[the_ad id=”36860″]

A senior quantitative researcher at crypto investment fund Ikigai says Bitcoin’s 2019 rally is not over yet.

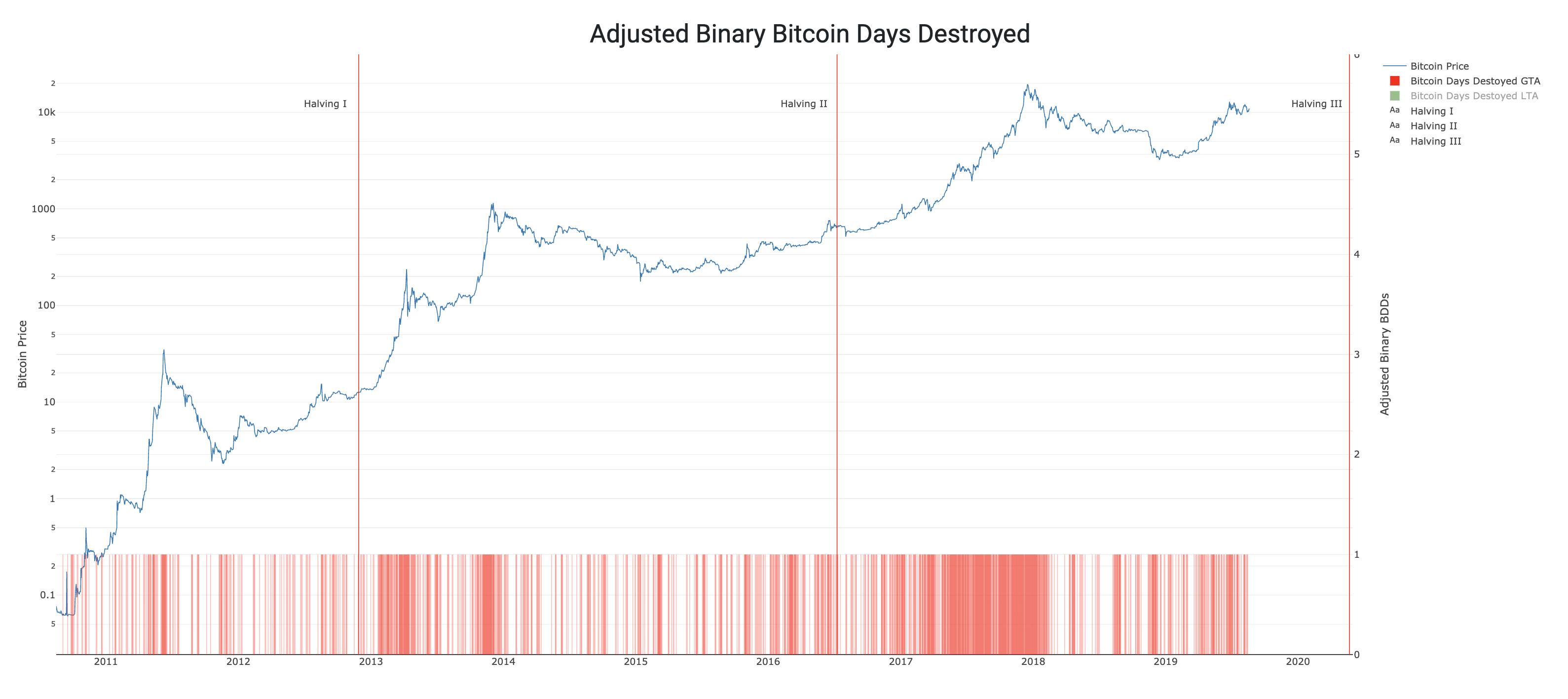

According to Hans Hauge, an analysis of the amount of BTC sold by long-term holders over time indicates the leading cryptocurrency has not yet reached a top in its current cycle.

“Bitcoin bubble tops are clearly identified with a dark red cluster of Adjusted Binary BDD. Until that happens, we’re not at the top. Public opinion is key here because that red cluster is caused by the assumption of the crowd and is self-fulfilling (reflexivity).”

To the contrary, Hauge says the numbers show a large amount of accumulation in the market.

“In fact, recently there’s been quite a bit of accumulation (or what you might call dormancy, a lack of ‘destruction’). A few people are always going to take short-term profits, but that’s to be expected in any market.

[the_ad id=”36860″]

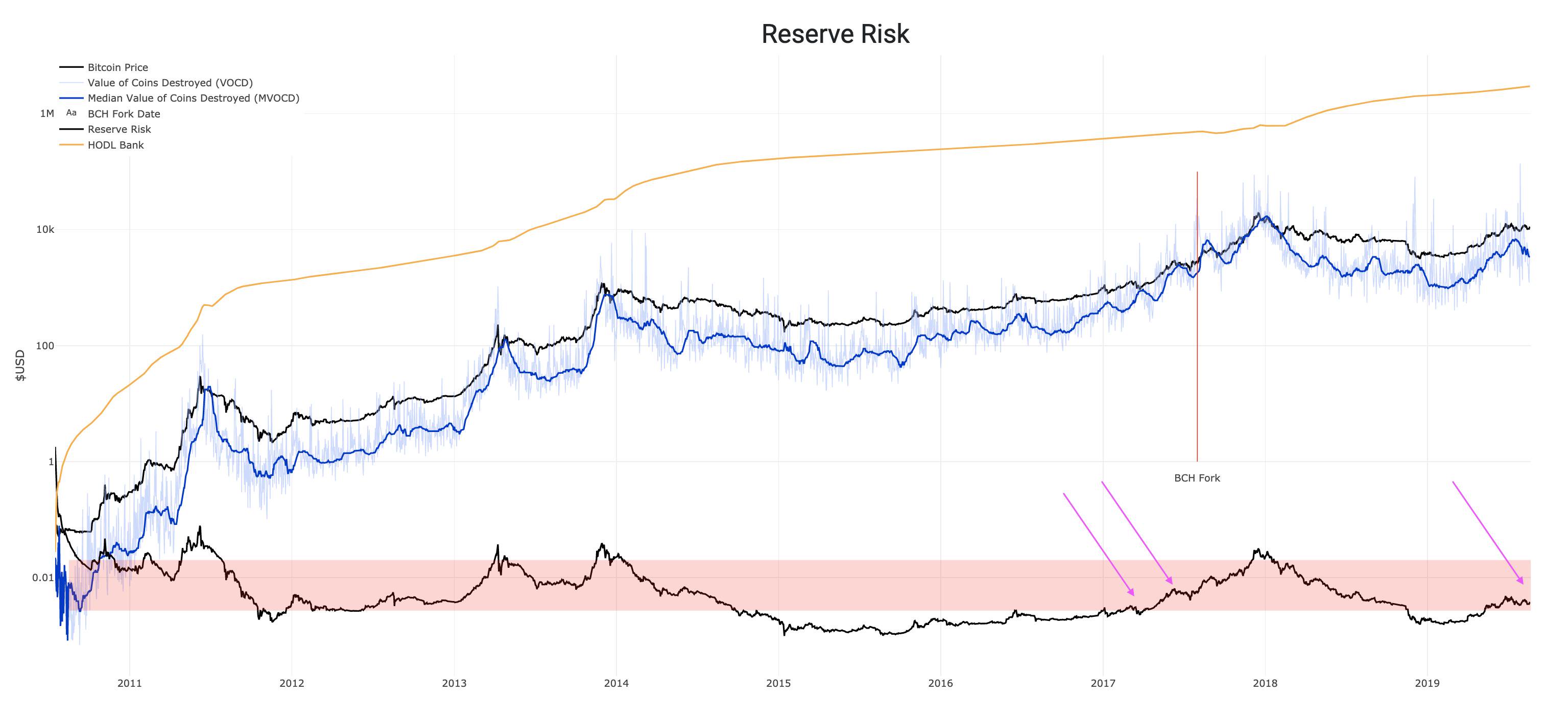

If we zoom out and think about the long-term, our current level of Reserve Risk is equivalent to where we were in the early part of 2017. If you recall that was right BEFORE things got really crazy and 6-9 months before the bubble burst (BTC was around $1-$2k at the time).”

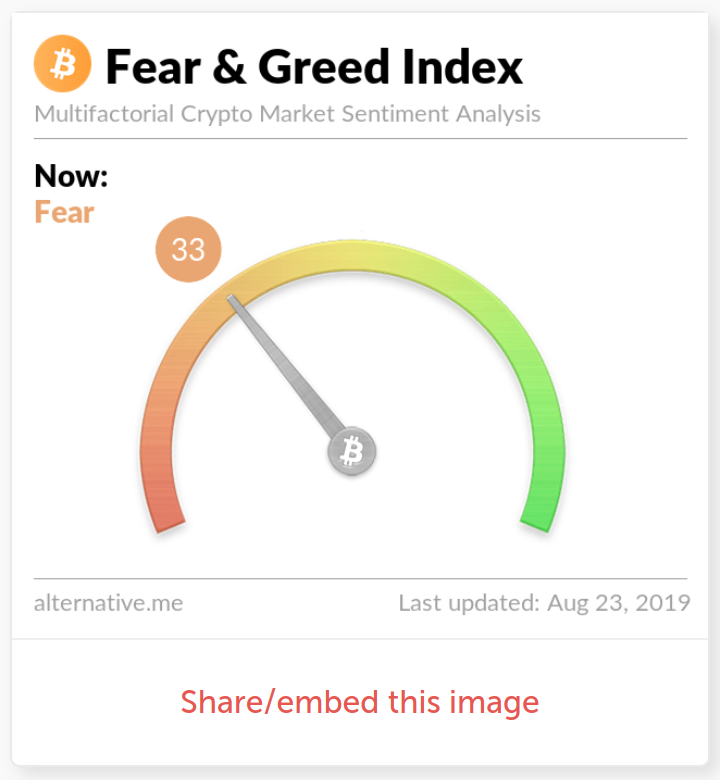

Crypto sentiment remains in the fear zone, according to the Fear & Greed Index from Alternative.me. The index hit a rock bottom low of 5 on Thursday, indicating traders were “extremely fearful” the price would continue to drop. According to the creators of the index, extreme fear often indicates the traders may have overcompensated and the market is overbought.

Right now, the Fear & Greed number has bounced back but remains in the fear zone at 33, at time of publishing.

[the_ad id=”36860″]

[the_ad id="42537"] [the_ad id="42536"]