Chinese investors are demanding more Bitcoin (BTC) as the country’s national currency continues to fall and as the US-China trade war continues to escalate spurring Chinese investors try to exchange a falling yuan for other assets like Bitcoin (BTC).

China’s ban on cryptocurrency exchanges and hefty premiums for Bitcoin have done little to stop investors’ appetite.

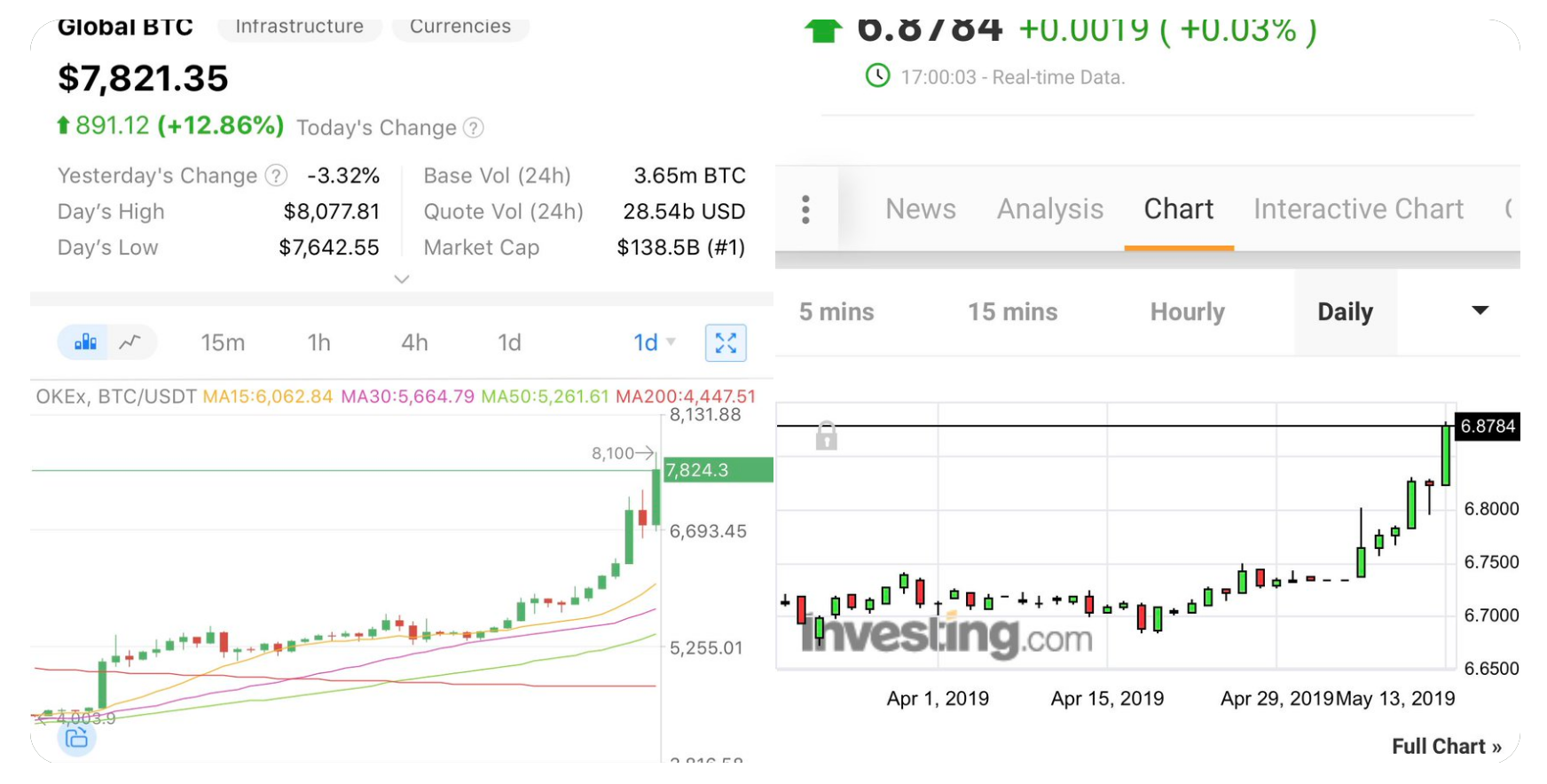

Since President Trump hiked tariffs on thousands of Chinese goods on Friday, May 10, imposing an increase of 10-25%, the price of Bitcoin has risen by 26% from $6,299. Bitcoin is currently trading at $7,938, according to data compiled by CoinMarketCap.

The BTC price increase appears to correlate with the sinking yuan, which has fallen 2% versus the dollar over the last two weeks, with Chinese investors losing confidence in the national currency as they expect it to continue dropping in value.

According to a CNBC report, in a note to clients on Monday, Andy Brenner, head of international fixed income at National Alliance Securities wrote,

“If you were in China and you wanted to diversify, it would seem logical that Bitcoin would be a short term alternative.”

“While we do not see the direct flows of who is buying Bitcoin, we can see that the bid for Bitcoin in this latest run has coincided with a big down tick in the value of the Chinese Yuan versus the dollar.”

Co-founder of crypto holding company Primitive Ventures, Dovey Wan, points to a comparison between Bitcoin and the US dollar-Chinese yuan exchange rate.

“Maybe just a coincidence but you tell me. Bitcoin is winning the trade war while China and US is a lose-lose.”

Forbes reports that demand for stablecoins has also risen sharply with more Asian investors using the cryptocurrency Tether to move money out of China and Hong Kong.

Philippe Bekhazi, CEO of New York crypto trading firm XBTO says,

“I’ve talked to a bunch of traders on the ground in Hong Kong. There’s a booming business in stablecoins because people are getting money out of China and Hong Kong.”

Most trades have been carried out over the counter (OTC) or on foreign exchanges through virtual private networks (VPNs). This makes it difficult to measure trading activity in China with significant accuracy.

Dave Chapman, chairman of Hong Kong OTC brokerage OSL suggests that approximately 20% of cryptocurrency trading volume stems from China.

He says,

“Most of OTC trading in China happens on WeChat groups.”

Speaking with CNBC on Thursday, IBM CEO Ginni Rometty worries that the trade war between the two superpowers is also threatening the free flow of digital data, highlighting how centralized powers are able to censor information.

“I’m hopeful that these things get resolved. But I also say that with all the talk about tariffs and the like around physical goods, some of what needs to be resolved are the rules around digital trade. That’s almost more important that there be free flow of data across borders and there not be localization of data. So those are all very serious issues to be worked on and I’m hopeful the trade talks address those things.”

The Bitcoin network is decentralized, allowing people to transfer value in a censorship-resistant environment without the consent of governments or help from third parties.

[the_ad id="42537"] [the_ad id="42536"]