Bitcoin (BTC) has been trading between $7,182 and $7,261 over the past five hours, showing a snapshot of relatively stable price action on Thursday following the latest announcement from the US Federal Reserve, which is set to pump another $2.3 trillion into the American economy.

The move comes as the Fed seeks to stabilize the financial markets as well as rescue small and mid-size businesses, states and municipal governments pushed to the brink in the midst of the ongoing economic meltdown triggered by layoffs, lockdowns and stay-at-home orders due to the coronavirus pandemic.

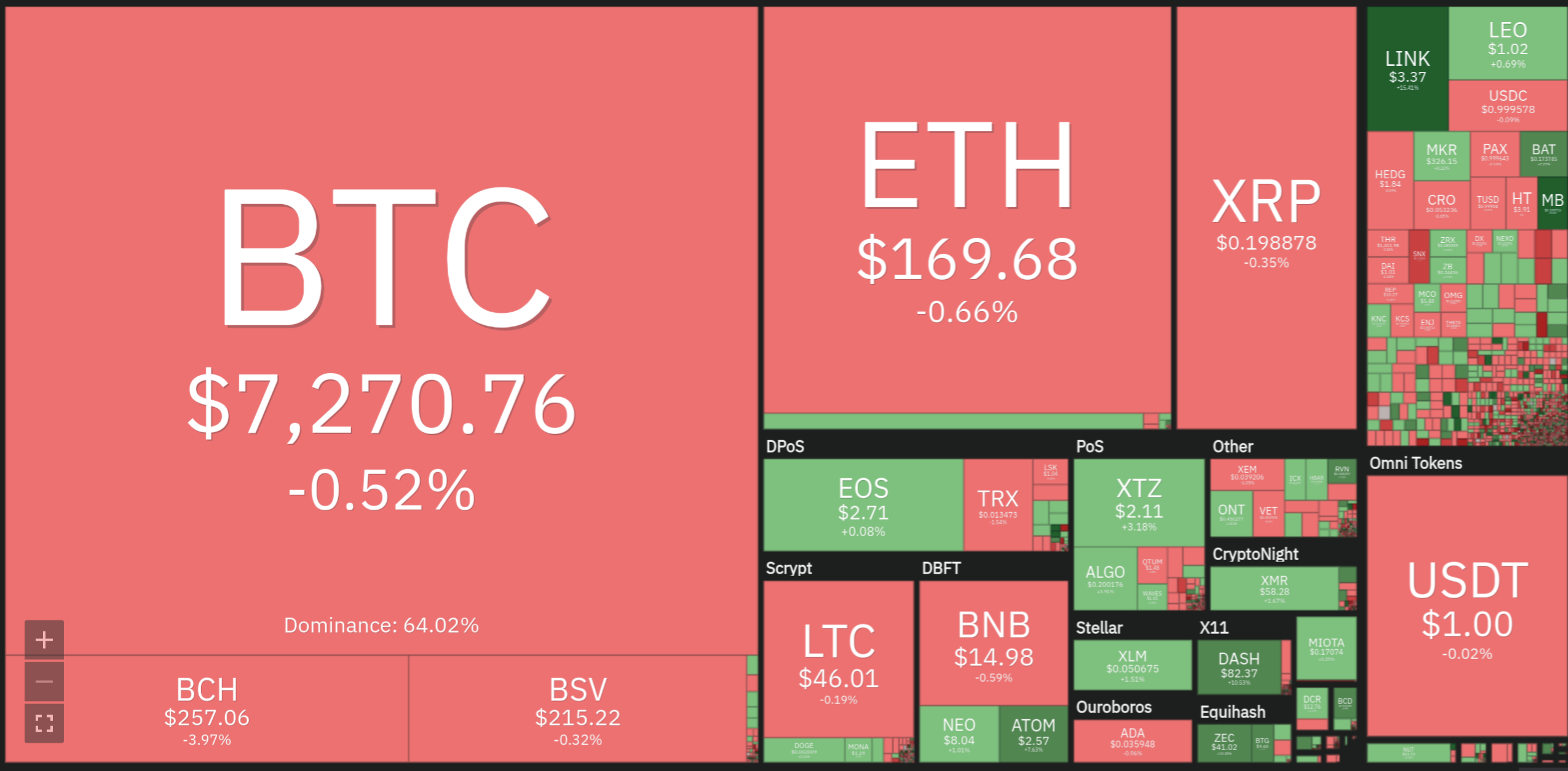

The three leading cryptocurrencies are all down less than one percent at time of writing, according to COIN360. Bitcoin is down 0.52% at $7,270, Ethereum is down 0.66% at $169.68 and XRP is down 0.35% at $0.19.

According to Federal Reserve Board Chair Jerome Powell, who spoke at an online event hosted by the Brookings Institute, the Fed will initiate a number of unprecedented actions, such as establishing a “Municipal Liquidity Facility” that will offer up to $500 billion in lending to states and municipalities.

Says Powell,

“Many of the programs we are undertaking to support the flow of credit rely on emergency lending powers…We will continue to use these powers forcefully, proactively, and aggressively until we are confident that we are solidly on the road to recovery.”

The Fed’s latest efforts are on top of slashing rates to nearly zero, purchasing mortgage-backed securities and government debt with tallies into the billions, and bolstering the $350-billion emergency loan program for small businesses in order to prevent more layoffs and shuttered doors on Main Street.

Crypto influencers are sounding the alarm bell.

Bitcoin educator and developer Jimmy Song says the Fed’s money printing will slam other countries the hardest.

“All this money printing will hurt the people in third world countries the most. USD demand in those countries will increase, their currencies will hyperinflate and our bureaucrats will wag their fingers at them for their bad monetary policy which was forced on them.”

Crypto analyst PlanB, who has popularized the application of the stock-to-flow model to predict the price of Bitcoin, is calling the Fed’s latest measures the last warning.

“Don’t think Central Bank don’t know what they are doing. CB know exactly what they are doing, and also how it ends. But they have no choice. Consider it your last warning signal, the canary in the coal mine. Protect yourself, buy stuff CB and governments can NOT print. #Bitcoin.”

Meanwhile, economist Joseph Stiglitz suggests business owners who don’t like the government’s proposals may roll the dice by declaring bankruptcy instead. He’s calling for ‘super Chapter 11’ procedures that are designed to keep companies in business to avoid systemic collapse.