A prominent technical trader says he’s buying the Bitcoin (BTC) dip despite bearish forecasts and widespread fear in the crypto markets.

The analyst, known in the industry as Light Crypto, tells 20,000 followers on Twitter that global equity markets are showing signs of a potential bottom, which could bode well for BTC. That, combined with the fact that the price of gold fell further than Bitcoin on Friday, has the trader feeling bullish on Bitcoin in the short term.

“Beginning with a broad macro perspective, after seven days of rarely seen bloodshed in global equity markets, and in particular US equities, bidders have finally stepped in today with a rally off the capitulation notched in the overnight spoos markets.

Gold is down the most since 2013, possibly sold to cover margin calls – this is a further sign of an emotional and capitulatory macro environment. In all of this, Bitcoin has held, losing less on the day than gold(!).”

The trader is also pointing to analysis from fellow trader Cantering Clark, who says relief could come if BTC can remain above $8,600.

/5 This sort of spasticated action with price not budging downwards is indicative of a large, patient latent buying interest.

And while selling has hammered the bid, few asks have been inserted above, opening the market to the opportunity of a surprisingly large move upwards. pic.twitter.com/7jsE9bPrfr

— light (@lightcrypto) February 28, 2020

In addition, Light Crypto points to bullish sentiment on Bitcoin’s upcoming halving as reason for optimism.

“External factors that push BTC’s price often provide excellent opportunities for taking the other side. And with the halving looming closer every day, and that narrative showing its potential strength in January, Bitcoin’s inherent tilt is overwhelmingly bullish in my mind.

And a cherry on top – a narrative is slowly sprouting among the forward-looking that the rate-cuts almost made inevitable by the implosion of risk markets and stand-still in credit will make Bitcoin more attractive on a macro relative basis.”

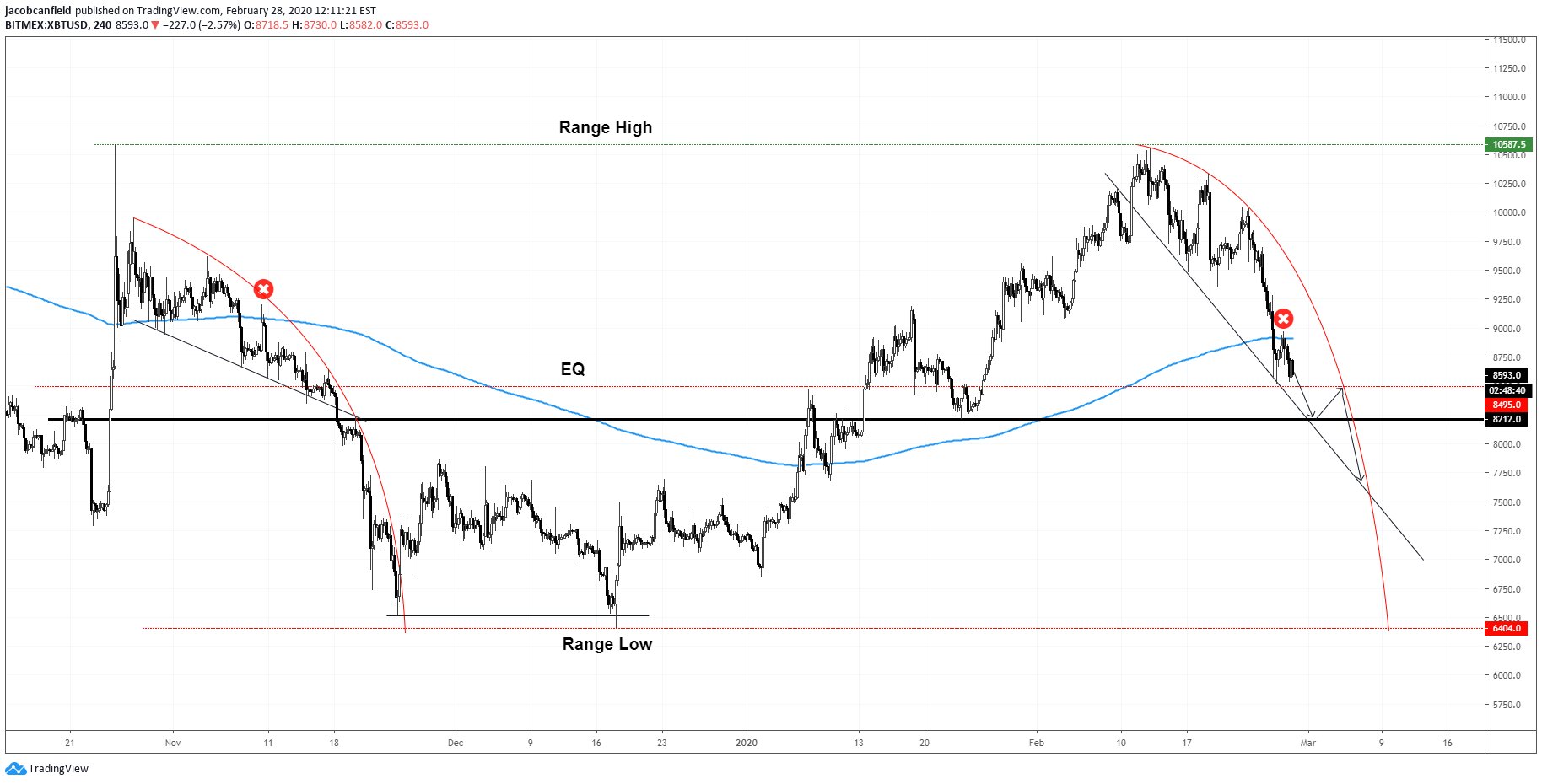

Meanwhile, analyst Jacob Canfield tells his 51,000 followers that he thinks the “aggressive” pace of Bitcoin’s pullback suggests the bottom is not yet in. He’s now looking for a bounce at $8,240. BTC is currently at $8,734, at time of publishing.

If Bitcoin doesn’t bounce at around $8,200, Canfield says the leading cryptocurrency will be exposed to further downside and could fall as low as $6,400.

“Not many people talk about downside parabolic structures, but they’re important to pay attention to. This recent structure has a much more aggressive slope to it than the post-china pump bleed out, which means sellers are more aggressive. Watching for a $8240 bounce potentially.”