A pair of crypto analysts aren’t buying bullish optimism on Bitcoin’s short-term prospects.

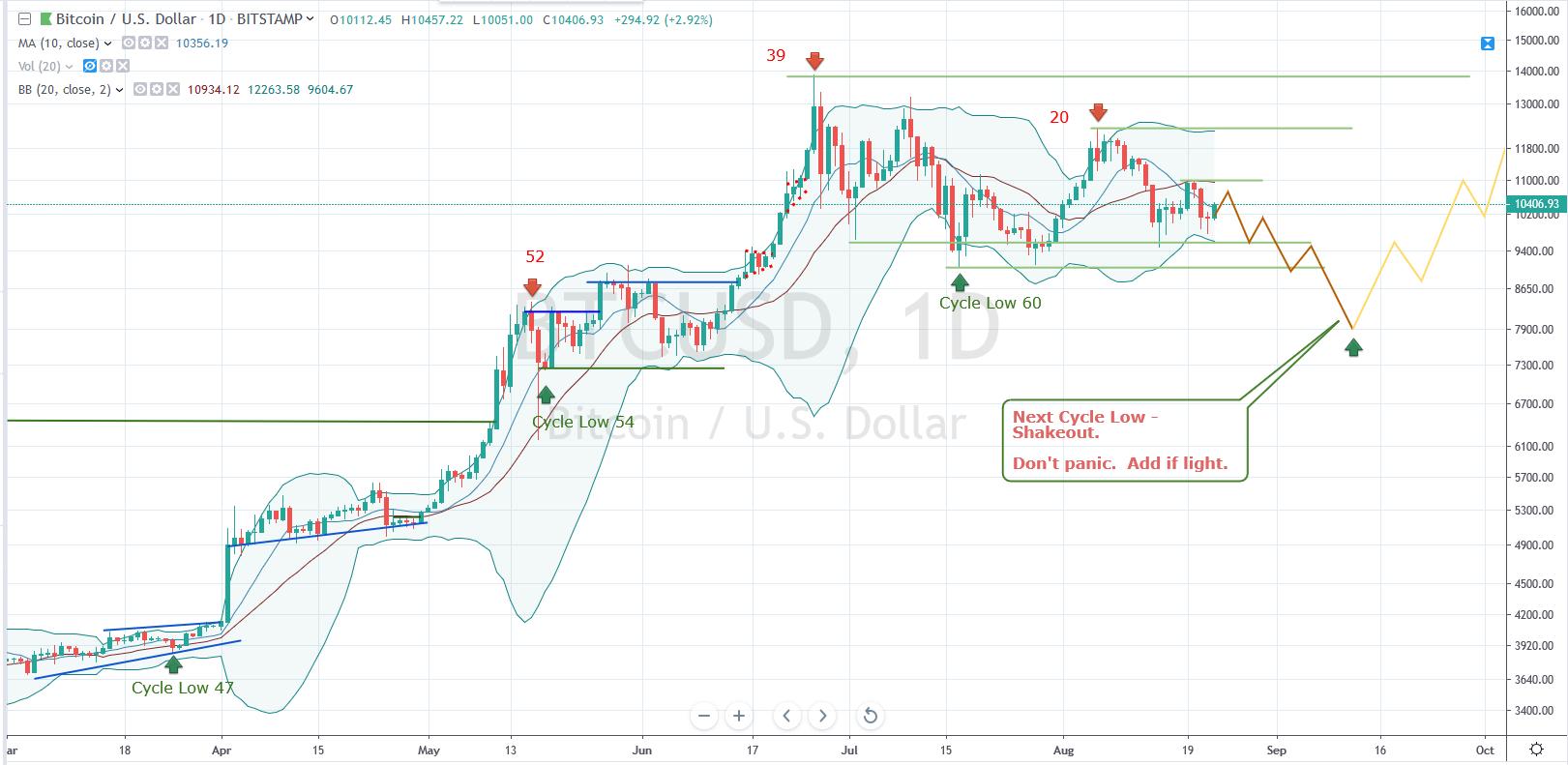

Crypto trader and entrepreneur Bob Loukas says Bitcoin’s rally that began in December of last year is on hold, with Bitcoin now posting a series of lower highs in succession. Loukas expects BTC to move as low as $7,900 in a “major shakeout” before a renewed rally begins.

“Buy and hold as if it’s going to rocket out of this consolidation. But know the intermediate-term rally from Dec lows ended. Therefore, a major shakeout from this consolidation, before a continuation, would be perfectly normal behavior.”

Meanwhile, a fellow analyst who goes by the alter-ego Squeezy told his 104,000 followers on Twitter that a doji top in Bitcoin’s daily chart indicates Bitcoin is poised to hit $10,500 before dropping below the $8,000 mark.

The doji is a candlestick pattern that’s used to identify potential market reversals based on prior price action.

Daily doji spotted. Expecting price to move up to ~$10,500.

So far, we have lower highs.

Doesn't exactly instill confidence in moving up past $11,000.Long scalping to $10,400+

Short entry target: 10,500 pic.twitter.com/THVs2esuT2— Squeeze (@cryptoSqueeze) August 23, 2019

Meanwhile, the CEO of financial advisory giant deVere Group is feeling far more bullish.

Nigel Green tells The Independent that the US-China trade war is likely to drive the price of Bitcoin higher.

“Escalating tensions between the two world’s largest economies will see investors pile into decentralized, non-sovereign, secure currencies, such as Bitcoin, to protect them from the turmoil taking place in traditional markets.”

Green, who recently said he believes Bitcoin will surge to $15,000 in the short term, tells CCN he expects BTC to remain above $10,000.

“It bounces at this price. If it fluctuates below this level, it shoots back up again. We have seen this in action on Monday when Bitcoin hit $10,500 in a matter of minutes.”

If the Sino-U.S. trade tensions were somehow dramatically de-escalated and the global economic outlook became more optimistic, the Bitcoin price would still continue to rise due to the other major factors driving it – not least the growing public awareness and institutional investment.”

[the_ad id="42537"] [the_ad id="42536"]