The institutional-grade research arm of the crypto exchange Binance is taking a close look at the correlations between the top 30 cryptocurrencies by market cap.

Binance Research analyzed crypto correlations from March 31st, 2018 and March 31st, 2019. The report finds that price correlations between large-cap digital assets are extremely high and on the rise, meaning that generally speaking, most coins rise and fall in unison.

This may be linked to the increasing adoption of stablecoins and the fact that crypto exchanges are increasingly offering a variety of crypto pairs instead of simply pairing every coin with Bitcoin.

Despite the high correlations across most crypto assets, the report finds a few exceptions, noting that Dogecoin, Tezos and XRP “showed the lowest correlations with other digital assets across this one-year period.”

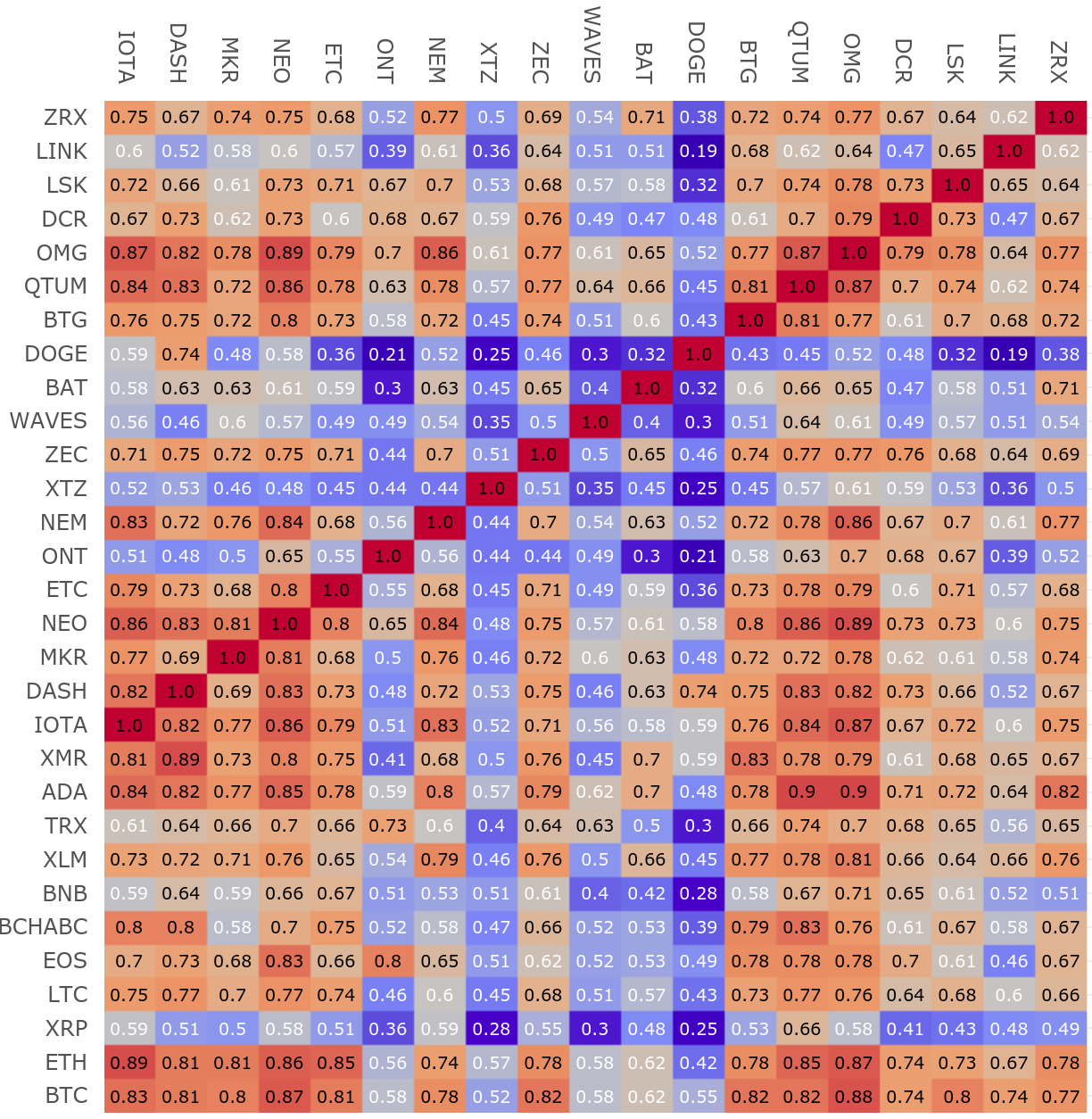

Here’s a look at all of the correlations across the top 30 crypto assets. The higher the number, the stronger the correlation.

Binance Research: Weekly Return Correlation Matrix

The report also determines that long-term analysis of XRP has shown the digital asset is less correlated with Bitcoin than previously thought.

“Based on weekly returns, large cryptoassets such as Bitcoin and Ethereum exhibit the highest correlations, but Ripple displays a lower correlation than in our previous report and is an exception as the best diversifier amongst digital assets with a market cap above $3 billion.”

In addition, the research reveals a strong correlation between XRP and Stellar Lumens.

“While Stellar was initially built on the Ripple protocol, its code was quickly forked and revamped. As of today, Stellar and Ripple code do not rely on the same common core. Yet these two digital assets still share several similarities as they both aim to reshape the global remittance industry.”

You can check out the full report here.

[the_ad id="42537"] [the_ad id="42536"]