Binance Research has released the first in a series of reports on Bitcoin allocations in various investment strategies.

By simulating different Bitcoin allocation techniques in existing diversified portfolios, Binance Research finds that Bitcoin has not exhibited a significant correlation with other traditional asset classes such as commodities, equities or fixed-income products.

The report, entitled “Portfolio Management Series #1: Diversification Benefits with Bitcoin” finds that portfolios that include Bitcoin tend to exhibit overall better risk-return profiles than traditional multi-asset class portfolios.

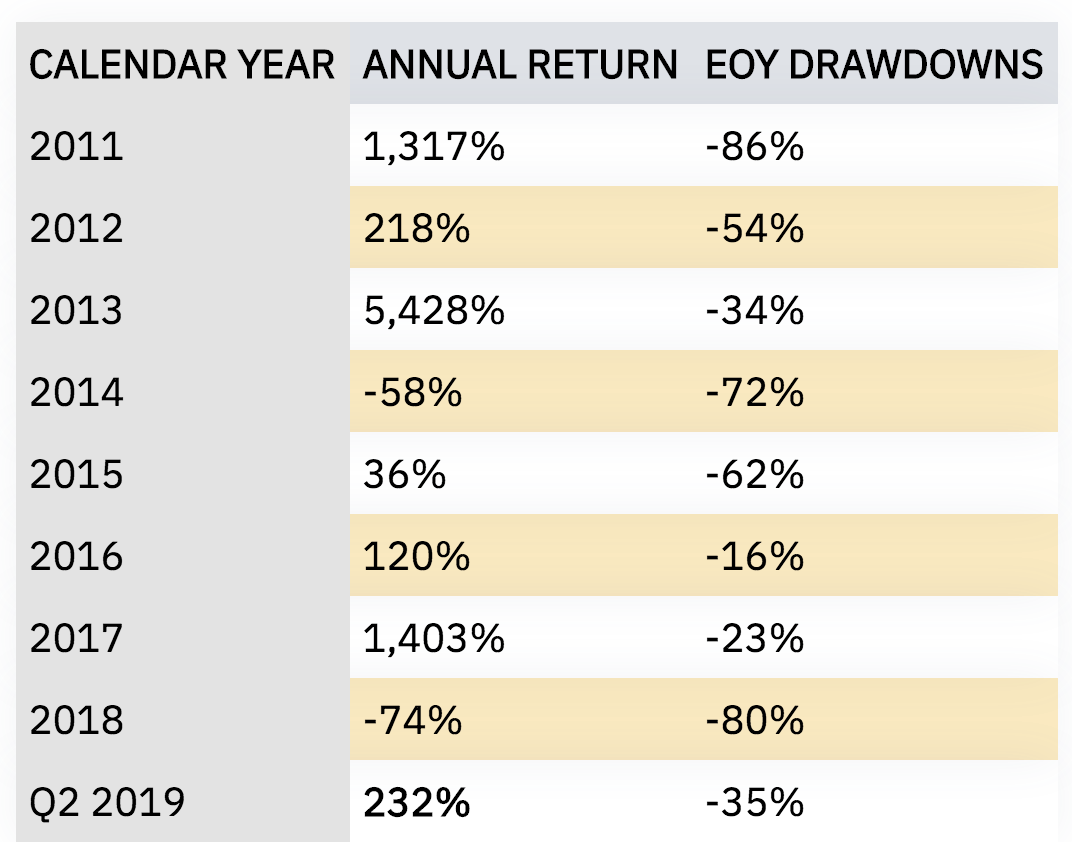

Calendar returns of Bitcoin (BTC) in US dollars

The researchers highlight Bitcoin as a high-risk, high-reward asset that has shown huge returns.

“From a trading perspective, Bitcoin is one of the most liquid assets on the planet with consistently low spreads, high volumes and price efficiency as trading venues are continuously being arbitraged.”

However, they also write,

“Bitcoin has been an extremely volatile asset, exhibiting large drawdowns following some of the largest price rallies recorded in history.”

You can check out the full report here.

[the_ad id="42537"] [the_ad id="42536"]