Kik CEO Ted Livingston is calling it quits for the popular messaging app targeted for teenagers.

By 2016, the free mobile app reportedly had 300 million registered users, had reached 40% of American teens and was valued at $1 billion.

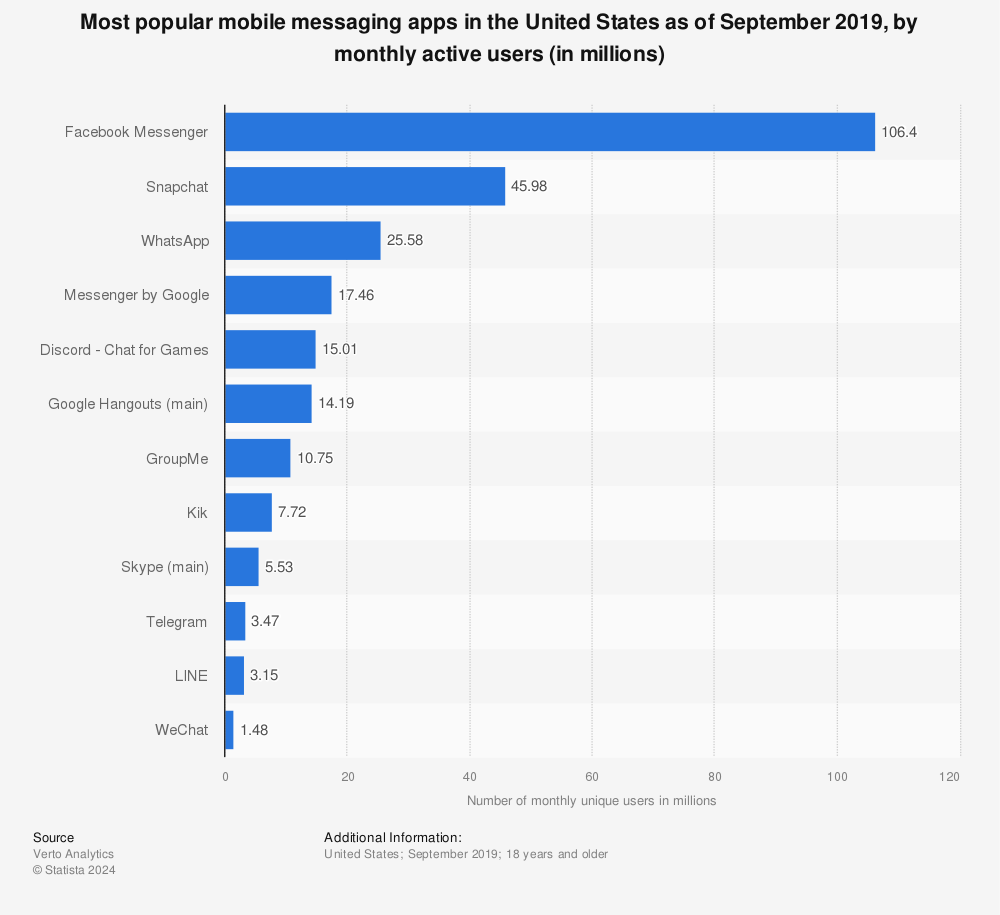

But by June 2019, Kik’s market share had dropped, according to Statista, with an estimated 5.1 million monthly active users.

Find more statistics at Statista

Livingston says the company will now focus on the development of its Kin (KIN) token after laying off 70 employees, downsizing to a staff of 19 people.

The decision, he says, is a direct response to the company’s long legal battle with the US Securities and Exchange Commission (SEC) following its controversial initial coin offering (ICO) in 2017. By shutting down, the company hopes to conserve time, energy and resources to develop the KIN cryptocurrency ecosystem.

In June, the Commission accused the Canadian startup of violating US securities laws when it raised nearly $100 million through its token sale.

“As alleged in the SEC’s complaint, Kik had lost money for years on its sole product, an online messaging application, and the company’s management predicted internally that it would run out of money in 2017. In early 2017, the company sought to pivot to a new type of business, which it financed through the sale of one trillion digital tokens. Kik sold its ‘Kin’ tokens to the public, and at a discounted price to wealthy purchasers, raising more than $55 million from U.S. investors. The complaint alleges that Kin tokens traded recently at about half of the value that public investors paid in the offering.”

The SEC further alleged that by selling $100 million in securities without registering the offers or sales, Kik deprived investors of information to which they were legally entitled, and prevented investors from making informed investment decisions.

Said Robert A. Cohen, Chief of the Enforcement Division’s Cyber Unit,

“Kik told investors they could expect profits from its effort to create a digital ecosystem. Future profits based on the efforts of others is a hallmark of a securities offering that must comply with the federal securities laws.”

In a blog post on Monday, Livingston detailed the scope of his company’s battle against the SEC.

“After 18 months of working with the SEC the only choice they gave us was to either label Kin a security or fight them in court. Becoming a security would kill the usability of any cryptocurrency and set a dangerous precedent for the industry. So with the SEC working to characterize almost all cryptocurrencies as securities we made the decision to step forward and fight.

While we are ready to take on the SEC in court, we underestimated the tactics they would employ. How they would take our quotes out of context to manipulate the public to view us as bad actors. How they would pressure exchanges not to list Kin. And how they would draw out a long and expensive process to drain our resources.”

Livingston aims to build a mobile wallet that makes it easy for millions of people to buy and use Kin, a blockchain-based cryptocurrency. According to the company website,

“We’re planning to make Kin available for use in many digital services and apps…

Through Kin, content creators and developers can be compensated for their offerings. This means that you can get access to better content and experiences.”

[the_ad id=”66406″]

[the_ad id="42537"]

[the_ad id="42536"]