Bloomberg says a key indicator suggests Bitcoin’s pullback is likely to continue.

The GTI global strength indicator, which is used to identify the strength of an asset’s price by comparing the movement of the daily close, shows BTC is not yet in oversold territory.

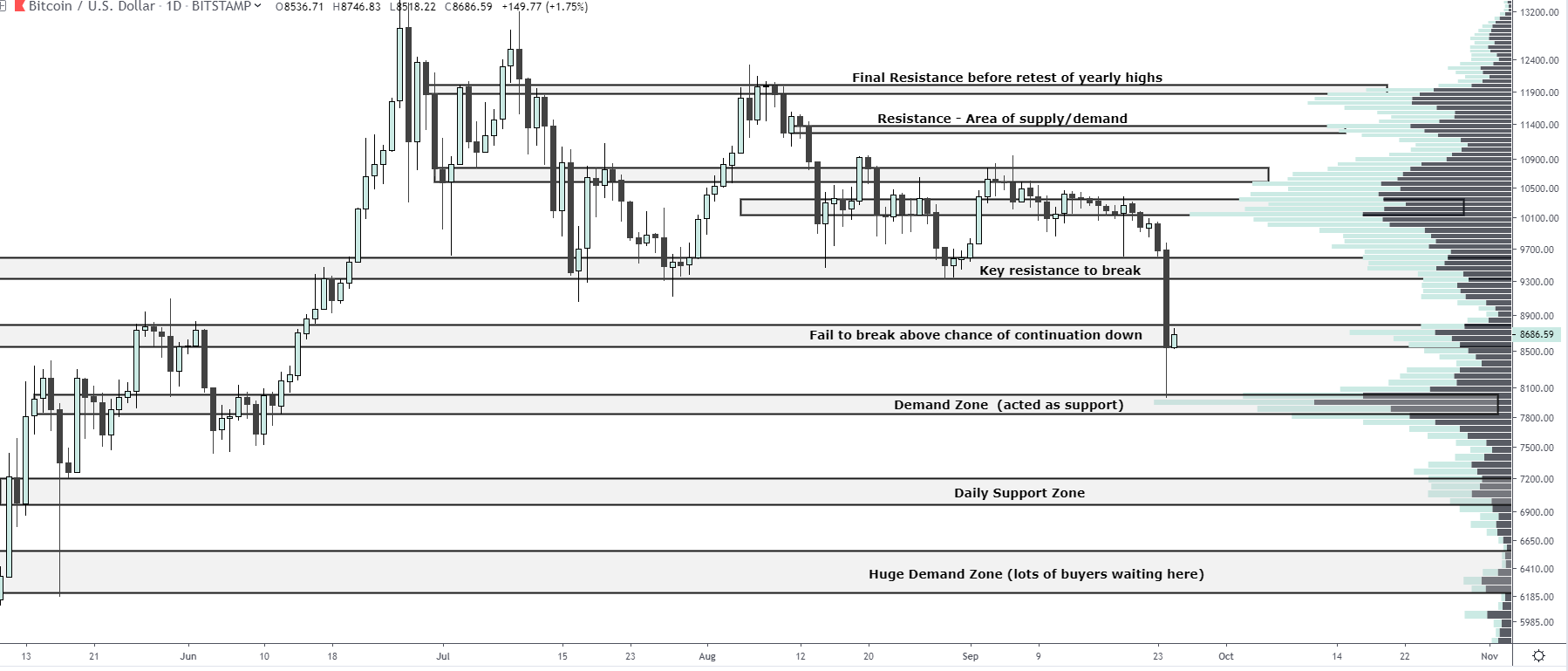

Analyst Josh Rager says if BTC can’t break through resistance at about $8,650, it could soon test support at around $8,100.

“In my opinion, the best and wisest move is to continue to scale-in at major support areas. While many are now targeting $6,100 to $6,500 as the ‘bottom’ – I can certainly see this level be front-run like every other major target this year. Another potential opportunity to get <$8,000 BTC…

If Bitcoin fails to break above the current level, we’ll get another retest of the support below – which has bounced once and could hold.

But if this isn’t a bear trap I do see price heading down to low $7,000’s. Lots of buyers are waiting between $6,180 and $6,500.”

Rager says that if Bitcoin does indeed slip into the $7,000s, he believes the altcoin market will likely suffer another 20% drop.

“Altcoins have seen more selling pressure after the breakdown of Bitcoin.

People realize this isn’t likely to be a quick ‘v’ reversal. I expect some alts to see new lows for this year against Bitcoin. [Altcoins] can lose 20%+ more as Bitcoin likely hits $7,000’s again (weekly close will tell).”

At time of publishing, Bitcoin is back in the red. The leading cryptocurrency is down 2.11% at $8,357, according to COIN360.

Most altcoins are also flashing red, with the exception of XRP and Stellar (XLM), up 1.48% and 7.78%, respectively.