[the_ad id=”36860″]

CME Group, the world’s largest derivatives marketplace by number of contracts traded, reports that CME Bitcoin futures set a new record on Tuesday.

The number of open BTC contracts reached an all-time high of 5,311 totaling an estimated $250 million, as BTC open interest rose by a record 643 contracts in a single day. CME reports that the surge suggests an influx of capital from institutional investors.

CME Bitcoin futures (BTC) shows growing signs of institutional interest. BTC open interest rose by a record 643 contracts in a single day, establishing a new all-time high of 5,311 contracts on June 17 (26,555 equivalent bitcoin; ~$250M notional). https://t.co/I6A3jD6Iq3 pic.twitter.com/ljz6EbvK79

— CME Group (@CMEGroup) June 18, 2019

Last month marked the biggest month for Bitcoin futures volume for CME since the launch of its BTC derivatives product in 2017, as nearly 300,000 contracts were traded throughout May, according to CoinDesk. Record volume for CME BTC futures is in step with Bitcoin’s bullish momentum, with Bitcoin currently trading at $9,124 up 143% from $3,754 on January 1, 2019.

[the_ad id=”36860″]

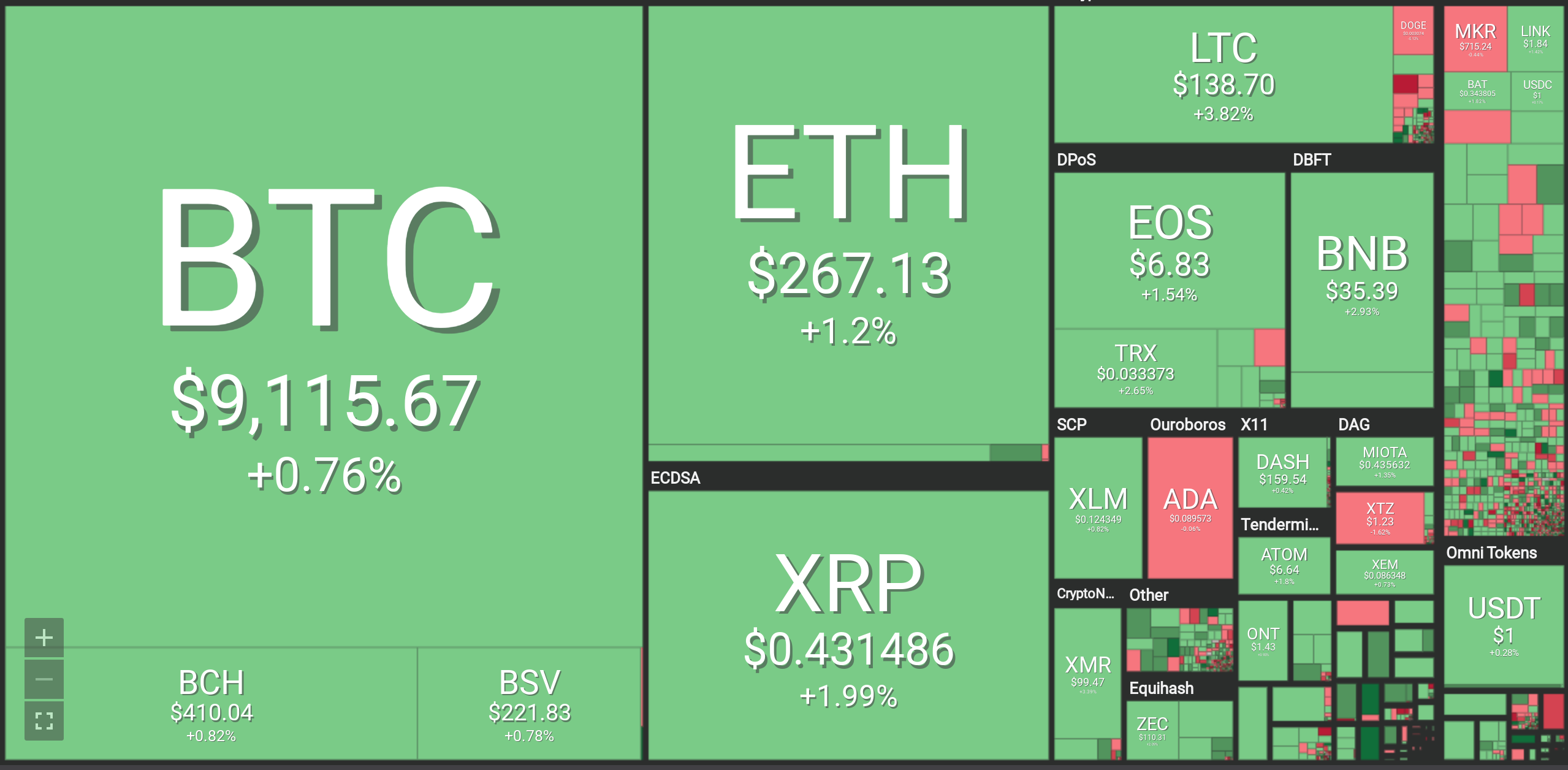

Right now, Bitcoin is up 0.76% at $9,115 according to COIN360. Ethereum is up 1.20% at $267.13, XRP is up 1.99% at $0.4314 and Litecoin is up 3.82% at $138.70.

Technical analysts are seeing mixed signals on Bitcoin as the leading cryptocurrency moves sideways.

Bitcoin

FXStreet – BTC recovery may stall as upside momentum has faded away

Bitcoin Live News – BTC eyeing strong gains above $10K

[the_ad id=”36860″]

Ethereum

Blockonomi – ETH primed for fresh increase above $270

FXStreet – ETH/USD hovers around $270 amid directionless trading

XRP, Bitcoin Cash, Litecoin, EOS, Stellar, Cardano

Coinspeaker – XRP/USD bullish on medium-term outlook

NewsBTC – Market testing crucial support: BCH, LTC EOS, XLM Analysis

Blockonomi – Cardano buyers now facing uphill task

[the_ad id="42537"] [the_ad id="42536"]