HodlX Guest Post Submit Your Post

Below we explore how Bitcoin and crypto spot and derivative markets have reacted, and what client use of our data reveals about the recent flurry of trading.

1) Is Bitcoin a Safe Haven Asset?

The current financial crisis is highlighting the very questions that led to the creation of Bitcoin in 2008. Governments are making use of all the financial tools that led Satoshi Nakomoto to create an asset class that can’t be perpetually diluted.

At the moment, as in all times of financial trouble, cash is king – but that may prove to be short-lived.

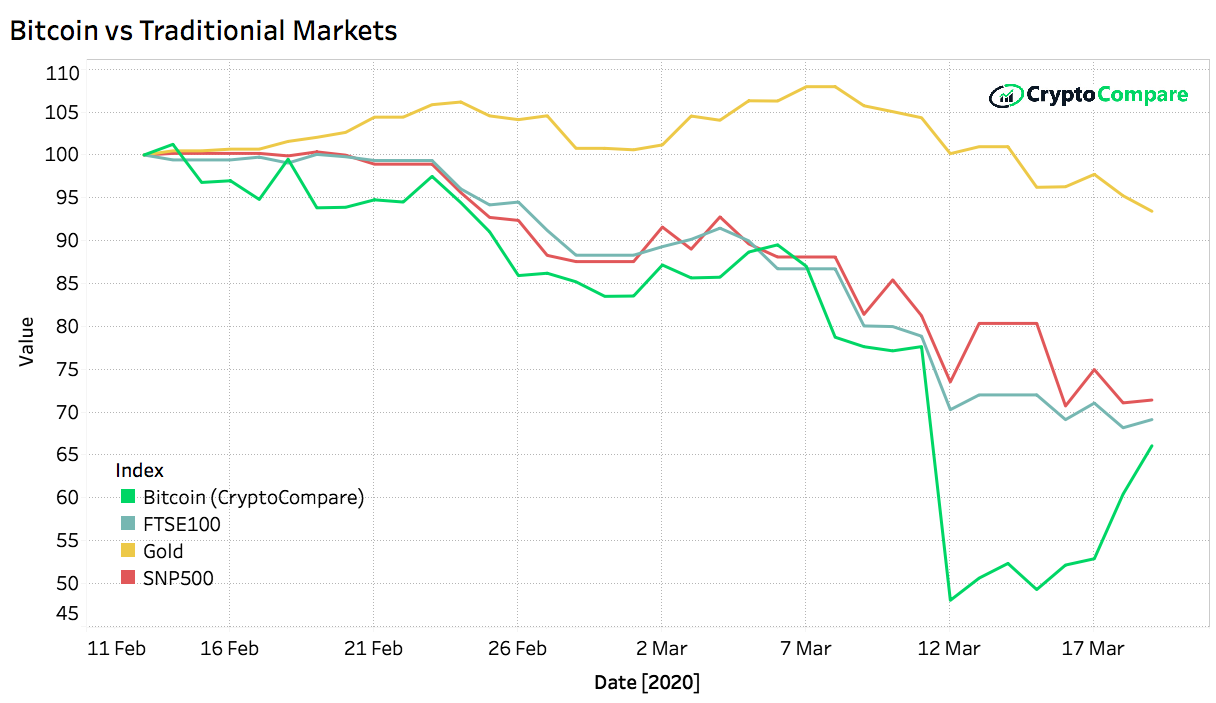

We are seeing a very risk-off trend across all markets. Digital asset markets have not been spared from this flight into cash and saw a precipitous fall on March 12 as the S&P and FTSE tumbled.

- The S&P 500 is down 29% in the last month

- The FTSE 100 is down 31% in the last month

- Gold is down 8% in the last month

- Bitcoin is down 30% in the last month

Bitcoin, however, is still in the process of establishing itself as an asset class. As this crisis unfolds, we may begin to see signs of it proving its worth as a less-correlated store of value. This chart shows how Bitcoin has fared against major stock markets and gold over the last six weeks:

Will Bitcoin show itself to be a safe haven asset?

Will Bitcoin show itself to be a safe haven asset?

With the upcoming halving of Bitcoin supply coinciding with one of the biggest experiments in money-printing and central bank intervention in modern history, the conditions are ripe for Bitcoin to prove itself as a deflationary, less correlated safe-haven asset.

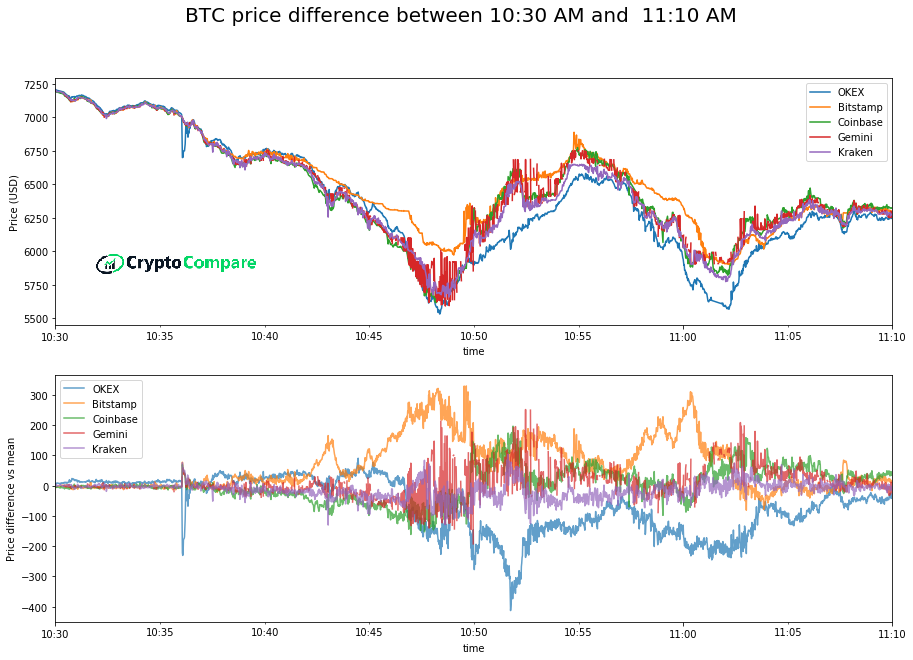

2) Crypto Exchanges Diverging

This chart shows the top exchanges that usually trade in line with each other. On March 12, we saw the spreads between exchanges widen substantially, and pricing between exchanges dislocate to levels not seen since before 2018.

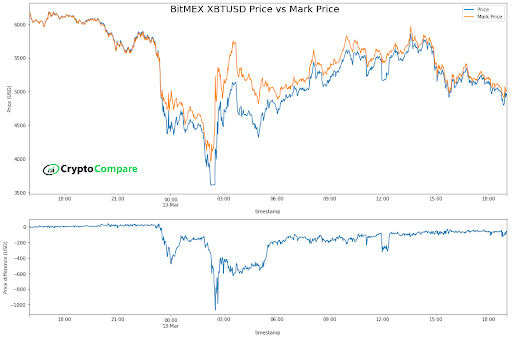

We have also seen a great deal of volatility resulting from the feedback between crypto derivatives markets and spot prices. Large orders from whales can significantly impact and distort pricing, encouraging more volatility at these times. Derivatives markets, too, saw substantial divergence between the futures price and the mark price on March 12 and 13 as the chart below shows.

We have also seen a great deal of volatility resulting from the feedback between crypto derivatives markets and spot prices. Large orders from whales can significantly impact and distort pricing, encouraging more volatility at these times. Derivatives markets, too, saw substantial divergence between the futures price and the mark price on March 12 and 13 as the chart below shows.

3) CryptoCompare Data Usage Soaring

At CryptoCompare,, we have also seen a massive surge in the usage of our data.

We saw

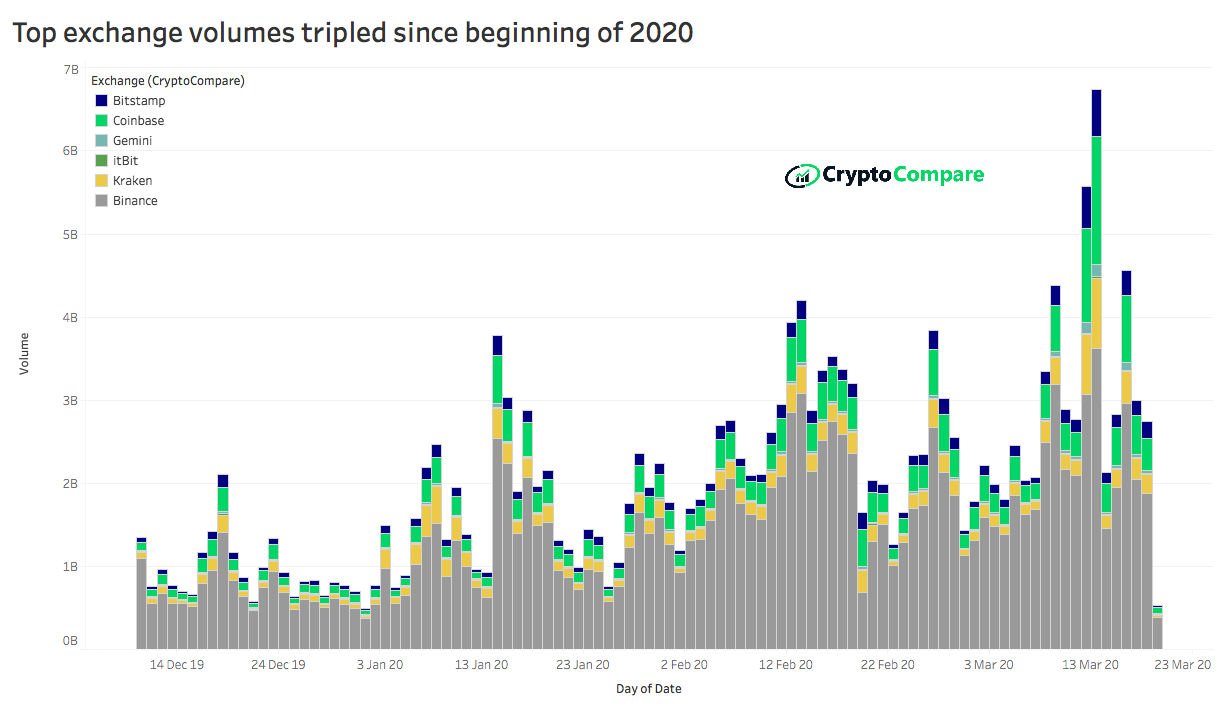

- A peak of 11,000 trades a second and 6 million per hour – a 200% increase from the average usage

- Over 2 million unique users of our data per day

- A total of 300 million calls to our API per day

- 18,000 connections to our streamers

The chart below shows how volumes have soared across crypto exchanges recently, pointing to a robust market place.

With volumes, data usage, and Google searches for Bitcoin soaring at such an important juncture in market history, crypto markets are far from falling apart.

The financial fallout from Covid-19 may prove to be one of the most serious economic events of the modern era. The pieces are in place, however, for Bitcoin and the digital asset ecosystem to prove their mettle.

Follow Us on Twitter Facebook Telegram

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Sergey Nivens