HodlX Guest Post Submit Your Post

Key Takeaways

Bitcoin prices have been trading in a narrow range recently and many traders have turned their focus to the altcoin space.

Fundstrat’s Tom Lee believes that when the S&P reached a new all-time high, Bitcoin would follow suit. Lee’s study also found that Bitcoin performs the best when the S&P has an annual return of 15%.

Overview

The recent lackluster price actions of Bitcoin have been testing crypto traders’ patience as the trendless situation endures. While there seems to be no end in sight, many crypto watchers have been asking when is this going to end? Should we expect a positive breakout or a price correction? A recent comment from a heavyweight crypto critic sheds light on the outlook of the leading cryptocurrency, and the equity markets may hold the key of the next Bitcoin rally. We have studied the nature of Bitcoin as a safe-haven asset like digital gold, and we will explore Bitcoin’s risk-on characteristic and what could trigger the sentiment to shift.

Bitcoin Uninspiring

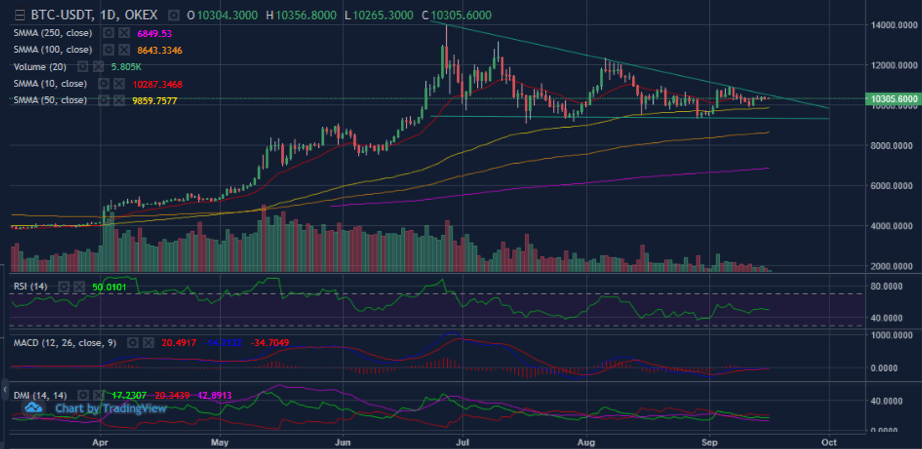

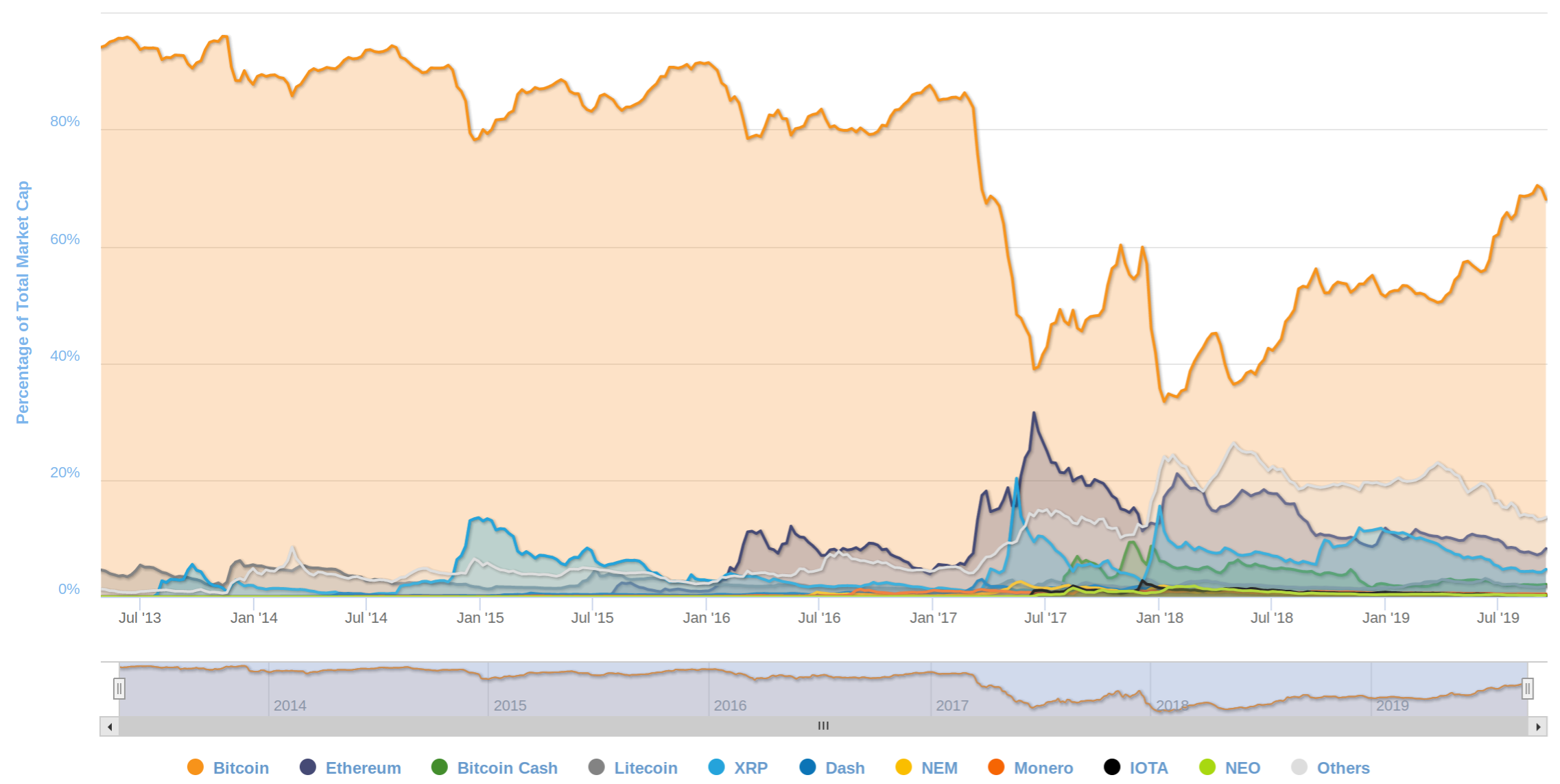

The prices of Bitcoin have been in range trading since early July and the range has been increasingly narrow in recent weeks. While the markets seem generally to believe that the dull price actions are part of the setup for the next big move of the leading crypto, many of the traders have been taking a wait-and-see approach. The gradual slowdown in trade volume could give the following picture (figure 1). Some comments are even more pessimistic, saying that Bitcoin dominance has peaked at 70% and will hardly go back to the 80% levels we saw three years ago. (figure 2).

Figure 1: BTCUSDT Daily Chart

Figure 2: Total Market Capitalization of Major Crypto

The big picture of Bitcoin remains largely positive with the institutional platform Bakkt expected to be in operation later this month. The platform provides only Bitcoin futures products and it’s expected to boost demand for Bitcoin. However, many traders have been asking when a breakout of Bitcoin prices will occur, regardless of the direction. Well, the equity markets may hold the keys.

Equities: Key to Bitcoin Rally

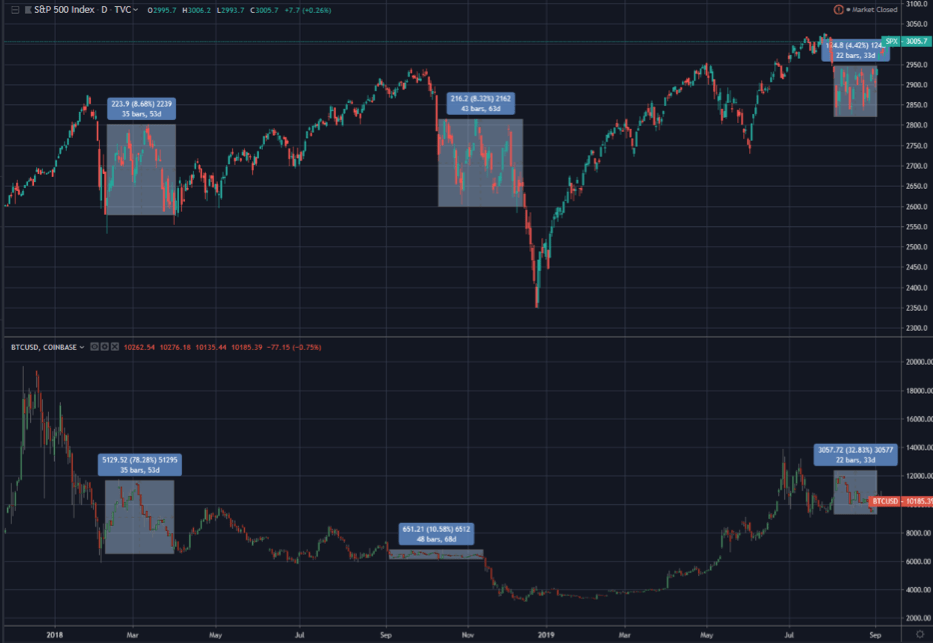

Just recently, a heavyweight crypto pundit has shed light on what could be the next big move for Bitcoin, and what could trigger the move. In an interview with CNBC, Tom Lee, co-founder, managing director and head of research at Fundstrat Global Advisors, believed that Bitcoin’s recent stalled price action was affected by the stalled macro outlook. Lee added, “A world without trend, Bitcoin doesn’t go up.” He stated that when the S&P reaches a new all-time high, it would be bullish for Bitcoin. When we look through the past two years, when the S&P was in range trading, coincidentally, Bitcoin was in range trading as well (figure 4). This happened twice in 2018 and once just recently.

Figure 3: S&P 500 and BTCUSD in See-Saw Patterns

The S&P 500 has been inching closer to its all-time high of near 3027 after a month-long consolidation (figure 4). The SPX has been in range-trading mode since early August, bouncing approximately between 2822 to 2943. In early September, the index broke out and has been trying to reclaim July’s highs, hovering just under its all-time high.

Figure 4: S&P 500 YTD Chart

In an interview with Marketwatch, Mislav Matejka, chief global equity strategist at JP Morgan, believes the US equity markets will rally into the end of the year. Matejka said,

“The key call is that the US is not headed for a recession. The consumer is strong, interest rates are coming down and there are signs that global growth will rebound.”

Read more: In Easing We Trust

Best of Both Worlds

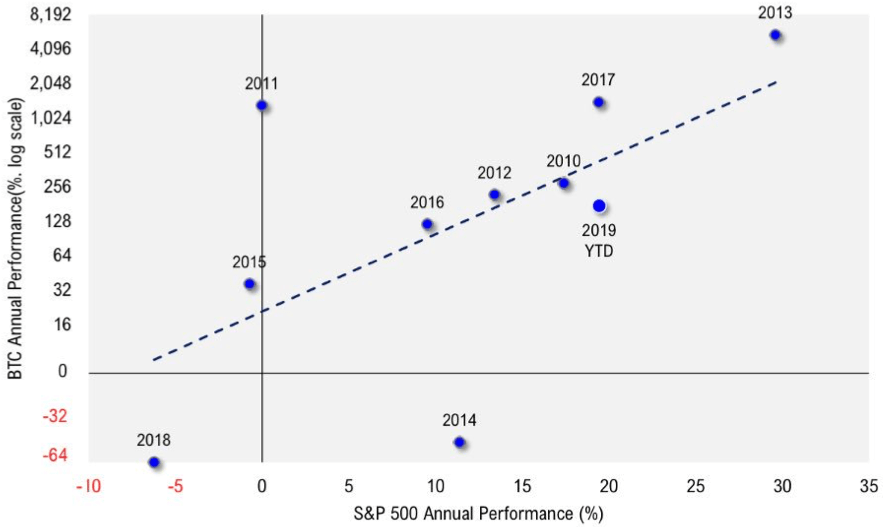

When Lee studied the comparative return of the S&P and Bitcoin, he found that Bitcoin does best when the S&P is up more than 15% (figure 5). His findings concluded that Bitcoin is like a coin with two sides. On one hand, when the markets experience turbulence it acts like digital gold; on the other hand, when markets are in the risk-on mode, Bitcoin could also be a risk-on asset.

Figure 5: Comparative Return of Bitcoin and S&P 500 Since 2010

Risk-on Now?

There are signs of optimism globally as we enter the final quarter of 2019. Looking ahead, some macro events could potentially be market movers.

Trade optimism: China’s trade officials are set to travel to the US this week to prepare for some high-level trade talks later in October. Although many believe that there’s much work to do to reach a comprehensive deal, the option of having an interim limited trade deal remains on the table. Meanwhile, Reuters reported that President Trump said a US-China trade deal could come before the 2020 election.

More rate cuts on the card: The US Federal Reserve lowered the interest rate by 25 bps again on Wednesday. The expectations of additional rate cuts for the remaining two FOMC meetings this year had been building up, which came after the European Central Bank cut its benchmark rates early this month and restarted the bond purchasing program.

Safe-haven assets check: Generally speaking when markets are in risk-on sentiment, safe-haven assets such as gold and JPY would be out of favor, and capital flow would increase in riskier assets such as equities and high beta FX. Let’s take a closer look at USDJPY, the pair traded above 108 most of the time this week. Some analysts believe that the rebound could extend to 108.85. On the other hand, gold surged 1% after the oil facility attacks in Saudi Arabia, but still not much action around the 1500 area. However, the outlook on safe-haven assets is still largely dependent on how the markets interpret the Fed’s forward guidance.

Conclusion

We’ve seen Bitcoin’s price flip-flopping in a narrow range, while traders’ attention has been shifting to the altcoin world. However, according to a prominent crypto analyst, the bull case of Bitcoin remains strong with rallies in the equity markets possibly triggering a fresh round of Bitcoin buying and turning the leading cryptocurrency from a safe-haven asset to a risk-on investment. However, the picture seems to remain somewhat mixed when it comes to a bull case for the equity markets.

This post originally appeared on OKEx Blog. Read more.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

About OKEx

OKEx is a world-leading digital asset exchange headquartered in Malta, offering comprehensive digital assets trading services including token trading, futures trading, perpetual swap trading and index tracker to global traders with blockchain technology. Currently, the exchange offers over 400 token and futures trading pairs enabling users to optimize their strategies.

Follow us on Twitter.

Check our latest press material on Press Room.

Follow Us on Twitter Facebook Telegram