HodlX Guest Post Submit Your Post

Will Bitcoin delight the market in H2 2019?

Key Takeaways

- Speaking at Jackson Hole Symposium, US Fed Chair Powell could signal more cuts.

- Easing bias among Asian policymakers has become more noticeable and aggressive.

- Bitcoin can reach $14,000 against USD by the year-end.

Overview

When the annual global central banks’ symposium kicked off at Jackson Hole, Wyoming last weekend, all eyes were focusing on US Federal Reserve Chairman Jerome Powell, as markets have been increasingly concerned about the fragile growth of the global economy, and the challenge of setting future monetary policy frameworks.

With additional rate cuts on the horizon and global central banks jumping on the easing bandwagon, the demand for hard assets like gold is expected to surge, and that inflation-hedging drive could push the prices of Bitcoin to $14,000-levels by the end of the year.

Surprising the Markets

Central banks around the world have been taking a more aggressive stance on easing, especially in the APEC region. Just this month, at least three central banks surprised the markets by lowering their interest rates. RBNZ went even further, slashing its benchmark rates more than expected by half of a percent in early August, noting that “Global economic activity continues to weaken, easing demand for New Zealand’s goods and services.”

A large part of the blame on the dovish shift is the US-China trade truce, especially in Asia. The strength of some local currencies, such as the baht, was also in play. However, regardless of local factors, the recent moves from Asian central banks are no less and only solidify the global rate cut cycle.

Fed’s Next Move?

On the back of a recession signal triggered by the bond markets, and US President Donald Trump’s America First policy, Fed Chairman Jerome Powell is expected to use the Jackson Hole meeting to signal an additional rate cut and the attitude towards the future cuts.

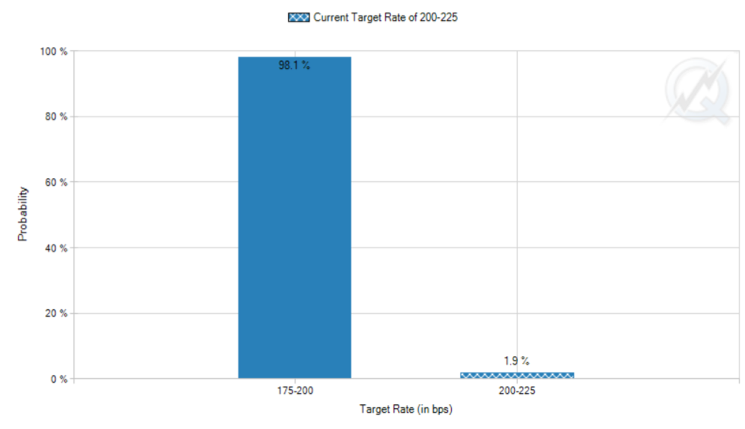

Although Trump has made some high-profile comments on the Fed’s policy recently, markets seem already priced-in at another rate cut in September. Data from CME’s FedWatch shows that there was a 98% chance that the fed funds rate will be slashed by another 25 basis points.

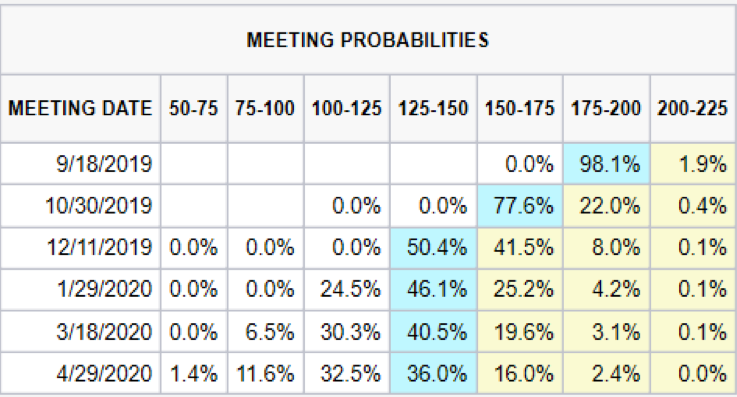

Furthermore, the chance of cutting rates in all the remaining FOMC meetings this year is also high. At the time of writing, the FedWatch tool indicates that there’s more than a 77% chance that a quarter-percentage-point cut will occur in the October meeting and a 50% chance for another cut before Christmas.

Figure 1: Target Rate Probabilities for September 18, 2019 Fed Meeting

Figure 2: FedWatch’s Upcoming Meeting Probabilities

Implications on Bitcoin?

We build on the estimation from the CME FedWatch, assuming three more rate cuts for the rest of 2019, and 25 basis points for each cut. Also, we measured the price performances of BTC in June, in which the FOMC left the rates unchanged in the policy meeting, but dropped the word “patient” in describing its approach to policy. The change in wording was considered a gesture to open the door for rate cuts. The anticipated rate cut was materialized after July’s policy meeting. It was the first cut since the 2008 global financial crisis.

Figure 3 shows that BTC gained about 12% against USD in between FOMC June and July meetings. Assume that a 25 bps cut could give an estimated 12% gain to BTCUSD. Three more 25bps cuts could send BTCUSD to $14,000 levels by the year-end, breaking the previous high near $13,800. Given the high volatility in BTC prices and the building-up expectation of a 50 bps cut from the Fed, the estimate seems rather conservative. However, a strong USD could limit BTC’s upside, since the inverse correlation between the two has been increasing.

Figure 3: BTC/USD Year-End Target

Conclusion

We’ve seen more central banks moving toward an easing bias, and markets are continuing to be clouded by uncertainties. It’s increasingly challenging for investors to pursue decent returns in traditional markets. We reviewed how the low-interest-rate environment could benefit Bitcoin, and the year-end target of $14,000 remains possible. However, it still depends on a basket of factors, such as the changes in monetary policy, the USD’s performances, the development of the US-China trade war and Brexit. We will keep a close eye on the global events that could impact the crypto space.

This post originally appeared on Medium. Read more.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

About OKEx

OKEx is a world-leading digital asset exchange headquartered in Malta, offering comprehensive digital assets trading services including token trading, futures trading, perpetual swap trading and index tracker to global traders with blockchain technology. Currently, the exchange offers over 400 token and futures trading pairs enabling users to optimize their strategies.

Follow us on Twitter.

Check our latest press material on Press Room.

Follow Us on Twitter Facebook Telegram