Technical and fundamental crypto analyst Nicholas Merten says whales are responsible for Bitcoin’s sudden, volatile price action.

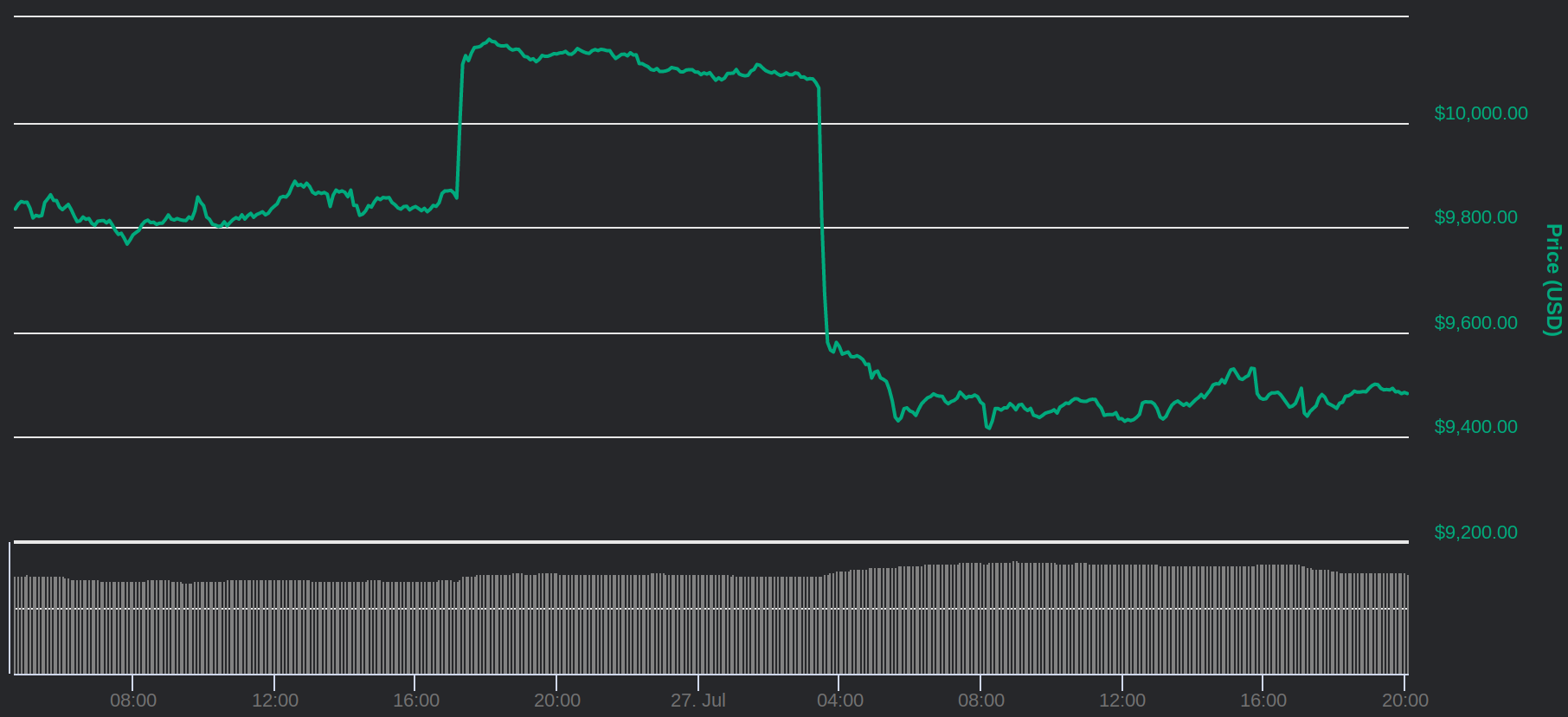

He attributes BTC’s rise above $10,150 and subsequent sharp drop to about $9,400 to a handful of large Bitcoin holders looking to manipulate the price of the leading cryptocurrency in order to reap the rewards by simultaneously trading on leverage.

“It’s a few people who are coordinating these prop ups of the market and dumps in the market. And they’re actually not really competing against you. In fact, they’re actually trying to compete against one another. Because really, anyone can do this. If you have enough Bitcoin, what you do is you manipulate the spot market and then you trade on margin on exchanges like BitMEX.

So if I have enough Bitcoin to push Bitcoin’s price down $600… I might incur some slippage in the process. I’m going to, for example, sell a lot of my Bitcoin through this price range clearing through the order book. But what I’m actually trying to do is I have another position on BitMEX that’s trading on leverage – 10x leverage, 10x leverage, meaning I’m trading with 20 times the capital. So even though I might incur the cost of trying to push the price down, I might be shorting Bitcoin on margin and be making a fortune.”

Merten highlights Bitcoin’s so-called Bart chart, which looks like the outline of Bart Simpson’s head, as a classic sign of whale activity.

“Here’s the thing though, have you ever noticed that sometimes when we get these Bart charts, we very commonly will have a switch in the trend very quickly or sometimes as soon as a few minutes after, where basically we’ll get a prop up in the market and price will deplete back down. That’s exactly what happens. It’s the fact that a lot of these whales are competing against one another.

That’s why a lot of them don’t take the risk 24/7 to simply try to do this. They’re dealing with very large positions and they’re coordinating behind the scenes. It’s a select few parties who do this kind of stuff. I don’t know who they are, but it’s exactly what you’re seeing in the price.”

Despite the power that whales have over the market, Merten says he doesn’t believe they can manipulate the longer-term Bitcoin cycle.

“They can do things in the short term. The longer-term are driven by either a wave of retail or institutional liquidity, more people getting into the cryptocurrency space, more utility being found in the space, whether it be through store of value, transfer of value or through all kinds of other use cases through the altcoin space. It doesn’t matter. What we’re focused on looking here is looking for optimal periods to average in. At least that’s what I’m looking for right now. And what I’ve talked about is that anything in this range [between $7,000 and $8,500], I’m eager to buy.”

[the_ad id="42537"] [the_ad id="42536"]