HodlX Guest Post Submit Your Post

The fourth quarter of 2019 was a rough ride for the price of Bitcoin and altcoins at large. On the one hand, BTC was still able to maintain its almost 90% year-to-date gains as we wrap up the year. On the other hand, markets have seen a very different story in the altcoin space this year. Large-cap names like ETH and XRP suffered double-digit losses, while the values of smaller names, such as XTZ and LINK, have doubled or even tripled in some cases. What’s behind the altcoin performance divergence, and how will this play out in 2020?

The End of “Alt-Season”?

The term “Alt-Season” has been one of the buzzwords in the crypto space throughout the year. The general altcoin space had a decent rally in the first half of 2019. The total crypto market cap excluding Bitcoin surged from below $48 billion to $142 billion in late June, and that was pretty much the “Alt-Season.” As the price of BTC peaked, altcoins started their six-month-long correction and failed to reclaim the 365-day moving average. The Crypto Total Ex-BTC Market Cap has given up almost all its yearly gains, approaching where it started this year.

Figure 1

Crypto Total Ex-BTC Market Cap – YTD Chart

In our October publications “Altcoin Season: To Be or Not to Be?” and “Party’s Over”, we’ve gone against the markets and are being skeptical about the new beginning of the “Alt-season”. However, our reports also highlighted the possible divergent performances between different altcoins and the importance of picking and choosing when it comes to altcoin investing.

Small Names, Big Performances

Despite the overall weakness in the altcoin space, we’ve seen some smaller altcoin names outperform their bigger peers and even BTC, and LINK and XTZ are some of the examples. Figure 2 underlines the massive gains that we’ve seen in LINK and XTZ. In comparison, the Crypto Total Ex-BTC Market Cap is likely to end on a quiet note, while ETH and XRP are already in the red.

Figure 2

ETH/XRP/XTZ/LINK/Crypto Total Ex-BTC Market Cap Comparison – YTD

What’s Behind the Divergence?

We believe that the increasing popularity of Bitcoin derivatives trading, investment appetite, and lack of institutional interest may have attributed to the performance divergence in the altcoin space.

Bitcoin derivatives trading has been one of the fastest-growing parts in the crypto space. Demand for futures, options, and swaps trading has been increasing across all client segments. The spectrum of derivative trading has been getting wider with increasing product selections. We believe that the growing derivative trading demand has been drawing the overall crypto investing needs away from the altcoin space, particularly from the institutional client group. This draw–away effect has been more noticeable in large-cap altcoins.

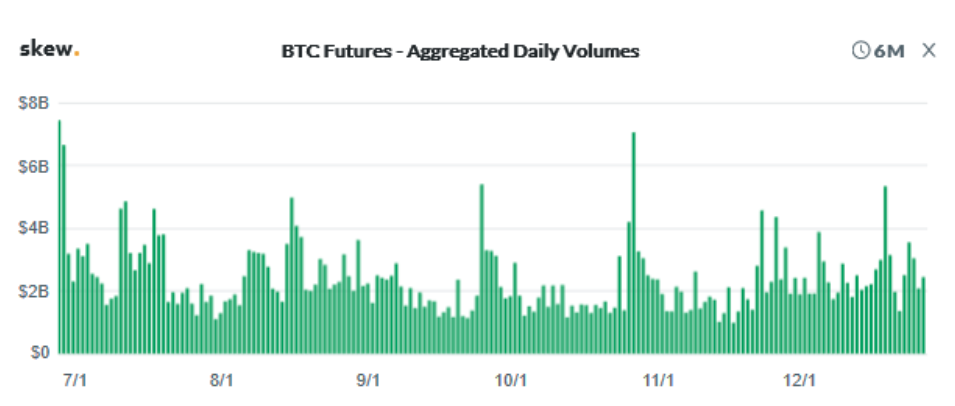

Figure 3a

OKEx BTC Futures Aggregated Daily Volume

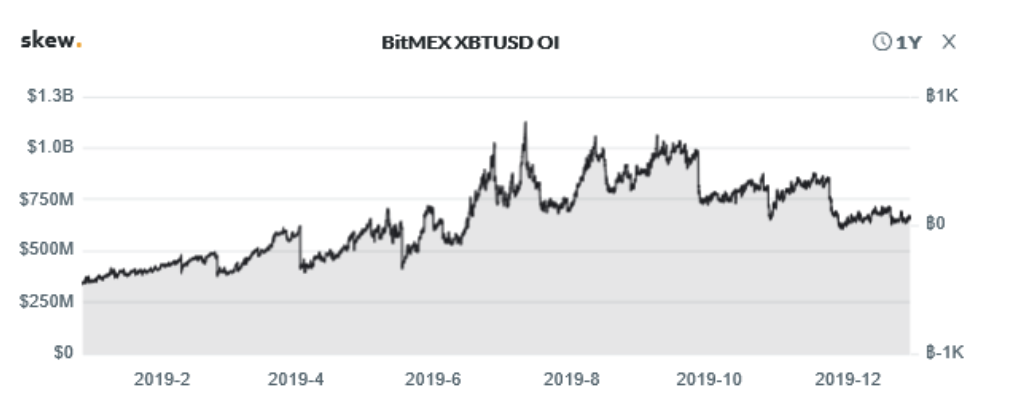

Figure 3b

BitMEX XBTUSD Open Interest

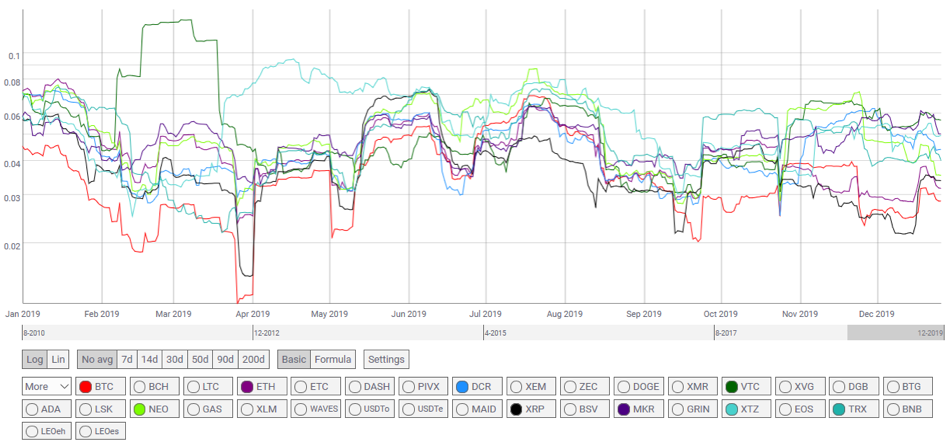

The investment appetite for the overall altcoin space has been decreasing over time, and high volatility could be one of the factors. Generally, assets with low volatility are more attractive to investors or HODLers, while higher volatility assets tend to get more attention from speculators. However, over-speculation often results in massive price fluctuations, and that’s the last thing that long-term investors and institutions would like to see. We believe that’s the case with some of the mid/small-cap altcoins.

Figure 4

BTC/Major Altcoins 30-Day Volatility vs. Daily Returns

Lack of institutional interest could be another reason behind the altcoin performance divergence. We know that one of the reasons why BTC has been gaining value is because institutions have been buying, and BTC has always been the very first step for traditional financial giants to step into the crypto space. While firms like Fidelity Digital Assets expressed their intention to support ETH in 2020, Tom Jessop, president at FDAS, admitted that the demand for ETH custody remains subdued. Moreover, for institutions that would like to expand their crypto exposure beyond BTC, additional regulatory challenges and obstacles would like to follow suit, and that could be a hurdle, especially for large-cap altcoins.

The Shifting Narrative

Although altcoin names like ETH and XRP have been underperforming BTC and some small altcoins, the outlook of some of the large-cap altcoins, such as Ethereum, is not as gloomy as prices suggest. We’ve noticed that the market narrative on ETH has quietly shifted from being a utility token to more of a high-value transaction settlement application, thanks to the rise of decentralized finance (DeFi).

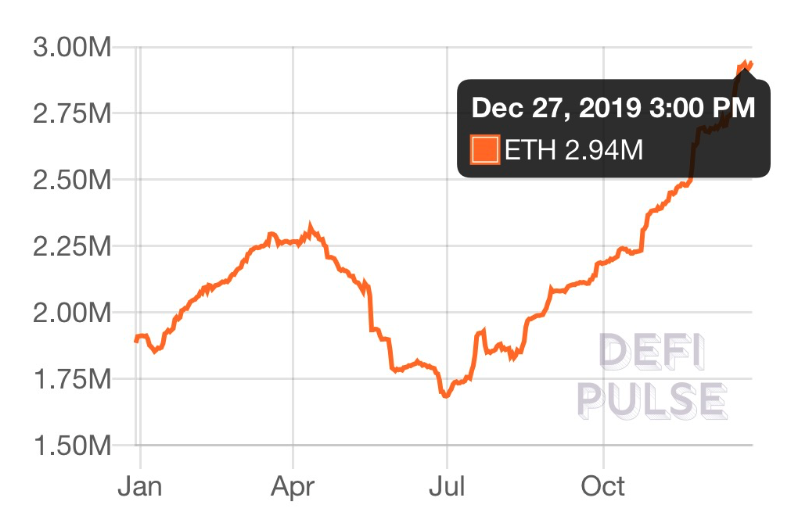

Figure 5

Total ETH Locked in DeFi

Data from DeFi Pulse shows that the total ETH locked in the DeFi system has almost reached three million. Digital assets, financial smart contracts, protocols, and DApps being built on the Ethereum blockchain are expected to proliferate in 2020. Although the current ETH DeFi lockup portion accounts for about 2.5% of the total ETH supply, the number is expected to increase gradually in the coming years. The price of ETH could benefit from the growing ETH lockup. Ethereum’s open financial system has been taking shape, and we expect the impact of this system to be more imminent and evident to the markets in 2020.

Furthermore, other major altcoins have started to show distinctive characteristics. Some of them go further into the payment world, while others are committed to serving enterprise transaction needs. In addition to the Bitcoin halving, this increasing vibrant environment could make a new impact on the altcoin space in 2020.

Conclusion

Looking forward, the Bitcoin halving event is expected to happen in May 2020. It will likely be a dominant theme of the whole crypto space before and after the halving occurs, and the market dynamics will be likely to change in both the BTC and the altcoin world. The way investors prepare for the halving could implicate sentiment, and that’s something that all crypto watchers should keep a close eye on. On behalf of the OKEx teams, may the New Year bring you happiness, peace, and prosperity.

This post originally appeared on OKEx Blog. Read more.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

About OKEx

OKEx is a world-leading digital asset exchange headquartered in Malta, offering comprehensive digital assets trading services including token trading, futures trading, perpetual swap trading and index tracker to global traders with blockchain technology. Currently, the exchange offers over 400 token and futures trading pairs enabling users to optimize their strategies.

Follow us on Twitter.

Check our latest press material on Press Room.

Follow Us on Twitter Facebook Telegram