A senior analyst at Bloomberg Intelligence says he’s feeling bullish on Bitcoin.

According to Mike McGlone, BTC has hit its first solid support zone since May, and CME Group’s launch of Bitcoin options early next year should help trigger a new rally in the long run.

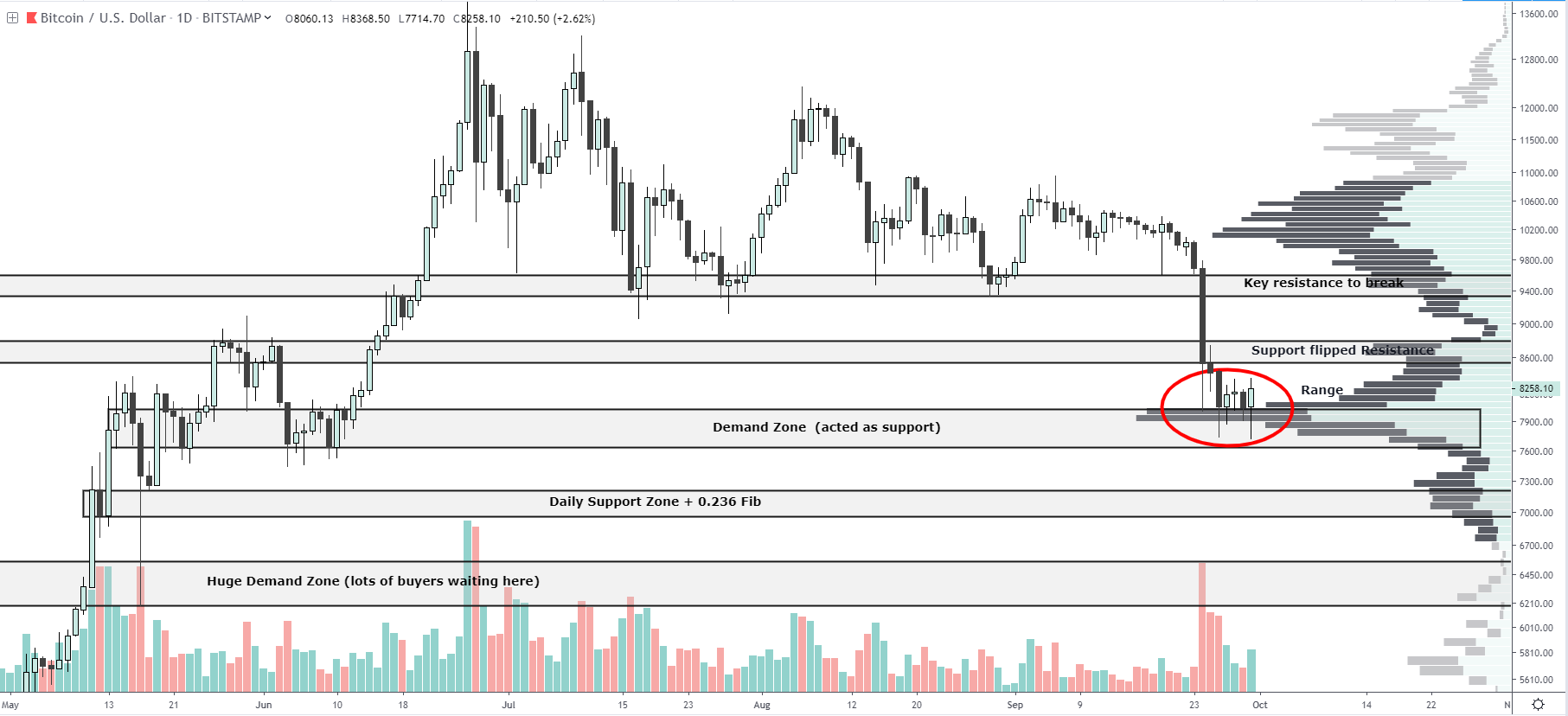

“The price has dipped into the first good support zone since the May breakout. When Bitcoin, in orange, rallied above $6,500, it signaled a recovery. This level is now about the 52-week average, in white.

$8,000 to $6,500 is a good support area. The first good resistance is now about $10,500. Options will begin trading next year, so responsive long positions appear warranted.”

Meanwhile, trader Tone Vays is pleading caution and says Bitcoin may have a lot more room to fall.

In an interview with BlockTV, Vays says BTC may continue to correct from its meteoric rally that began in early 2019.

“The entire move has now fallen 42%, which is typical of Bitcoin to fall 40% and then go back to the upside.

However, because the move from $3,000 all the way to $14,000 was virtually exponential, I continue to look for a bigger correction before being comfortable in, say, going all-in on Bitcoin with whatever savings I have left.”

Josh Rager is also looking for Bitcoin to continue its major pullback.

He says BTC will have to close above $8,800 in order for the bulls to take back the momentum.

“BTC seems to have found a support that it likes at $8,000. Will continue to watch order books and how price reacts up at $8750-$8800 if it makes it up there.

Expect more down, but sideways is expected after a violent dump. Would flip more bullish with a close above $8,800.”