Leading cryptocurrency exchange Binance is expanding its fiat-to-crypto gateway for Africa. Through a new partnership with Lagos-based fintech Flutterwave, Binance is allowing African users to purchase cryptocurrency with fiat.

Starting today, users in Nigeria can buy Bitcoin, Binance Coin and Binance’s new dollar-backed stablecoin with Naira (NGN) using a debit or credit card. In addition to new support for BTC, BNB and BUSD, Binance says it will roll out fiat pairs for local currencies throughout Africa, such as BTC/KES (Kenyan Shilling) and BTC/ZAR (South African Rand), in the near future.

As politicians in the US deliberate over Facebook’s Libra, crypto and fintech leaders around the world, from Asian to Africa to South America and Europe, are working at a rapid pace to expand the growing digital economy, taking systematic and definitive steps toward permanently altering the face of the existing banking system and the traditional mechanisms that move money and value.

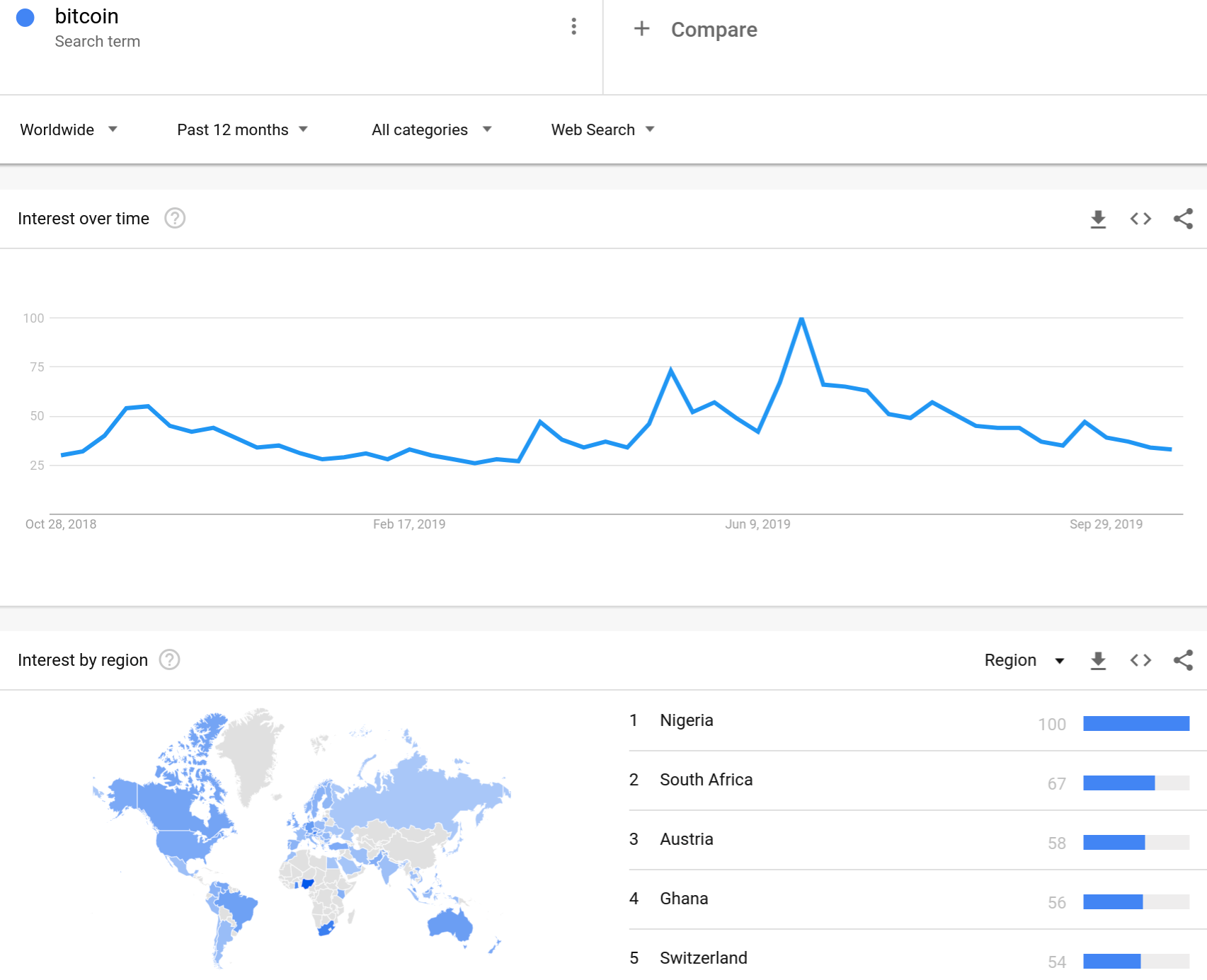

According to Google Trends, Nigeria dominates searches for Bitcoin.

Over the past five years, Nigeria and South Africa have consistently dominated Google searches worldwide.

Says Binance CEO Changpeng Zhao,

“Africa has illustrated one of the largest demands and instrumental use cases for cryptocurrency, notably for financial access, in the world’s second-largest continent. In Sub-Saharan Africa, about 95 million people remain unbanked while many regions in the area, including Nigeria, have embraced new technologies with an increasing amount of innovation. Working with Flutterwave will help bridge the fiat-to-cryptocurrency gap and we hope to stimulate more financial inclusion as Africa demonstrates strong potential in leading crypto adoption.”

Binance has spun up one of the most powerful brands in the crypto industry, licensing its matching engine and wallet technologies to several partner platforms including Binance Uganda, Binance Jersey, Binance Singapore and the newly launched Binance US. The platforms are operated independently in their respective local jurisdictions and offer fiat-crypto trading functions.

Flutterwave allows clients to customize payments applications.

The company has processed 100 million transactions worth over $3 billion since inception, according to company data.

Co-founder and CEO Olugbenga Agboola is eying cryptocurrencies as a new way for marginalized people to create prosperity.

“What we do at Flutterwave is create possibilities for the everyday African to become prosperous. We create opportunities for the everyday African to reach prosperity levels that were beyond them in the past. That’s what this partnership is about. Africans are firmly part of the global financial community, Flutterwave is ensuring this.”

In addition to Binance, Flutterwave’s existing customers include Alipay, Uber and Booking.com. The startup partnered with China’s e-commerce giant Alibaba in July to facilitate digital payments on Alipay between Africa and China.

It partnered with Uber last year.

Cryptocurrencies and digital payments are powering fast and cheap transactions that can serve people without the need for a physical branch or location. Other leaders advancing the digital economy include UK-based Revolut, a digital-only platform that has just launched its services in Singapore. Using smartphones, customers are now able to open an account on the platform to start spending worldwide in over 150 currencies, reports The Business Times.

At the launch event on Wednesday, Revolut said it plans to roll out its latest features, such as cryptocurrency and commission-free stock market trading, in Singapore as well.

[the_ad id="42537"]

[the_ad id="42536"]