Coinbase’s master plan to bring $10 billion of Wall Street money into Bitcoin and crypto just hit a major milestone.

The leading US crypto exchange says its institutional crypto storage solution Coinbase Custody now has $1.3 billion in assets under custody. The company says it won’t be long before that number jumps to $2 billion.

3/ “There’s a narrative out there that institutional-grade services don’t exist in crypto. This isn't true. Coinbase Custody is a regulated, insured and secure custodian. We have $1.3bn AUC and expect to hit $2bn soon. We have no intention of stopping there.”

— Coinbase Institutional ?? (@CoinbaseInsto) June 13, 2019

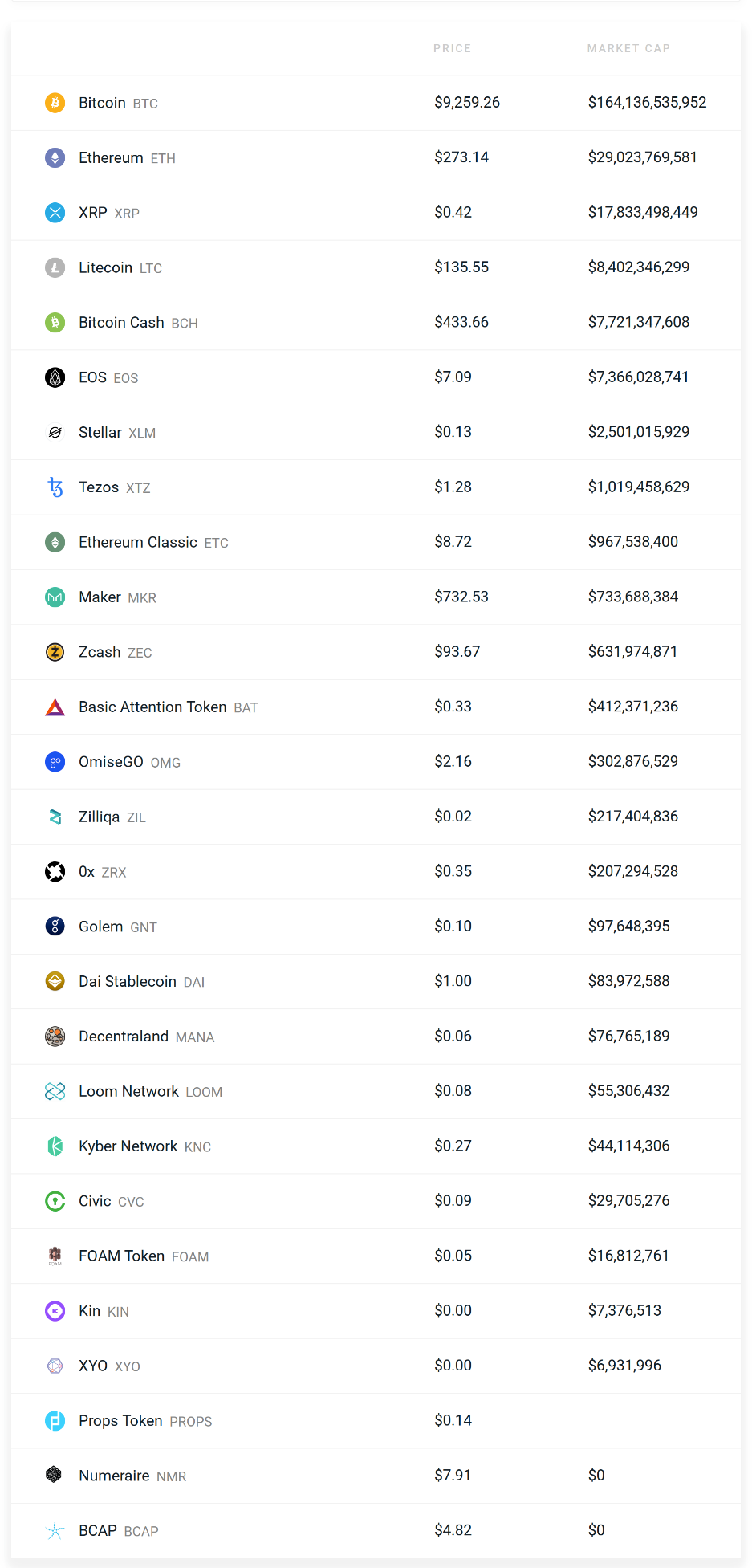

Coinbase Custody is only available to institutional investors with at least $10 million in deposits. The platform currently supports a total of 27 crypto assets covering more than 90+ percent of crypto by market capitalization.

Right now, about 60% of the company’s institutional clients are from the US.

“Coinbase Custody services over 90 clients. Of those, approximately 40% are outside of the US. As crypto matures as an asset class, we see financial hubs like London becoming centers for crypto innovation. We’re excited to be one of the companies driving this.”

Coinbase has been targeting institutional investors since late 2018, with the launch of its over-the-counter (OTC) trading desk. The platform allows investors with deep pockets to make large trades at a fixed price.

[the_ad id="42537"] [the_ad id="42536"]