Despite the market downturn that has watched Bitcoin slide 50% from its 2020 high of over $10,000, Bakkt has just announced a Series B funding round. The Bitcoin futures platform has raised $300 million from several participants, including its parent company Intercontinental Exchange, Microsoft’s M12, PayU, Boston Consulting Group, Goldfinch Partners, CMT Digital and Pantera Capital.

In 2019, Bakkt rolled out an end-to-end regulated market for Bitcoin, along with an institutional custody offering, after the launch of its physically-backed Bitcoin futures.

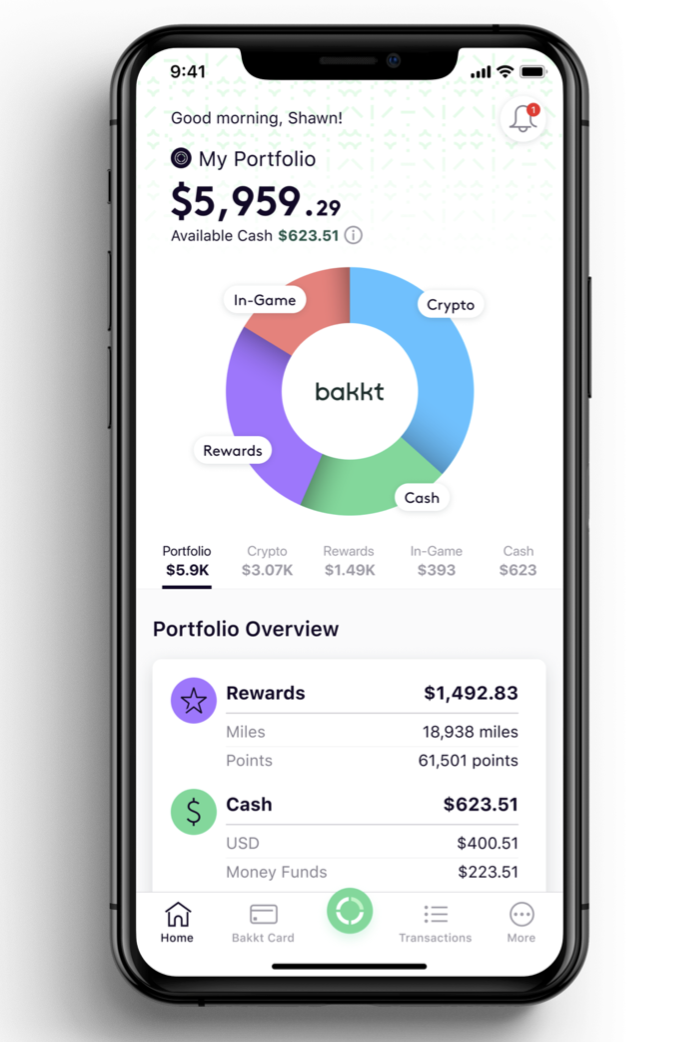

Bakkt is now focusing on consumer products and services to push digital assets into the mainstream.

Users will be able to convert a wide variety of digital assets into cash to make rewards points, in-game assets, merchant stored value and cryptocurrencies more accessible and easy to spend. According to Bakkt, these assets represent $1 trillion in consumer spending power, and its new app will allow users to combine their rewards, miles, loyalty points, Bitcoin and crypto into a single digital wallet.

“In just a few taps you can use those assets to shop at your favorite merchants, send them to family and friends, or convert them to cash. We believe that you hold more value than you realize and we’re here to help you track, spend and send your digital assets however you want.”

Bakkt chief executive officer Mike Blandina says Bakkt now powers loyalty redemption programs for seven of the top 10 financial institutions and over 4,500 loyalty and incentive programs including two of the largest US airlines. The company adds that it is well-positioned to leverage the technology and infrastructure, along with the right partners, to deliver innovative new products that expand access to the global economy.

The Bakkt app is scheduled to launch this summer.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Chinnapong