[the_ad id=”36860″]

The latest analysis from Adamant Capital says a new Bitcoin bull run will bring BTC’s market cap into the trillions.

According to the analysis, whales are accumulating BTC, and the leading crypto asset’s price history shows unique parallels to the 2014-2015 bear market, which preceded Bitcoin’s eventual rise to nearly $20,000.

“We pride ourselves in having published our 2012 and 2015 Bitcoin reports during what we perceived as periods of significant undervaluation. Each report was issued when Bitcoin was down more than 80% from all-time highs. Now, at 75% down below its 2017 all-time high, we believe the current bear market represents an exceptional opportunity for value investors.

During this accumulation phase, we expect for Bitcoin to trade in a range of $3,000 to $6,000, until the new bull market permanently cements the denarian cryptocurrency as a multi-trillion dollar asset class.”

The outlook mirrors that of a veteran technical trader Peter Brandt, who called Bitcoin’s crash in January of 2018 and now says BTC may be on track to begin a new parabolic bull run.

Either from Dec '18 low or from retest of same (circa analog dbl bottom in 2015) it would not surprise me if $BTC enters a new parabolic phase. $btcusd pic.twitter.com/XV89Qz7P4n

— Peter Brandt (@PeterLBrandt) April 5, 2019

Meanwhile, a tech analyst at Swiss bank UBS says Bitcoin and crypto bulls “should consider what happens after the bubble – not every bubble that bursts recovers the old highs.”

[the_ad id=”36860″]

As reported by Business Insider, Kevin Dennean warns it traditionally takes many years for assets to recover after the bubble bursts.

“We’re struck by how long it took other asset bubbles to recover their peak levels (as long as 22 years for the Dow Jones Industrials) and how pedestrian the annualized returns from trough to the recovery often are.”

Historically, Bitcoin’s price action has been extremely volatile and far different from traditional markets like the Nasdaq, Dow and S&P 500. When BTC’s bubble burst in late 2013, it took less than a year for a new bull trend to begin. The current market downturn has lasted far longer, and began in December of 2017.

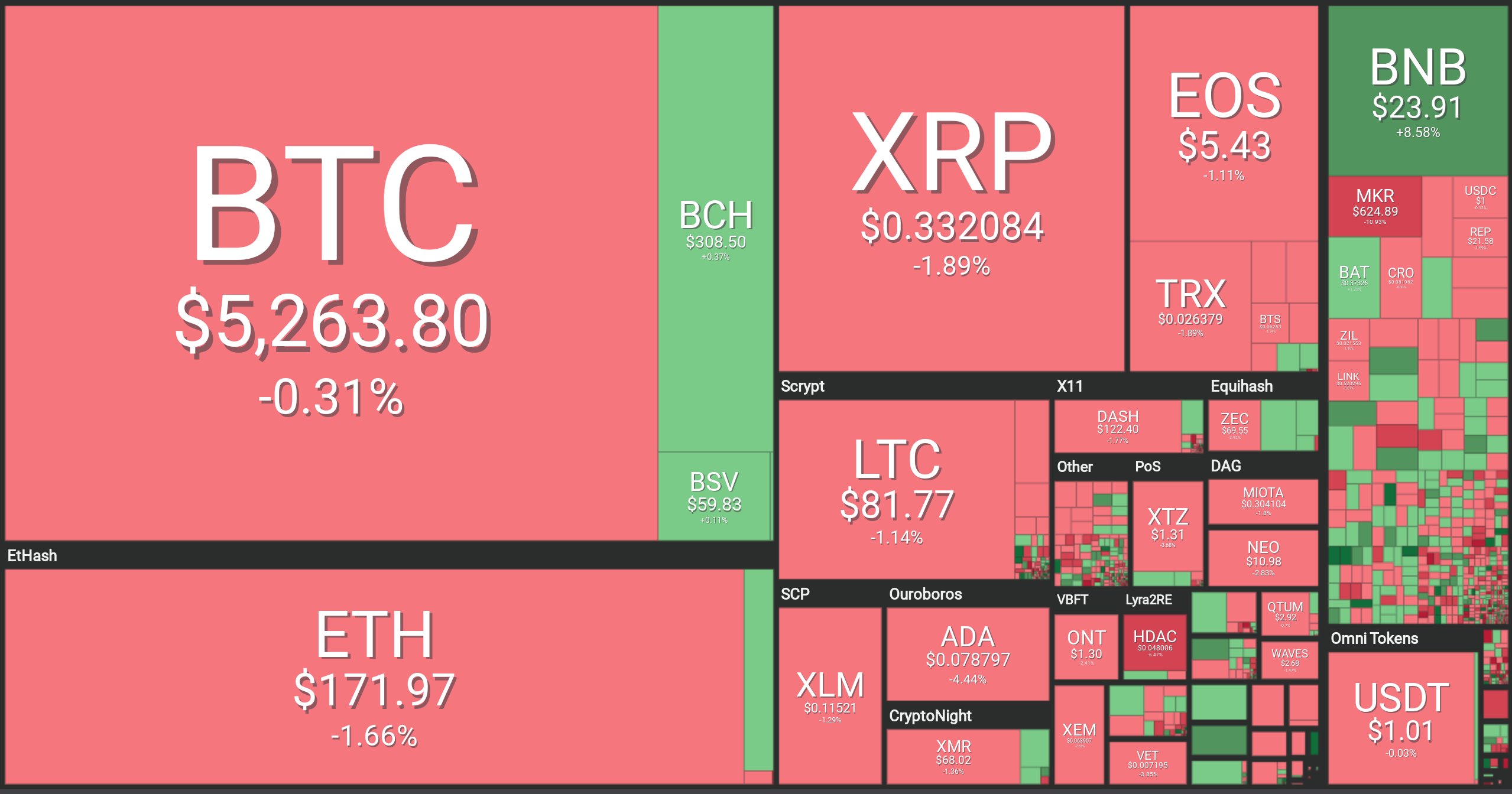

Right now, the crypto market is decidedly in the red. Bitcoin is down 0.31% at $5,263. Ethereum is down 1.66% at $171.97, and XRP is down 1.89% at $0.3320.

Technical analysts are looking for Bitcoin to clear $5,500, with mixed outlooks on Ethereum, XRP and Litecoin.

Bitcoin

Blockonomi – Price action still bouncing inside the ascending channel

CryptoGlobe – BTC’s Medium-term trend in the bull zone

NewsBTC – Prices trending above $5,000 thanks to events of early April

[the_ad id=”36860″]

Ethereum

FXStreet – ETH/USD bulls break past $170 and aim for $180-level

Blokt – Bullish ‘golden cross’ confirmed for Ethereum

XRP

FXStreet – XRP/USD $0.3000 again exposed

CryptoGlobe – XRP’s Medium-Term bearish after bulls fail to break $0.35

Litecoin

Ethereum World News – Dips remain attractive to the bulls

FXStreet – LTC/USD bulls locked in on $100 and beyond

[the_ad id=”36860″]

[the_ad id="42537"] [the_ad id="42536"]