Crypto analyst and influencer Willy Woo thinks half the world will be utilizing crypto assets in seven years.

At the 2020 Unconfiscatable Conference in Las Vegas this past weekend, the digital asset strategist and partner at Adaptive Capital compared crypto’s rise to the internet’s, saying it’s a process that starts off slow and gradually gains exponential speed.

“Human nature is one that looks at things in a linear stance. So we’re not very good at looking at exponential growth, which is obviously what Bitcoin is doing. The equivalent question is, the internet was invented in the 1960’s. [Say it’s] 1994 now – why don’t we have mass adoption? The thing is, it was growing at a very hyperbolic rate.

If you were to look at where we are on the adoption curve, 1% of the world population is holding this asset class, and if you look at the rate at which that’s growing, which is 2x every year, there’s kind of a Moore’s Law of adoption happening right now. It’s 4x in a bull market.

If you run those numbers, we’re going to have half the world using this stuff within seven years. So when you say, ‘Why don’t we have mass adoption?’ Well, it’s happening now. And by the time we hit like 5%, 15%, it’ll be a year or two away before it’s there. So I’d look at the model of the internet and what happened by the time we hit the 2000s.”

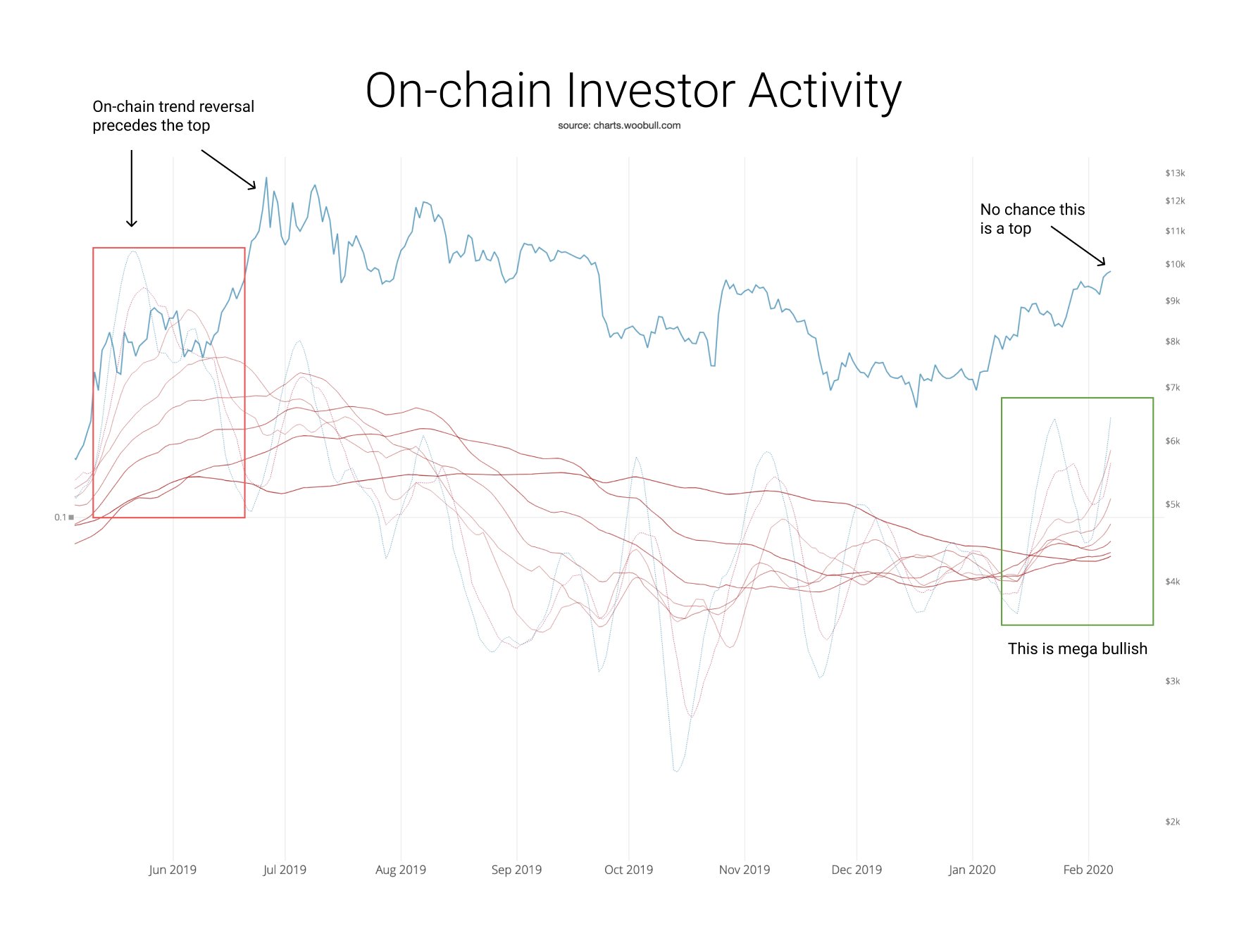

Back in December, Woo released on-chain analysis that he says indicates Bitcoin is entering another bull phase.

“On-chain momentum is crossing into bullish. Prep for halvening front running here on in. Can’t say what this indicator is, as it’s proprietary to @AdaptiveFund , but it tracks investor momentum. The bottom is mostly likely in, anything lower will be just a wick in the macro view.”

He also published additional BTC analysis earlier this month, saying a surge in the number of people holding Bitcoin for the long haul is bullish for BTC.

“This breakout is the real deal. Fundamental investment activity is backing this $10k breakout.

Lower chart tracks investor velocity (the buy and hold people, not short term traders). This metric corrects for degradation of signal from coins moving off the blockchain onto layer 2 (exchanges etc), that was something NVT was prone to.”

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Quardia