[the_ad id=”36860″]

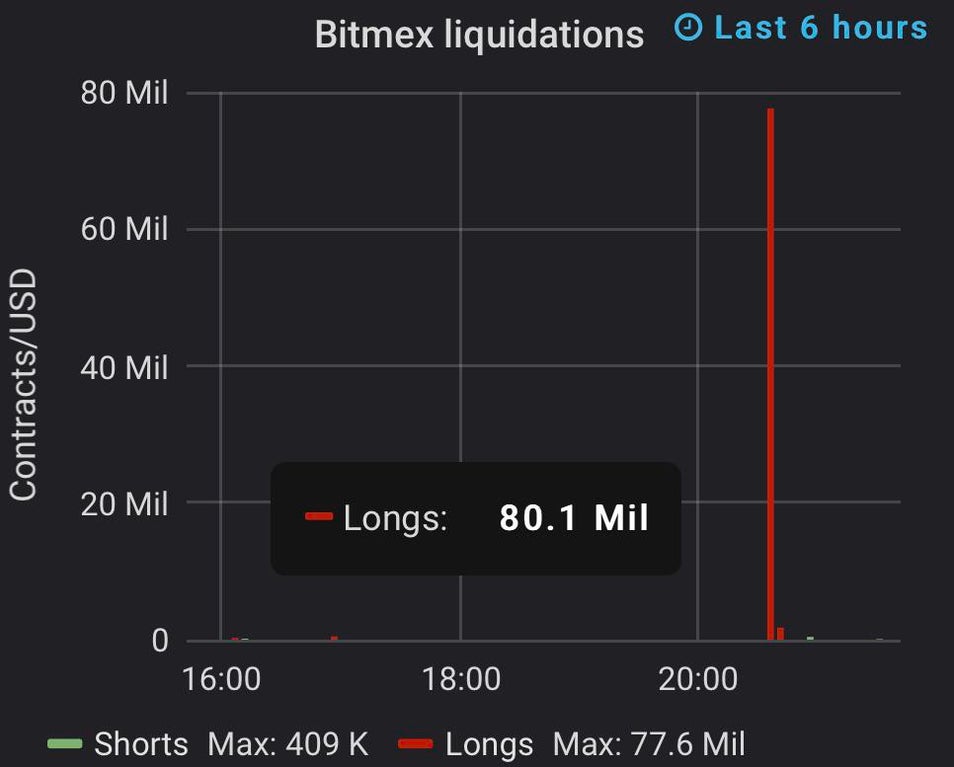

Bitcoin’s drop from around $10,337 to a 24-hour low of $10,027 triggered $80 million in long liquidations on the crypto derivatives platform BitMEX.

The liquidations were tracked by the margin trading monitor Datamish.

Bitcoin is down 2.20% at $10,091 at time of publishing, according to CoinMarketCap.

[the_ad id=”36860″]

Analyst Josh Rager says the king of crypto could slide to $9,000 in the short term if the bulls don’t manage to stage a comeback.

“Bitcoin price breaks through current support area on the daily and through the 20MA.

If buyers don’t step in the next couple days, we’ll see Bitcoin retest the previous support in the low $9,000’s A break from there likely leads to $8,000.”

FXStreet’s Rajarshi Mitra says BTC is now facing its first level of resistance at $10,280 and appears to have support at $10,080.

“There are two resistance levels on the upside at $10,280 and $10,450.

On the downside, healthy support level lies at $10,080, which has the SMA 5, SMA 10, 1-day pivot point support 1, 15-min Bollinger band middle curve, 1-week Fibonacci 61.8% retracement level.”

[the_ad id=”36860″]

As Bitcoin teeters on the edge of $10k, Blockforce Capital says BTC is hitting its lowest levels of volatility in about four months.

Chief investment officer David Martin tells Forbes that Bitcoin’s 30-day volatility is now at around 53.50%.

“So far in September, Bitcoin’s price has continued the consolidation and range-bound nature that was kicked off early August.

As of [Tuesday] morning, Bitcoin’s volatility is now at a four-month low of 53.5%, a level not seen since May 11th.”

[the_ad id=”64368″]

[the_ad id="42537"] [the_ad id="42536"]