A pair of crypto analysts are feeling bullish on two of the leading cryptocurrencies.

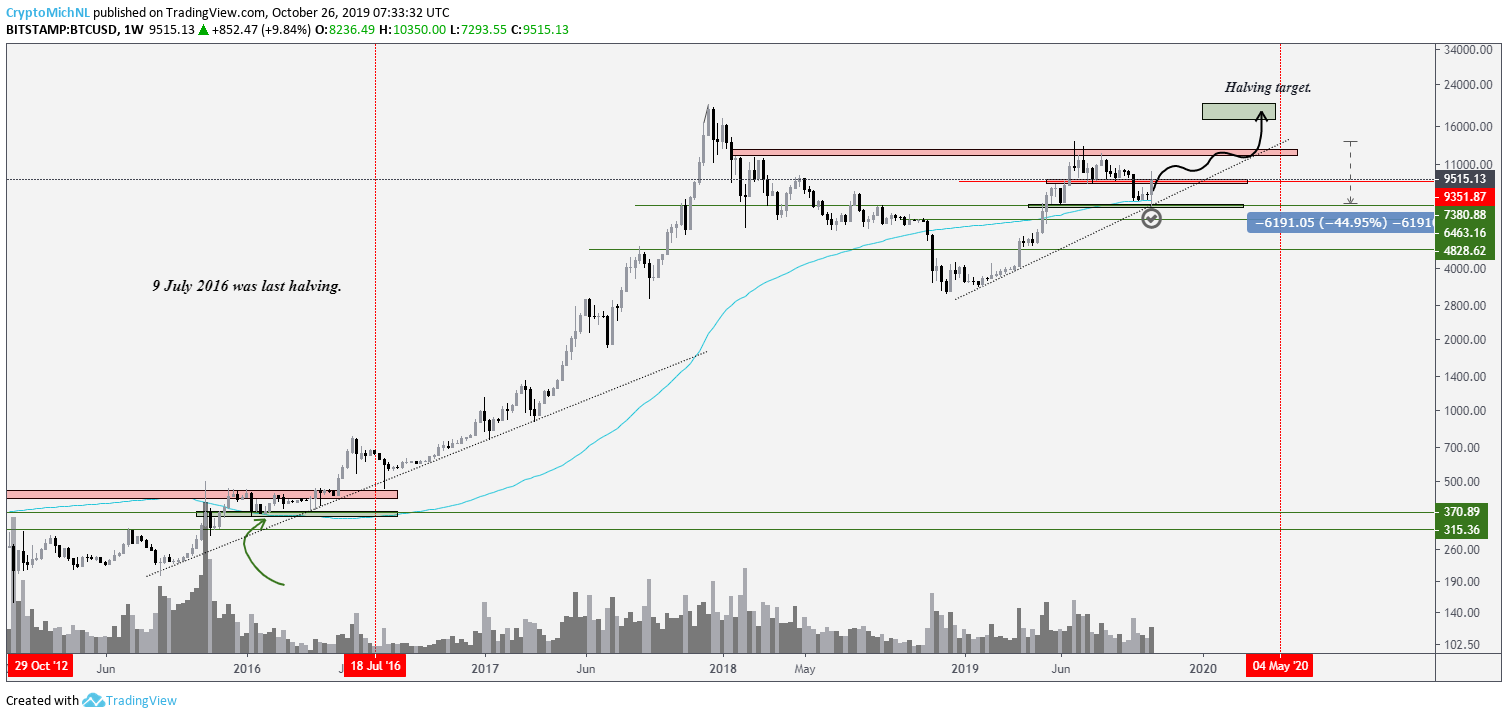

Crypto Michaël tells his 43,000 followers on Twitter that several key Bitcoin metrics are looking solid after Friday’s big rally.

Michaël says BTC’s current price action is comparable to 2016 and his new target for the leading cryptocurrency is $17,000 to $20,000.

“100-Week MA test completed and held, similar to beginning 2016.

Back above 200-Day MA & EMA, important indicators. Holding trendline as well.

2016 period and now are still comparable in which targeting $17,000-20,000 prior to halving is realistic.”

Analyst Josh Rager is preaching caution to his 59,000 followers and says BTC will dip to $9,000 and continue correcting after its big spike.

“This is something that I’m not really panicked about because really what it’s doing is it’s ranging after moving up 40% in a day. So it’s totally natural to correct a little bit. So as Bitcoin currently corrects right here, nothing really to worry about.

If we take the Fibonacci, which acts as typical percentage of pullbacks, we can see that from the top to bottom, the price could potentially bounce at $8,821. It would wick down to as low as $8,400. I really don’t want to see that though. Really what I want to see is that price stays above $8,800.”

Meanwhile, Crypto Gainz tells his crew of 34,000 followers that he thinks XRP is a “powder key” that’s ready to burst.

The analyst is looking for XRP to play catch up with Bitcoin and the rest of the market ahead of Ripple’s Swell conference in Singapore next month.

https://twitter.com/CryptoGainz1/status/1187920278837452800

As for the reason behind Bitcoin’s big end of the week rally that pushed BTC past $10,000, analyst Alex Krüger says there’s little evidence to show that China’s President Xi Jinping’s recent show of support for blockchain technology triggered BTC buys in China.

Instead, he thinks the big news from President Xi lifted sentiment among crypto traders outside of China who are already in the market.

“China news driven does not equal Chinese driven. Two most likely sequences:

#1 Xi endorses blockchain

#2 Many in China associate blockchain with bitcoin, some buy, others buy more

#3 Speculators speculate on that and front-run it, or speculators use news to drive price“

Interest in Bitcoin in China has barely edged up. Chart shows Baidu searches for Bitcoin (blue) vs Blockchain (red). Looks very conclusive to me, particularly so given the price spike. pic.twitter.com/UGwU5416jO

— Alex Krüger (@krugermacro) October 26, 2019