The recent cryptocurrency market surge has set off a chain reaction in China where Bitcoin enthusiasts are all in. Their huge demand for the world’s number one cryptocurrency has triggered a premium price for the stablecoin Tether (USDT), which is used to settle over-the-counter (OTC) purchases of Bitcoin and is one of the only ways to buy BTC due to China’s restrictions.

Since the second half of 2017, when China restricted crypto-related business activities and prohibited banks from servicing exchanges, several companies were forced to shut down their operations. To circumvent the crackdown, they used platforms like Telegram, WeChat and OTC trading to make crypto transactions.

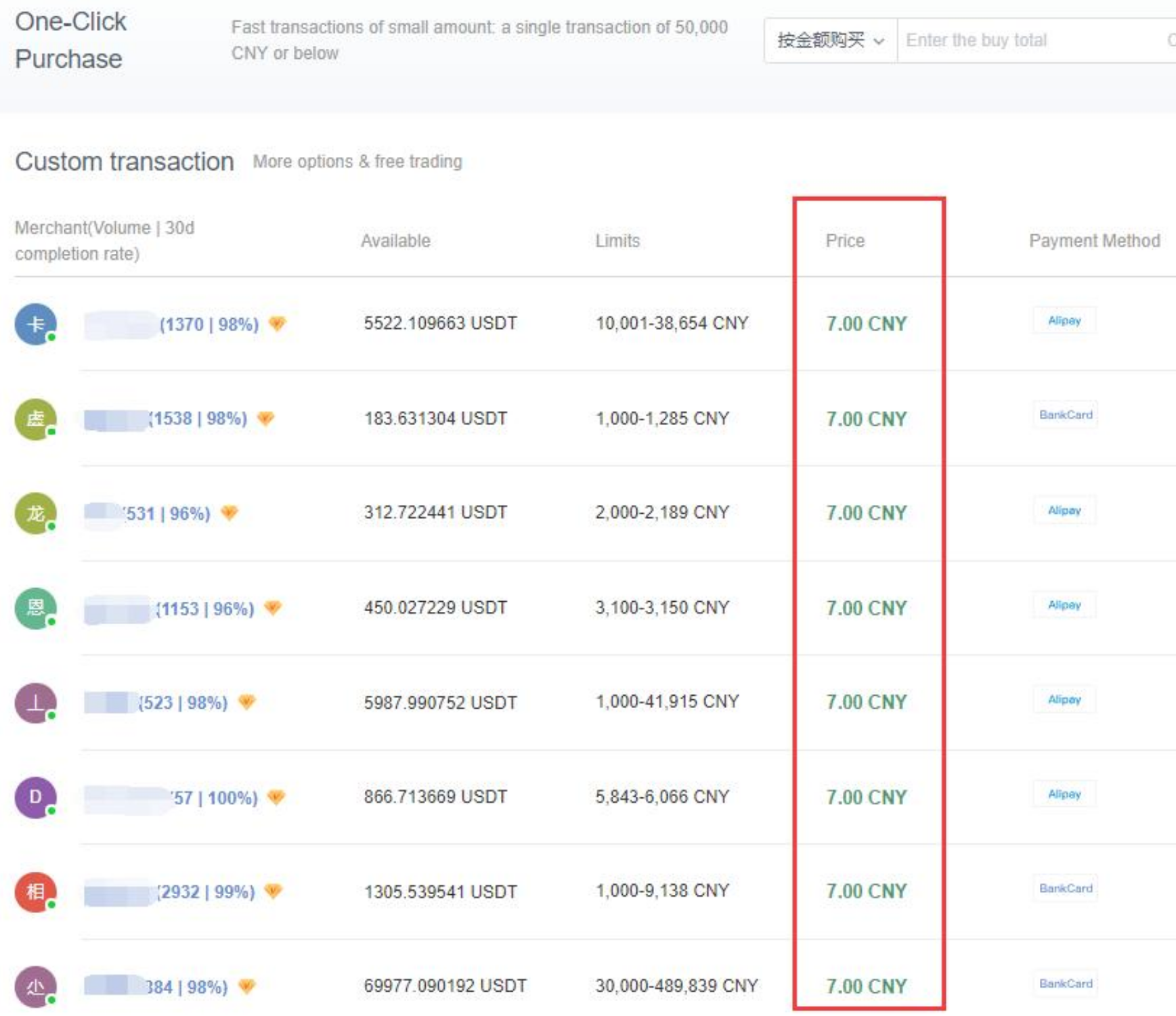

For Chinese crypto investors and traders, USDT, the most popular stablecoin, has become the oil in the machine and go-to method for buying Bitcoin with fiat. But according to local news outlet cnLedger, the stablecoin is rising above the nominal one-dollar peg.

“Why is the USDT premium going up? After the PBoC ICO/exchange ban, the most convenient way to buy cryptos in China, is to buy stablecoins like USDT first using OTC, and then trade it into any cryptos you want in exchanges.”

USDT Premium

Now, instead of paying 6.7 Chinese yen (CNY) for 1 USDT, buyers are paying 7 CNY, a 4.48% markup.

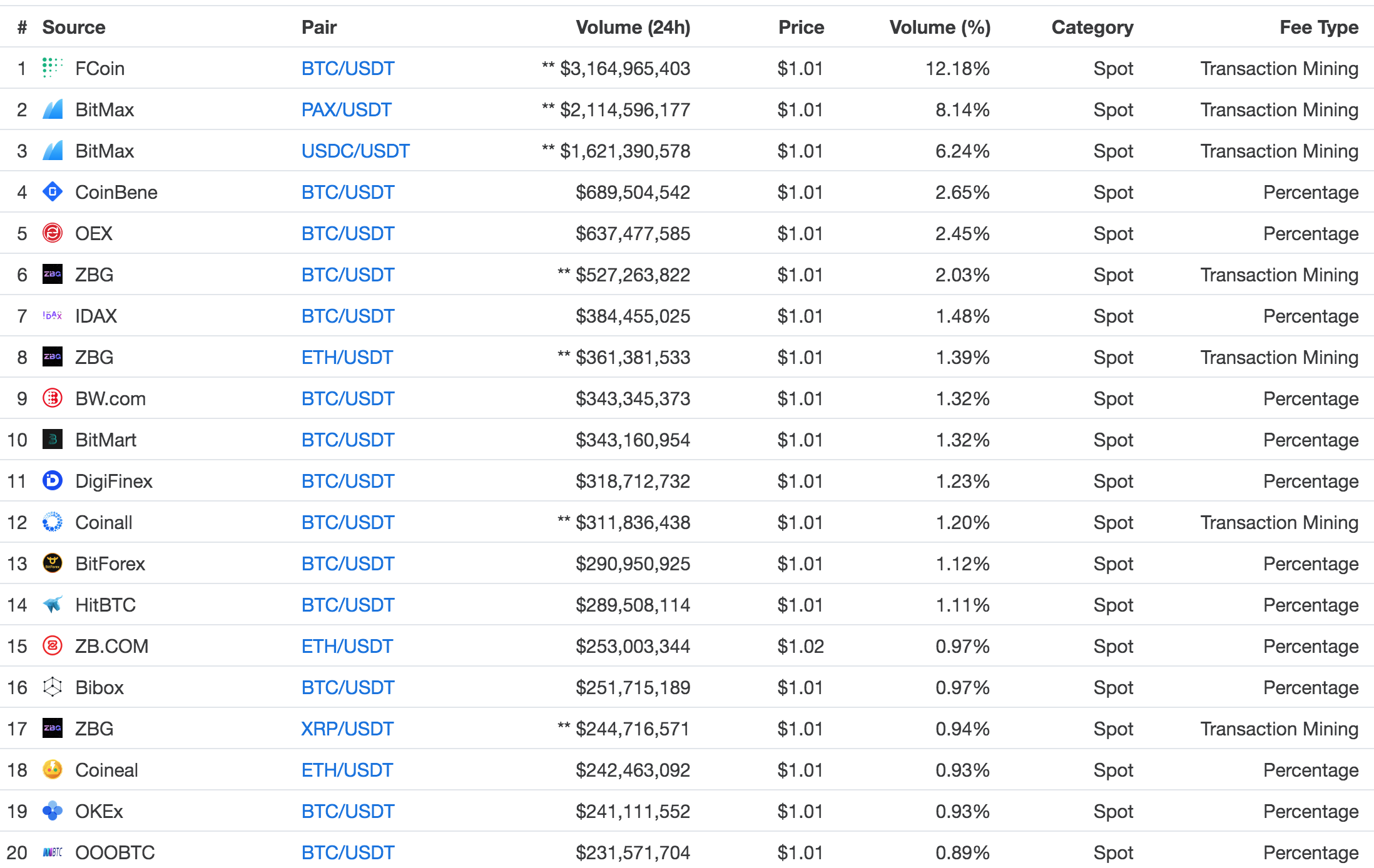

China-based cryptocurrency exchange FCoin, which launched less than a year ago amid reports about its controversial trading volumes, appears to be the number one market for BTC-USDT trading pair, capturing 12% of the Tether markets.

Tether Markets