Bitcoin’s slide below the psychological level of $9,000 is debunking the narrative that geopolitical uncertainty from coronavirus fears and a sizable hit to the stock market would drive more investors to the leading cryptocurrency.

With the Dow plunging 6.6% and shedding 1,877 points in the past five days, Bitcoin has made a similar move to the downside, dipping 7.0% from $9,663 to $8,985, at time of writing.

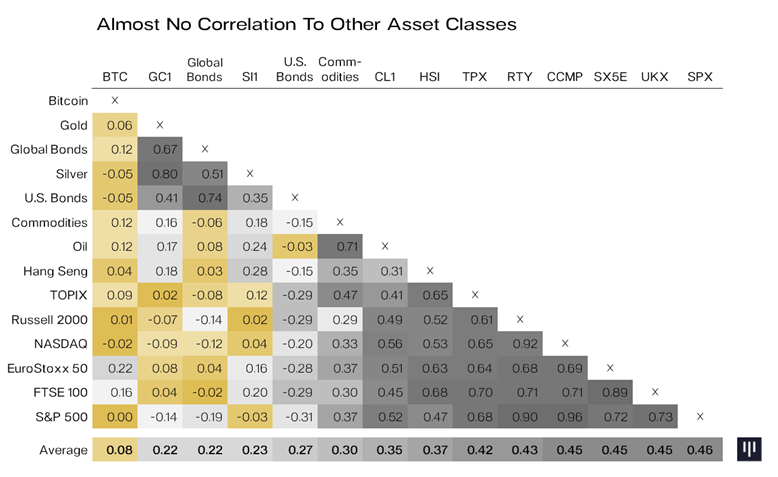

According to Bitcoin critic and gold proponent Peter Schiff, BTC’s safe-haven narrative has gone bust and all that’s left is a pivot to a new tune: “Bitcoin is an uncorrelated asset.”

Says ‘The Breakdown’ host Nathaniel Whittemore via Twitter,

“As a dude who spends a LOT of time on narratives, bitcoin as uncorrelated has always been the narrative base case.

The flirtation with ‘safe haven’ has been driven by a couple moments, a belief in future potential, and a bet that some might put a down payment on that future.”

Luke Martin, trader, analyst and founder of Venture Coinist, tells his 214,000 followers,’

“Bitcoin has been uncorrelated to other asset classes. If stocks drop, this does not mean Bitcoin has to pump. If gold prices climb, this does not mean Bitcoin will rise with it every time. Not negative or positive. uncorrelated. Narratives will come and go.”

Schiff cries foul on all the Bitcoin supporters and says the gig is up.

“On CNN Anthony Pompliano [Morgan Creek Digital co-founder] admitted that Bitcoin isn’t a safe haven asset, but a non-correlated asset, meaning regardless of what other assets do, Bitcoin is as likely to go down as up. So the value of Bitcoin is that no one has any idea what its price will do. What’s that worth?”

According to Pompliano, the uncorrelated asset will be worth about $100,000 by the end of 2021.

Adds Schiff,

“Bitcoin is neither money nor a currency. It’s a digital asset. The question Anthony Pompliano and I are debating is whether it’s a safe haven asset that stores value over time, or a risk asset with a market price than can rise or fall substantially over time. The answer is obvious.

During the recent global stock market rout investors dumped risk asset and fled to their safe haven of choice. Bitcoin not only followed risk assets lower, but led the decline. How can an asset that falls more than risk assets during market declines be considered a safe haven?”

Schiff adds,

“We’ve been climbing this wall of worry, so I think too many people look to take profits. They really have no idea how high the price of gold is going to go. And it’s not the coronavirus that’s driving it. It’s Fed monetary policy.”

…

“As the digital gold narrative falls apart, as did the digital currency narrative that proceeded it, Bitcoin pumpers are pivoting to the non-correlated asset angle. They argue Bitcoin should be bought because it’s uncorrelated to every other financial asset, including gold.”

Bitcoin proponents are also arguing that gold’s financial market can be displaced.

Dan Tapiero, founder of Dtap Capital, an investment advisory firm, says gold is mostly jewelry with a fraction of the precious metal representing the financial market in the form of coins, bars, gold-backed exchange-traded funds and central bank reserves.

“$9.6 trillion total world gold. Not sure bitcoiners realize that 2/3 is jewelry+official. Only $2 trillion is available ‘investable gold.’ Bitcoin is already 10% the size of investable gold. Incredible accomplishment for just 10 years of existence. Bitcoin too big to die now.”

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Romolo Tavani