Changpeng Zhao, the chief executive of crypto exchange Binance, says internal data shows active crypto traders have lower returns than investors who buy and hold for the long run.

In a new series of Tweets, Zhao replies to a follower’s query on the best approach to crypto investing.

“Not financial advice, data shows more holders outperform traders. But holding is hard. Trading makes you feel like you are in control. Holding feels passive.”

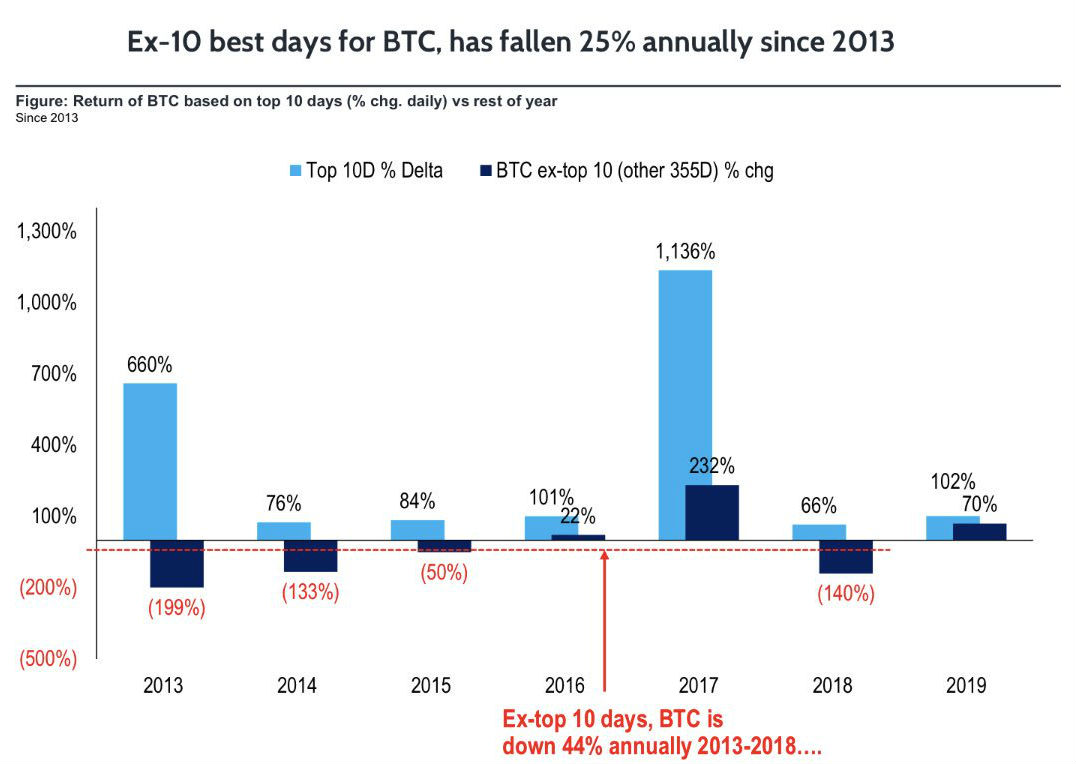

A 2019 study on the equities markets found similar results, revealing that over a 15-year period, a passive investment strategy consistently outshined active trading. As for the crypto markets, Tom Lee of the research firm Fundstrat says most of Bitcoin’s gains come in the cryptocurrency’s 10 best days of the year, which highlights the difficulty in timing the BTC market.

“Before everyone starts freaking out whether crypto winter is over, remember the Fundstrat ‘rule of 10 best days.’ [Minus Bitcoin’s] 10 best days, BTC is down 25% per year. All the gains come in 10 days. Are you that good at trading?”

Zhao also says he believes crypto investors have time on their side and shouldn’t worry about missing the boat.

“Everyone I have met that got into crypto, thinks they got in too late, no exceptions, myself included, until 5 years later. I expect the same will be true in 2025. We are still early in the game.

Not financial advice. And don’t trade if you are not a trader. hodl.”