A new Bitcoin (BTC) valuation model is offering a unique way for traders to forecast the future price of the leading cryptocurrency.

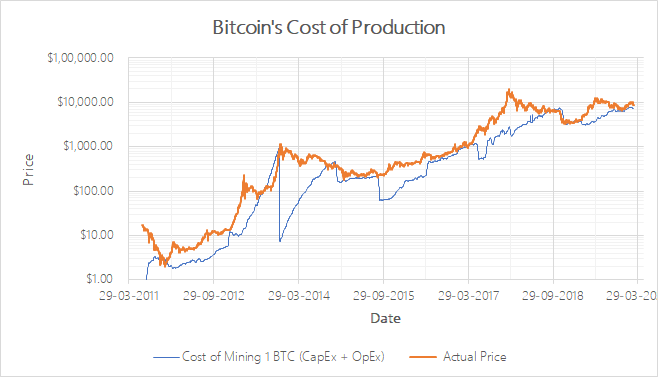

Crypto analyst Data Dater just introduced the Bitcoin Cost of Production (CoP) model. The metric factors in the capital expenditure (CapEx) and operating expenditure (OpEx) of the miners who power the Bitcoin network in order to calculate a projected minimum price of BTC.

CapEx includes the cost of a mining rig, farm infrastructure and regulatory expenses, while OpEx includes labor expenses, pooling fees and power expenses.

When analyzing Bitcoin’s past price action, the model has proved surprisingly accurate in signaling when Bitcoin may be due for a rally – suggesting that as the cost of mining one BTC touches the actual price, a move to the upside could be in store.

Says Data Dater,

“The CoP model is reliable for obtaining an intrinsic floor price of Bitcoin. This is the price that a bitcoin tends to move towards and serves as an over/undervaluation metric.”

Based on the model, the analyst says the price of BTC may surge to nearly $14,000 when Bitcoin’s next halving occurs in about 70 days.

“At present, the cost of mining 1 bitcoin is about $7,577.51.

Assuming the network hashpower remaining same and with the introduction of the S19 Pro, this cost is expected to be at $13,964.11 at the time of the next block reward halving in early May 2020.”