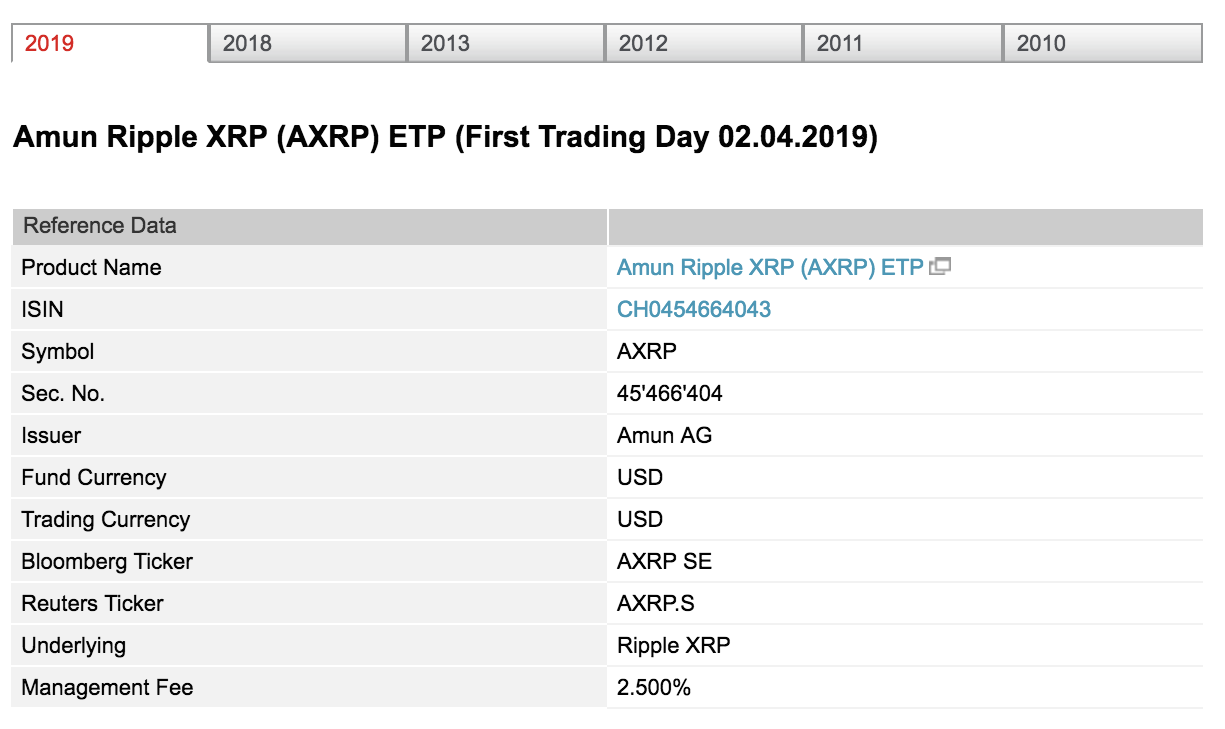

A new XRP-based exchange-traded product (ETP) makes its debut tomorrow, April 2nd. The ETP will be available on the Swiss stock exchange SIX under the name “Amun Ripple XRP (AXRP).”

Amun Ripple XRP will incur a management fee of 2.5%. According to SIX, the ticker used to identify the asset on Bloomberg is AXRP SE while the Reuters ticker is AXRP.S.

Crypto startup Amun has raised $4 million in funding to facilitate more on-ramps for buying digital assets. The company plans to simplify the process of making crypto investments by establishing channels that are familiar to traditional investors.

“Amun makes investing in crypto assets as easy as buying a stock. Investors can invest in crypto easily, safely, and in a regulated way on the SIX Swiss Exchange.”

SIX listing rules require ETPs, including Amun Ripple XRP (AXRP), to be collateralized in order to meet regulatory demands for consumer protection. ETPs are collateralized by presenting the underlying instrument for deposit either physically or in the form of a futures contract.

Co-founder of Amun, Hany Rashwan says,

“The collateral also has to be kept at an independent qualified custodian. The calculation of the price is checked multiple times a day by several parties.”

Kingdom Trust, an SEC registered crypto and traditional assets custodian, helped to collateralize the assets.

In addition to AXRP, several other crypto exchange-traded funds will be listed on SIX exchange, including Amun ETPs for Litecoin, Bitcoin Cash, EOS and Stellar Lumens. The company plans to release all of the scheduled ETPs before the end of 2019.

SIX, Switzerland’s leading stock exchange, plans to launch its own digital assets exchange in 2019 in order to tokenize assets and utilize blockchain technology to power trades. The platform will be built on R3’s enterprise blockchain-based settlement platform Corda.

Modified Image via Wikimedia/CC BY 3.0

[the_ad id="42537"] [the_ad id="42536"]