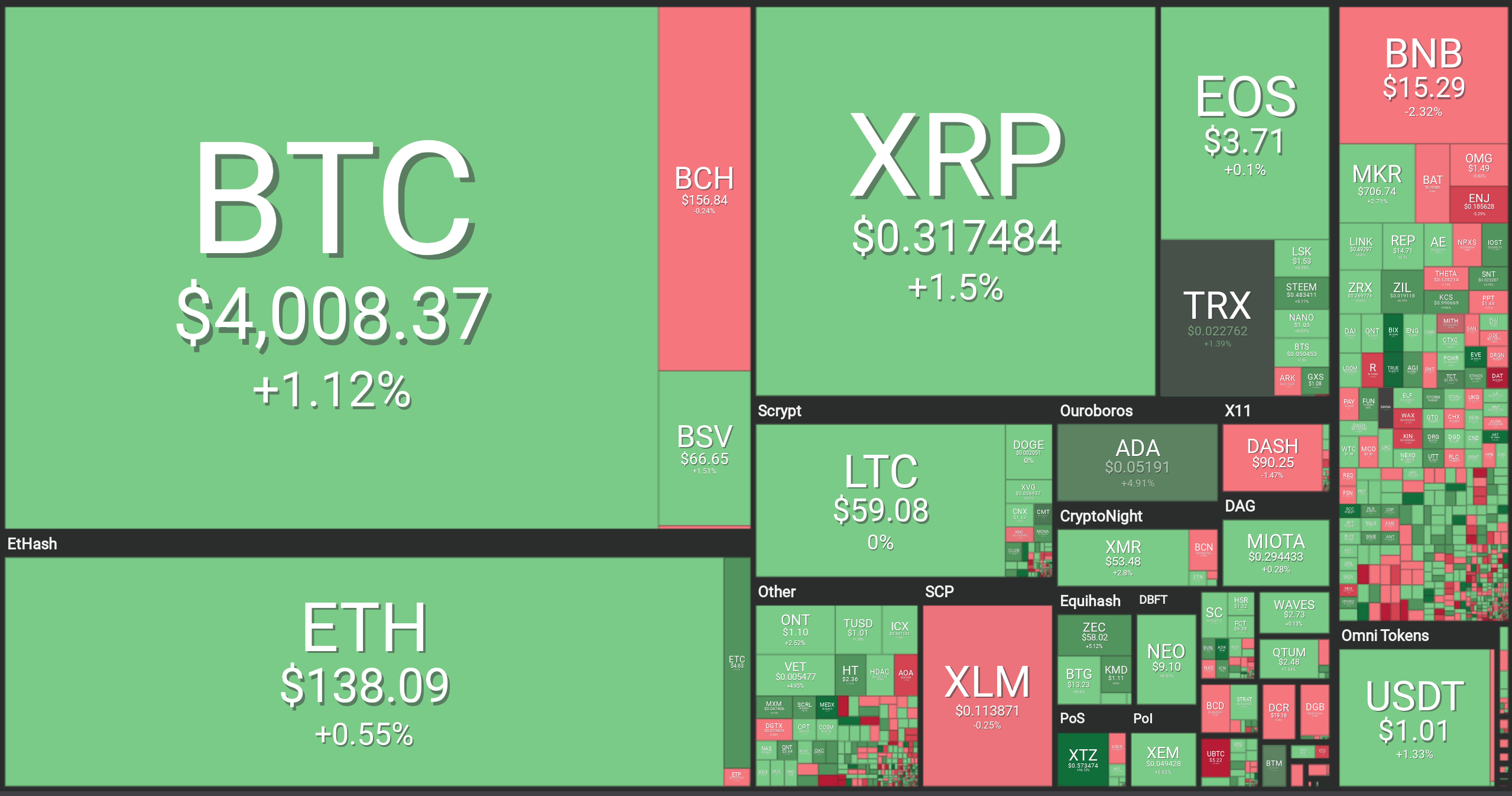

Right now, the crypto market is mostly in the green. At time of publishing, Bitcoin is up 1.12% at $4,008. Ethereum is up 0.55% at $138, and XRP is up 1.5% at $0.3174.

[the_ad id=”36860″]

Overall, technical analysts are looking bearish on Bitcoin and XRP, with mixed outlooks on Ethereum.

Bitcoin

FX Empire – Bears are looking for a way back to sub-$4,000

Ethereum World News – Bitcoin still in correction mode, RSI indicates selling pressure in play

CoinDesk – BTC faces minor price retreat amid increasing bull exhaustion

Ethereum

Ethereum World News – ETH might be done with its slide

ETHNews – Ether eyeing last line of defense

NewsBTC – ETH trading near crucial juncture

XRP

NewsBTC – XRP could decline to $0.3000 as sellers take control

FXStreet – Market trending in a narrow range as bears take over

Blockonomi – XRP bears gaining control, price could extend downside correction

[the_ad id="42537"] [the_ad id="42536"]