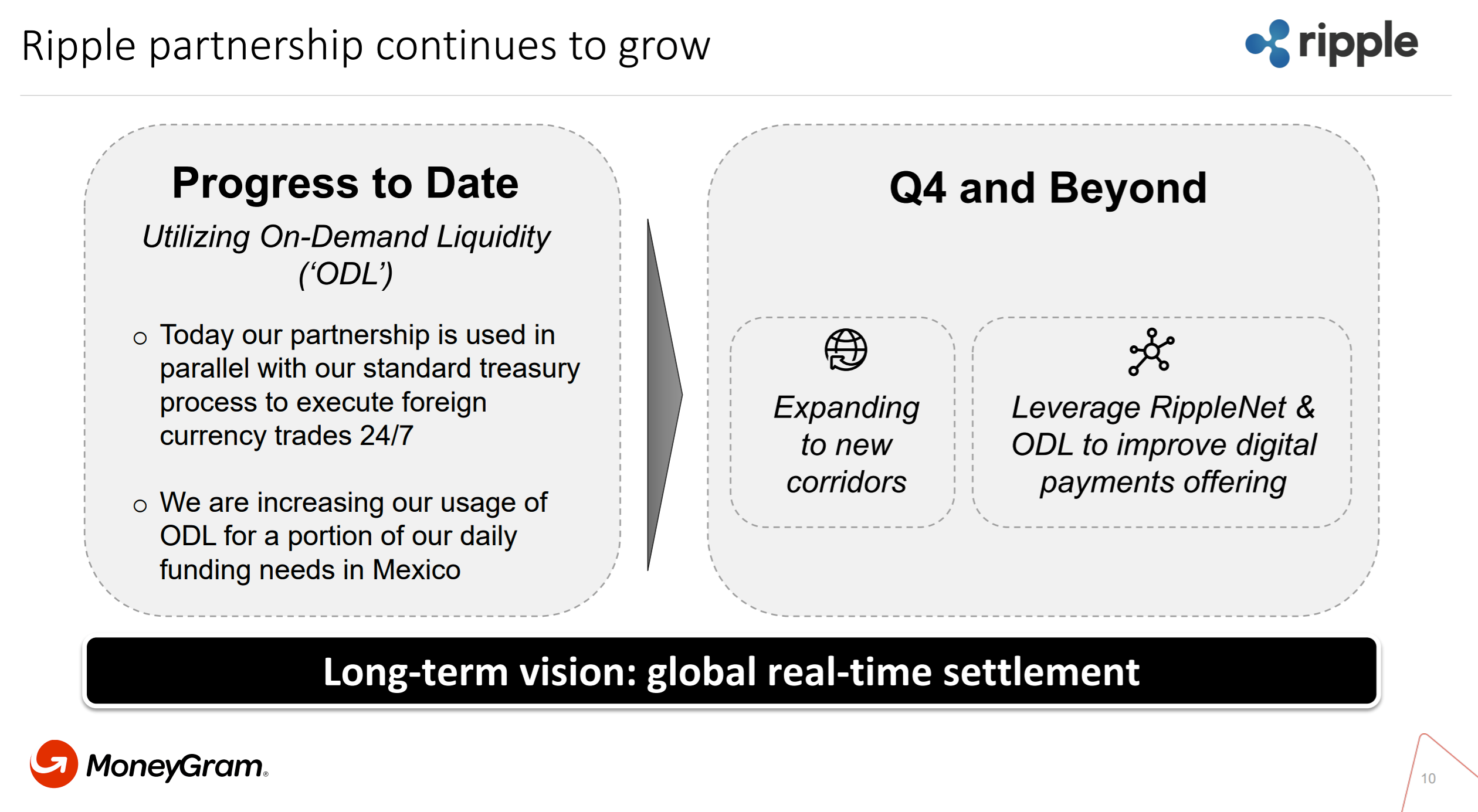

MoneyGram is planning to expand its partnership with Ripple, using the fintech’s XRP-based cross-border payments solution to enter new corridors by the end of the year.

Says Asheesh Birla, senior vice president of product at Ripple,

“In today’s MoneyGram earnings call, CEO Alex Holmes announced plans to expand use of Ripple’s on-demand liquidity to new corridors before EOY. ‘Our partnership with Ripple will be a competitive differentiator in the months and years ahead.’

According to MoneyGram’s Q3 2019 earnings call report, its innovative partnership with Ripple “is progressing.”

The partnership is used to execute MoneyGram’s foreign currency trades around the clock. It will increase its use of Ripple’s On-Demand Liquidity (ODL) solution to power daily funding needs in Mexico and will expand into new corridors by leveraging RippleNet and ODL.

Says MoneyGram CEO Alex Holmes,

“Our third-quarter results reflect the continued transformation of our business as we increasingly focus on customer experience improvements, cross-border digital growth and industry-leading innovation through our strategic partnership with Ripple.

While the US market, which continues to be our primary challenge, showed signs of improvement on a sequential basis, we are very pleased that our non-US business achieved year-over-year growth for the quarter.”

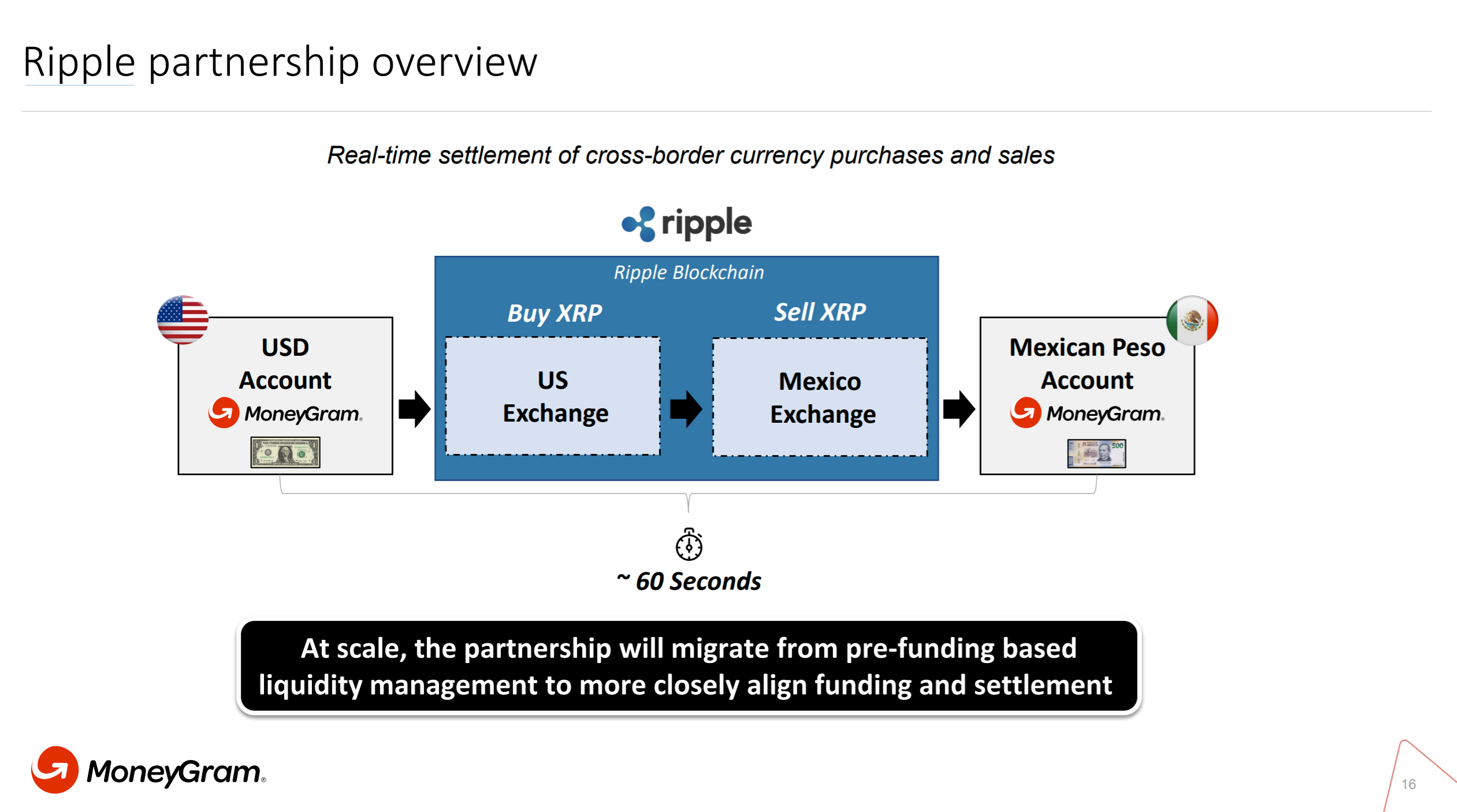

The MoneyGram slide deck also highlights how the money transfer giant will utilize XRP as a bridge currency to achieve fast transaction speeds at low cost.

You can check out the full report here.