[the_ad id=”36860″]

From the potential impact of Bitcoin’s increasingly limited supply to an update on Ethereum 2.0, here’s a look at some of the stories breaking in the world of crypto.

Bitcoin

Crypto analyst and author of Cryptocurrencies Simply Explained, Julian Hosp, says a metric known as the stock-to-flow ratio indicates Bitcoin is on a trajectory to $1 million over the next 10 years.

The ratio calculates the current supply of a given commodity divided by the amount produced per year in order to predict future value. When using the ratio to determine where Bitcoin may be heading, the leading cryptocurrency’s limited supply of 21 million coins emerges as a key factor. In the short term, Hosp says the model shows that Bitcoin’s upcoming halving, which will cut the block reward given to miners in half in 2020, should boost the price of BTC from $100,000 to as high as $300,000.

“Suddenly, we will have way less production… So by halving this, in order to keep the ratio stable, just from that the price [of Bitcoin] needs to double. But we are so much lower right now in the stock-to-flow ratio compared to gold, that if we get closer and closer to [gold’s ratio], the price should actually go to a $100,000 – maybe even $300,000. And then we would have a setback similar to how we always have these setbacks, to around $40,000.

As Bitcoin’s supply continues to dwindle over the next 10 years, Hosp says the price of 1 BTC is projected to climb to $1 million.

“You can see this in the entire calculation going up here. What we always have with this halving, we always have this move up… Obviously over time, we would get to a million here. And this is something that will be the long-term interesting part. By 2030, in this kind of example here, we would reach – that’s over the next 10 years – $1 million.

[the_ad id=”36860″]

Hosp says the ratio has proven to be remarkably accurate when looking at Bitcoin’s past price history.

This entire stock-to-flow value is actually 95% correct over the past years. And this is crazy, if you think about it. It’s such an accurate predictor. It would have predicted the 2014 bubble. It would have predicted the 2016 undervaluation. It would have predicted all of that… You could have seen the 2017 bubble going up here, and you would have seen the undervaluation now in this [past] summer.”

Ethereum

Ethereum scaling solution developer Prysmatic Labs just released a new update on Ethereum 2.0.

Prysmatic outlines a number of milestones and says new developers are welcome to come on board for testing.

“We are always looking for devs interested in helping us out. If you know Go or Solidity and want to contribute to the forefront of research on Ethereum, please drop us a line and we’d be more than happy to help onboard you :).

Check out our contributing guidelines and our open projects on Github. Each task and issue is grouped into the Phase 0 milestone along with a specific project it belongs to.”

[the_ad id=”36860″]

Ripple and XRP

Ripple’s global hiring spree continues. The company is now hiring a new account manager in Dubai.

.@Ripple is #hiring a Account Manager ! Apply today https://t.co/8GD3oYdXvg via @greenhouse #jobs #fintech

— Jim Chauncey-Kelly (@JChaunceyKelly) May 24, 2019

At the time of writing, the San Francisco-based startup has a total of 56 open positions, including eight for the company’s XRP development and fundraising arm Xpring.

Litecoin

OKEx, the popular digital asset exchange, released a tweet this week hinting at a potential collaboration with Litecoin. The lightning bolt in the background has triggered speculation that OKEx may be gearing up to adopt Litecoin’s Lightning Network.

It's about time to light up the market.@litecoin @SatoshiLite pic.twitter.com/vpC8fLCPQ2

— OKX (@okx) May 22, 2019

[the_ad id=”36860″]

Stellar

Paysend, a UK-based Fintech company, says it’s launching a new stablecoin on the Stellar network.

“The Paysend stablecoin is built directly on Stellar, which was designed expressly for tokenising assets and making payments. Stellar offers real-time transactions at a fraction of the cost of other blockchain networks.”

Paysend Group details why they chose to build their asset on the #Stellar network.

(TL;DR: They were looking for the ideal place to facilitate fast, low-cost transactions, and Stellar was it.)

Press Release: https://t.co/EjxbnYlVRe

— Stellar (@StellarOrg) May 23, 2019

Tron

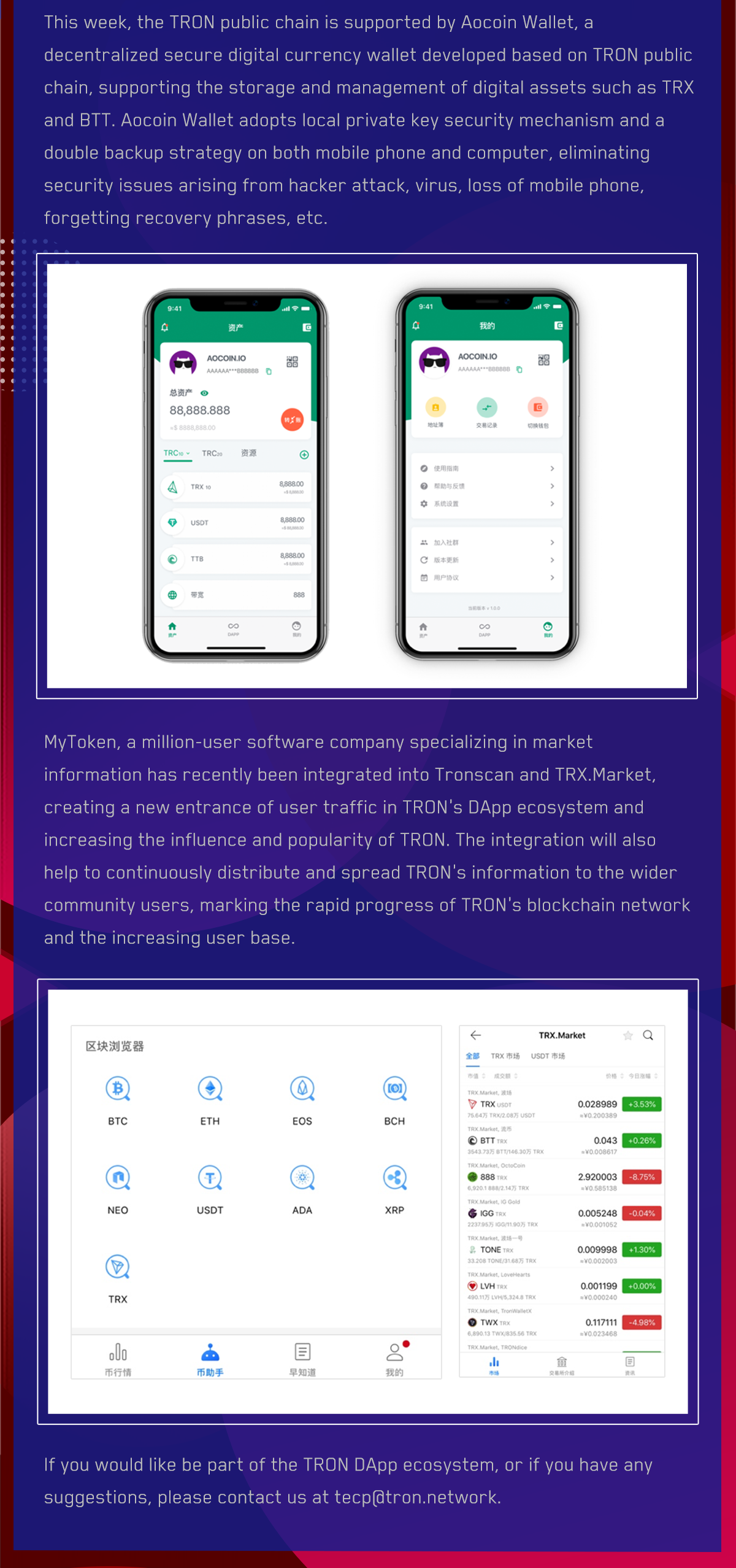

Tron’s latest report on the platform’s decentralized app (DApp) ecosystem is out.

The new edition highlights the Aocoin Wallet, a decentralized token storage on the TRON public chain, MyToken’s integration of Tronscan and TRX, and the latest DApps on the Tron network.

[the_ad id=”36860″]

Monero

Monero’s core developers are reportedly gearing up to switch to a new proof of work algorithm.

The software will be audited by the decentralized internet company Arweave, which revealed the news of the privacy coin’s upgrade to Cointelegraph. The audit will take place over the next two months, and if all goes well, the new proof-of-work algorithm is set to go live in October.

[the_ad id="42537"] [the_ad id="42536"]