[the_ad id=”36860″]

Fidelity Charitable has added XRP to its list of assets, allowing donors to make contributions using the world’s third-largest cryptocurrency.

According to the announcement,

“The addition of Ripple expands the existing array of assets, including bitcoin, that donors can contribute into their donor-advised funds to fuel their philanthropy.”

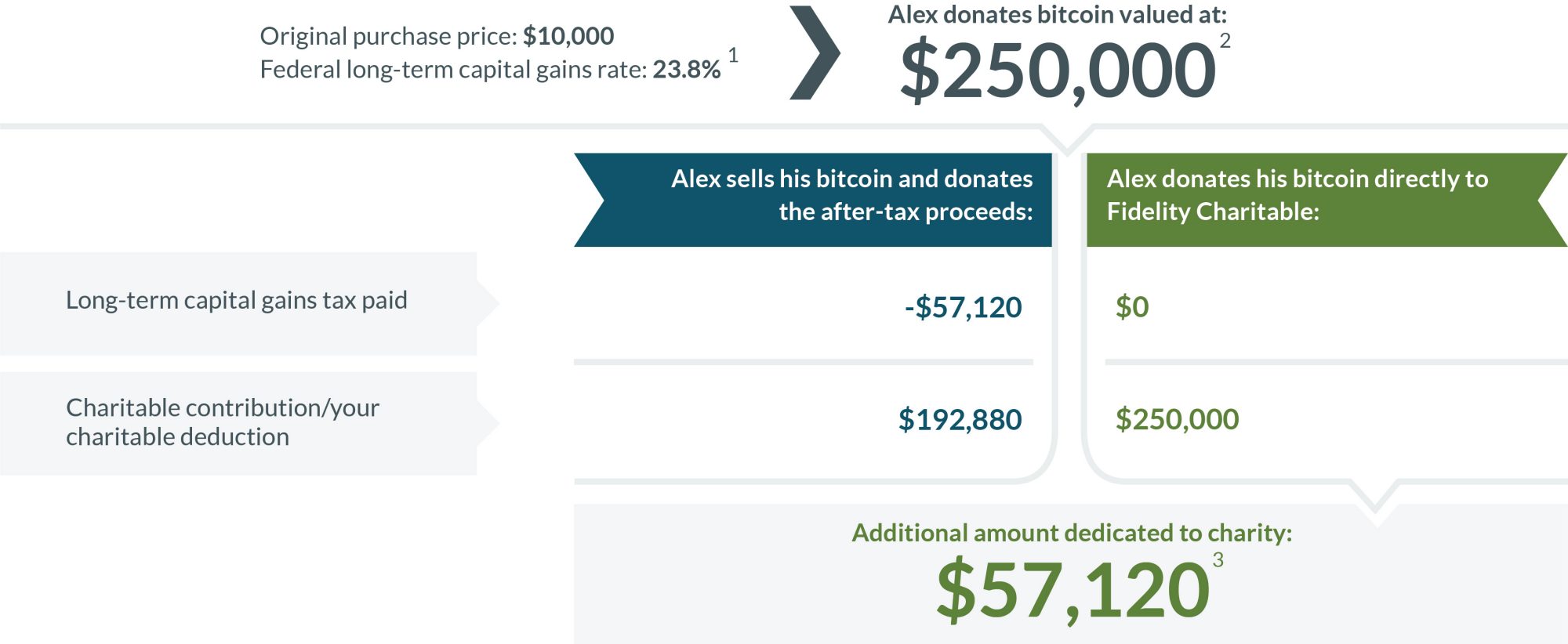

Cryptocurrency donations give people a way to increase their charitable giving since gifts are exempt from paying capital gains taxes. Instead, the 501(c)(3) charity receives the full value of a donor’s contribution.

Crypto Donations to Fidelity Charitable

In the example above there are three key assumptions.

- Assumes all realized gains are subject to the maximum federal long-term capital gains tax rate of 20% and the Medicare surtax of 3.8%. This does not take into account state or local taxes, if any.

- Amount of the proposed donation is the fair market value of the appreciated property held more than one year that donor considers, as determined by a qualified appraisal.

- Assumes a contribution of 100 bitcoin. Alex’s tax basis is assumed to be $100/bitcoin. If Alex sold 100 bitcoin for $250,000, he would have $240,000 in capital gains and would pay $57,120 in tax.

[the_ad id=”36860″]

The organization says there’s also another upside to making donations using cryptocurrencies such as Bitcoin and XRP to Fidelity Charitable, which has a donor-advised fund program: participants can recommend how the contribution is invested and potentially grow it tax-free.

The organization has helped donors support more than 278,000 nonprofit organizations with more than $35 billion in grants. It hit a milestone last year with $1 billion in contributions from complex assets such as private stock, limited partnership interest, real estate and cryptocurrency.

The addition of XRP rounds out the organization’s support for the world’s top five cryptocurrencies: Bitcoin (BTC), Ether (ETH), XRP, Bitcoin Cash (BCH) and Litecoin (LTC).

[the_ad id=”36860″]

[the_ad id="42537"] [the_ad id="42536"]