HodlX Guest Post Submit Your Post

As the Federal Reserve unveiled an ‘unlimited’ quantitative easing plan, many in the crypto community became very excited, claiming that a zero interest rate will push investors to switch to digital currencies. But what does QE really mean for the future of Bitcoin?

The goal of quantitative easing is to make credit cheaper and jump-start the lagging economy. It’s been fairly effective in the past, and will be central banks’ most powerful weapon against the coronavirus recession.

However, a lot of people in the crypto space unjustly malign QE. They have a very simplistic idea of how QE works and how it will affect Bitcoin and other assets.

The general opinion among the crypto enthusiasts can be summed up like this:

‘Evil central banks will print mountains of money and make fiat currency valueless. Everyone will finally see that fiat money is a lie and switch to Bitcoin – the only asset that has real value. Mass adoption is coming!’

But how does this optimistic vision compare to reality? Will QE and zero interest rates really cause investors to dump fiat and switch to crypto? To understand this, we first need to recap how this money policy works.

Why use quantitative easing?

When things are going badly in an economy, the central bank needs to give it a push – an incentive for businesses to produce and hire workers, for people to spend money and buy homes, and so on. One way to do this is to make it cheaper to borrow money.

The problem is that banks won’t lower their lending rates on their own during a recession. The central bank needs to provide more resources to banks so that they can give out more loans – and at the same time drive interest rates down to make those loans affordable.

To achieve this, the central bank first creates more money. When we say that the Fed ‘prints’ more money, we don’t mean making actual paper bank notes on a printing press. The Fed and other central banks have a mechanism to generate money electronically out of thin air.

How can the rate go below zero?

Next, the central bank starts buying securities from banks – usually government bonds or mortgage-backed securities. The central bank’s demand for the bonds pushes their price up. However, the nominal interest rate on each bond remains unchanged, so the resulting actual yield goes down.

If the Fed keeps buying bonds, they can become so expensive that their actual interest rate will reach zero. And beyond that, it will turn negative. Denmark, Switzerland, Japan, and the European Central Bank already have below-zero rates.

The effects of zero interest rate

As a result of the Fed’s intervention, the banks now have a lot more money to lend to businesses and individuals. The money supply in the economy expands.

The rate on state bonds drags all the other interest rates behind it. Banks don’t lend money at a zero rate, because they still need to make a profit, but they have to cut rates on business loans, mortgages, credit card rates and so forth. This wide availability of cheap money should jump-start the economy.

Another positive result of QE is that the national currency loses some of its value. This will make the country’s products become cheaper in the international market, and exports will grow as a result.

A possible negative effect of QE is that money can lose some of its purchasing power. As people buy more, inflation will increase. However, in the 2008 crisis the Fed’s $1 trillion QE package didn’t lead to a rise in prices. In general, zero interest rate and inflation is a contentious subject. To learn more, check out this video.

Bitcoin vs other assets: where to invest in the era of QE

Now let’s look at the situation from the point of view of an investor. Here are your key options at the moment.

- Bonds – very safe, but you won’t earn any interest

- Bank deposit – safe, but just like with bonds, you won’t earn anything

- Gold – reasonably safe and will grow by 5-6%. However, the costs of purchasing and storing gold are high

- Commodities – oil, industrial metals, etc. With the current turmoil, it’s clearly a risky option, but the returns can be significant

- Bitcoin – volatility risks are exceptionally high, but Bitcoin ROI can exceed +50% in a year

- Stablecoins – a good way to store your money, but not a way to make a profit

Where would you put your money in times of crisis? The answer depends on your appetite for risk. Among various types of investors, only a minority will be motivated enough by the potentially high Bitcoin returns to make a large investment.

Risk-averse: these investors will still buy gold, bonds and blue-chip stocks. They are fully aware that the Bitcoin rate of return can be very high. Even so, they won’t switch to a cryptocurrency that can lose 40% of its value in one day. Whatever some crypto evangelists might say, Bitcoin is not a good hedging asset, as shown by the following Twitter exchange between Gemini founder Tyler Winklevoss and crypto trader Josh Rager.

https://twitter.com/Josh_Rager/status/1239373607027032065

Medium appetite for risk: they might put a share of their money in Bitcoin. The rest will go into less risky assets that can grow rapidly once the economy recovers – such as palladium, which gained 90% between February of 2019 and February of 2020.

High appetite for risk and familiar with crypto: they already own Bitcoin and will buy more this year. Those who are ready to risk even more might join a crypto lending platform to earn an additional Bitcoin interest rate on their deposit. However, these investors would buy BTC anyway.

High appetite for risk and not familiar with crypto: these investors are now looking into Bitcoin, attracted by the optimistic Bitcoin price forecast for the period after the halving in May. This is where most of the new investment will come from.

Will investors really turn to Bitcoin?

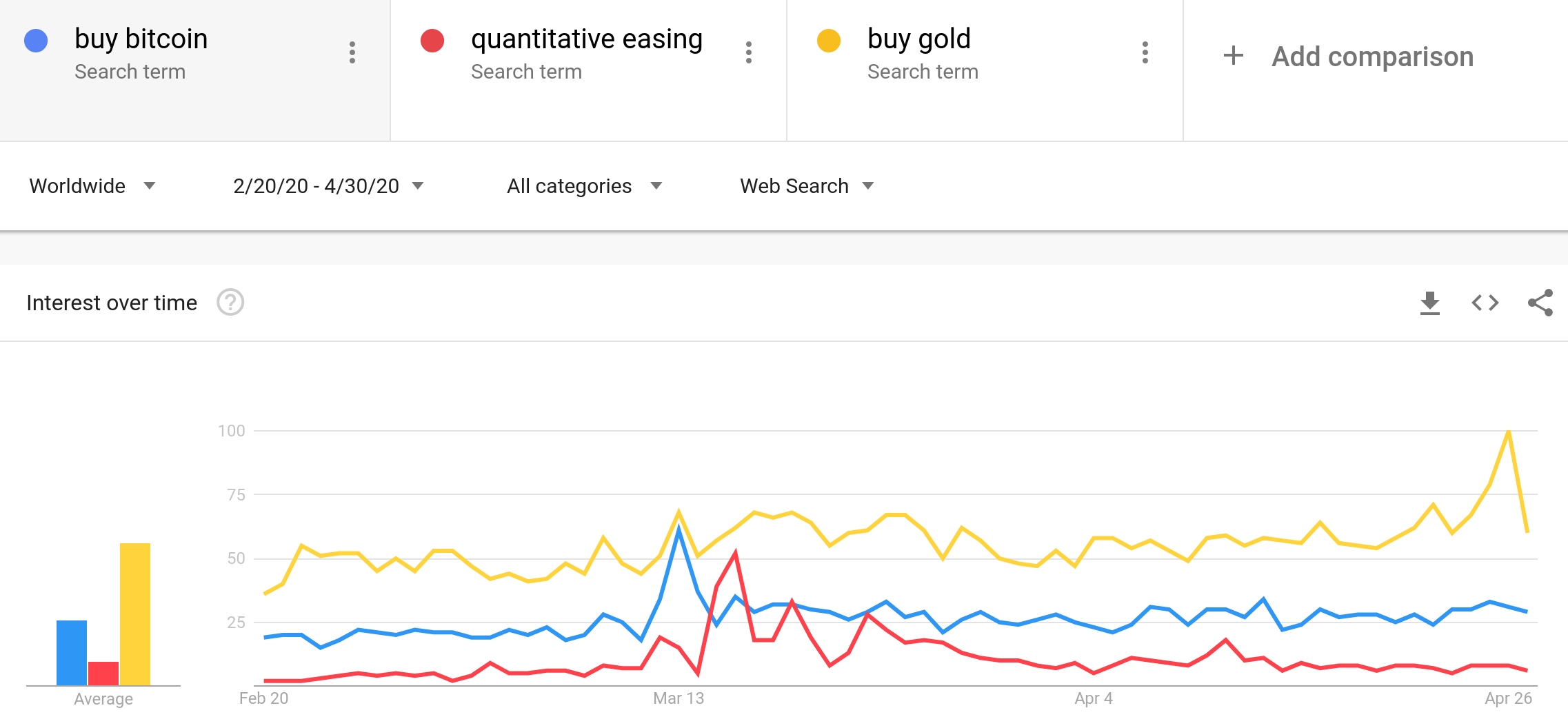

How many people will buy Bitcoin because of the QE measures and low interest rates? Perhaps not as many as crypto enthusiasts like to think. This chart from Google Trends shows the relative number of global Google searches for ‘buy Bitcoin’, ‘buy gold’ and ‘quantitative easing’.

As you can see, the interest in buying both gold and BTC started growing in March, as the coronavirus emergency spread to Europe and the US. The peak of interest in QE fell on March 15, when the Fed cut the borrowing rate for banks to near zero. There were smaller peaks on March 19 (a QE announcement by the Bank of England) and March 23 (further measures by the Fed).

The interest in buying Bitcoin doesn’t closely follow the line of searches for QE – but it roughly trails the searches for ‘buy gold’ searches. However, the interest in BTC stays far below gold. In fact, the only time when searches for Bitcoin reached the same level as for gold was when BTC dipped below $5,000 after the liquidation crisis on BitMEX.

Which conclusions can we draw from this data? More people started looking into how to buy Bitcoin as new QE measures were introduced. But there are far more investors interested in buying gold. Clearly, the desire for safety is stronger at the moment than the desire for a quick profit.

This aversion to risk is confirmed by the behavior of businesses that accept crypto payments. For example, among the 220+ clients of the global payment provider Cryptoprocessing.com, over half choose to convert their crypto revenue into fiat immediately instead of storing it in BTC. This has nothing to do with the risk of crypto theft: the platform provides secure cold storage. Rather, many companies simply don’t want to keep Bitcoin on their books, in spite of the potential gain.

The bottom line

Will the price of Bitcoin grow this year? Yes, most likely. But will zero interest rates and QE cause a mass exodus of investors from traditional markets and into crypto? Not really.

Clearly, there will be a massive redistribution of investment capital this year. Money will flow out from stocks, oil and bonds – but only a small share will go into Bitcoin, at least in the next three or four months. The current atmosphere of anxiety isn’t conducive to risky investments – and we all know how risky Bitcoin is.

BTC has a chance to win over investors’ trust if it manages to stay up after the halving. But if it goes into a new nosedive along the way – as it easily can – profit-seeking investors are much more likely to buy into growth commodities, such as rare metals.

Bitcoin can still outperform most traditional assets this year. But it will be thanks to the positive effect of the halving and other internal forces – not QE, zero interest rates or coronavirus.

Follow Us on Twitter Facebook Telegram

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Inked Pixels