Two US Congressmen are addressing the rise of cryptocurrency. They believe the US dollar is at risk of getting left behind – with the horse and buggy – as digitization sweeps the globe and governments around the world move to modernize their monetary systems and reinvent how they transfer, distribute and create money.

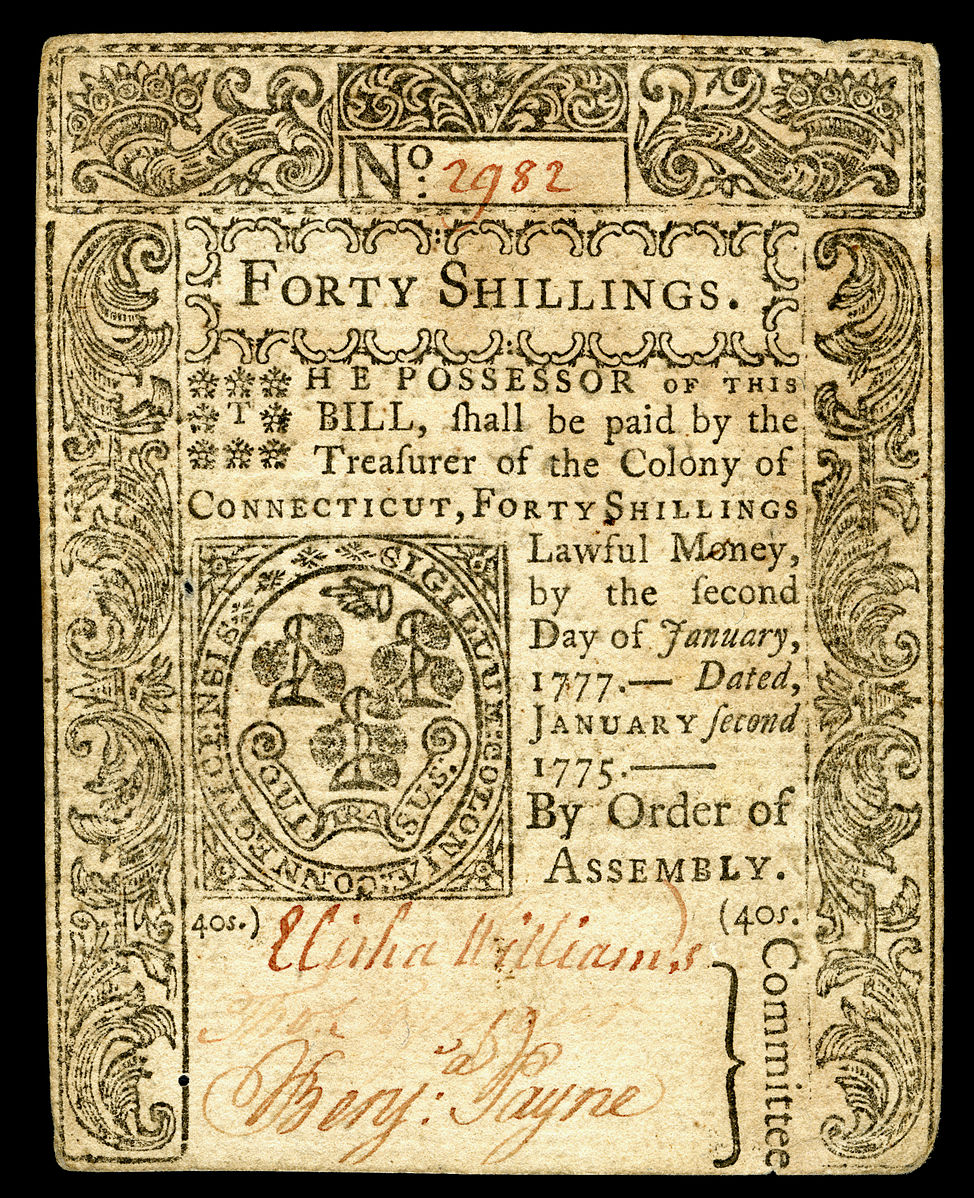

Representatives French Hill and Bill Foster have issued an open letter to Federal Reserve Chairman Jerome Powell expressing their concerns about the status of today’s US dollar, a decidedly old instrument that is one stop in a long line of early colonial currency (depicted below) and paper money known as Continental currency that was first issued by Congress roughly 240 years ago.

In the wake of Facebook’s Libra, a digital asset project that is fighting to appease regulators, governments are facing the emergence of a massive project that can scale instantly, that can cross borders without banks and onboard a built-in userbase of billions to send money around the globe as easily as email.

The revelations are forcing lawmakers to rethink how to tackle the threat to the US dollar. Instead of assuming that the technologies underpinning digital assets will suddenly disappear, many are devising plans to create competitive products in order to mitigate the risk of obsolescence or a significant loss of leverage of traditional currencies.

The letter states,

“As you are aware, the nature of money is changing. While this is not a new phenomenon – one might recall the advancement of paper money in China in the 9th century from a coin-based system – more recent advancements could be described as an inflection point in the evolution of money and payments. As outlined in more detail below, the Federal Reserve, as the central bank of the United States, has the ability and the natural role to develop a national digital currency.”

Calling the need for a US dollar digital currency “increasing imperative”, the lawmakers cite a number of pilot tests and examples around the world, from the “e-krona” in Sweden to Uruguay’s “e-peso” to China’s central bank-backed digital currency that’s expected to launch in 2020.

They add,

“While some Americans use cryptocurrency for speculative purposes, usage of digital assets may well increasingly align with that of paper money in the future.”

They also note that threats from the private sector are now well established and underway.

“Relying on the private sector to develop digital currencies carries its own risks, including loss of control of monetary policy, as well as the ability to implement and enforce effective anti-money laundering and counter-terrorism financing (AML/CTF).

The Facebook/Libra proposal, if implemented, could remove important aspects of financial governance outside of U.S. jurisdiction. In the private sector, J.P. Morgan recently became the first U.S. bank to create and successfully test a digital coin representing a fiat currency. Additionally, next year, Wells Fargo plans to begin piloting Wells Fargo Digital Cash which will be a cryptocurrency linked to the U.S. dollar.”

Foster and Hill are asking the Federal Reserve Board to respond to a list of questions regarding the potential development of a US dollar digital currency.

You can read the full letter here.