Bobby Ong, the co-founder of price tracker and market data aggregator CoinGecko, says that wash trading in the cryptocurrency markets appears to be getting worse.

Wash trading is a practice that’s used to manipulate markets and to pump up the appearance of marketplace activity. An investor will simultaneously sell a financial instrument and then buy it back, or vice versa, generating fake trading volume to lure and mislead other investors.

In a new interview with BlockTV, Ong affirms that market manipulation continues unabated and that the only way to get clean data on crypto trading volumes is from regulated exchanges.

“I would say that the situation is actually getting worse…The trading volume for the spot market is almost close to not being used as a trusted source anymore. There are so many exchanges that are just wash trading that it’s ridiculous.

If you really want to get real 24-hour trading volume, I think the only real way is to look at volume from regulated exchanges such as those in the US, in Japan – those licensed exchanges. Coinbase, Gemini and Japanese regulated exchanges. Those regulated exchanges will likely have legit volumes. Whereas everyone else that is staying in the non-regulated space – we don’t really know which ones are wash trading, which ones are not wash trading. It’s hard to say which is real and which is not.”

https://twitter.com/BLOCKTVnews/status/1192455483040391169

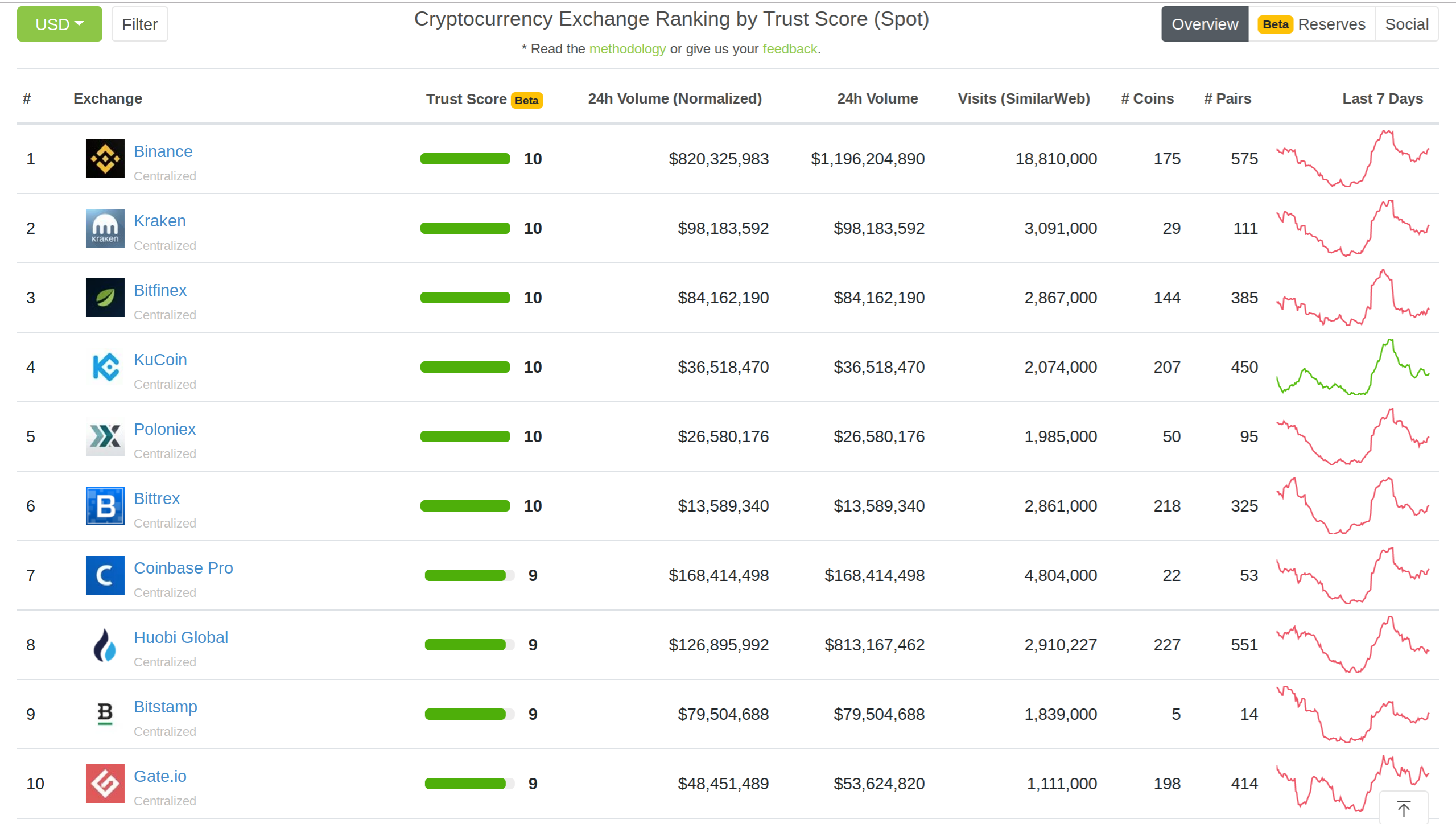

CoinGecko recently released its Trust Score, a metric designed to bring more transparency to reported crypto trading volumes. The new rating algorithm weighs exchanges’ reported trading volume, web traffic and order book depth. Crypto exchanges Binance and Kraken currently lead in 24-hour trading volume with Gate.io rounding out the top 10.