Bitcoin whales appear to be accumulating BTC at an increasing pace, according to a new report from the US-based cryptocurrency exchange Kraken.

In a recap of January’s BTC price and on-chain action, Kraken says the biggest buyers and holders of BTC are beginning to come out of hibernation, perhaps in anticipation of a seismic shift in the markets.

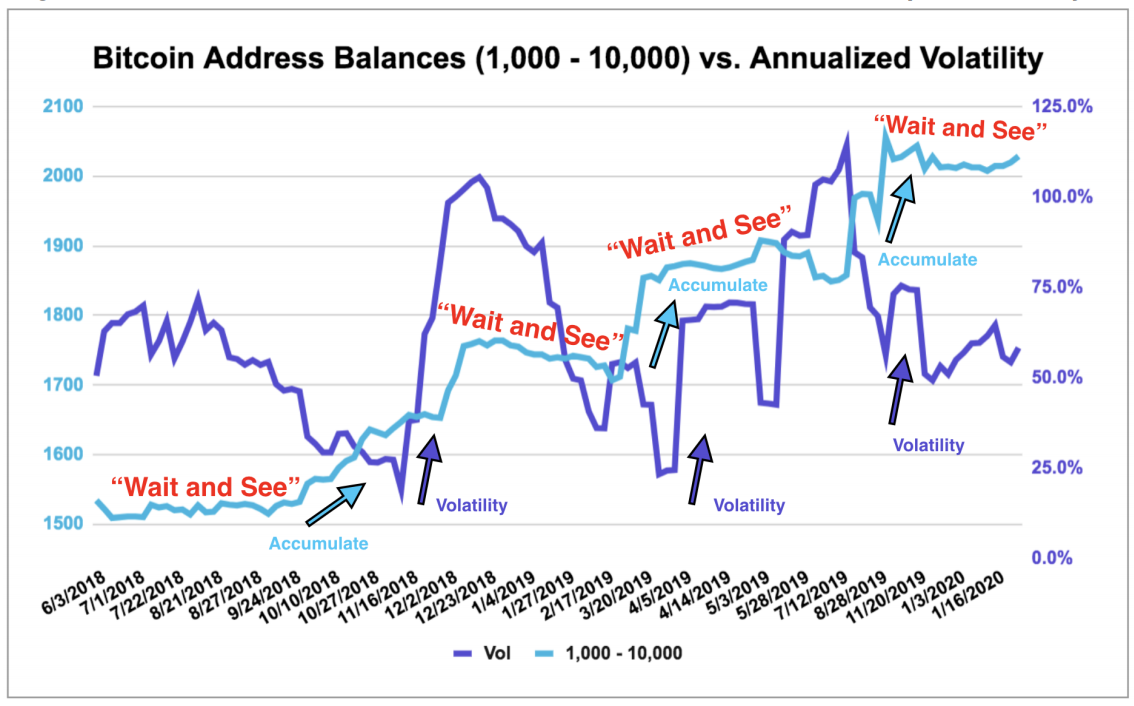

The report notes that BTC addresses with 1,000 BTC to 10,000 BTC grew noticeably near the end of January.

“Notwithstanding January’s surge in price and modest tick higher in volatility, the number of whales in this cohort ticked higher as we approached month-end. This may mean that sentiment amongst the ?1,000 – ?10,000 cohort is starting to shift to a new accumulation phase.”

In addition, Kraken says “accumulation has resumed” among retail investors, who also appear to be hoarding BTC at an rising rate.

“Should history repeat, we anticipate accumulation to conclude in the weeks/months ahead and volatility to re-emerge. This dynamic of ‘accumulation preceding volatility’ may be explained as an absorption of market liquidity, creating tight supply/demand imbalance conditions in the future.”

The report also cites rising one-month correlations between Bitcoin and gold, oil and US treasuries as a potential sign that BTC is maturing as a hedge against global economic uncertainty.

As for where the price of Bitcoin will head this month, Kraken says it’s watching the Crypto Fear & Greed Index to gauge sentiment among traders. The index shifted to the greed zone at the end of January, which could be a sign that investors are increasingly optimistic about the price of BTC. It has since shifted into the fear zone, with Bitcoin’s price once again tumbling below $10,000.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/R. Maximiliane