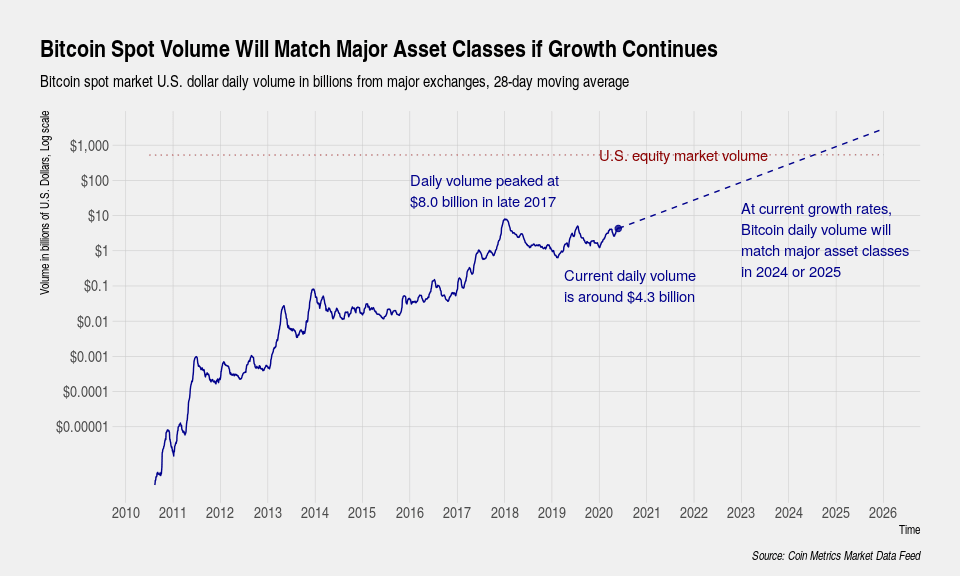

Coin Metrics says if past is prologue, it won’t be too long until Bitcoin’s trading volume matches other major asset classes.

In a new report, the crypto analytics firm compares BTC’s current trading volume to US equities, bonds and global FX markers.

Bitcoin’s daily spot market volume is only $4.1 billion. In comparison, the daily volume of the US equity spot market is $446 billion, $893 billion for the US bond spot market and $1.98 trillion for the global foreign exchange spot market.

Based on these numbers, Coin Metrics says Bitcoin has a lot of room to grow, and is currently more comparable to that of a large capitalization stock than of a distinct asset class.

“If historical growth rates can be maintained, however, Bitcoin’s current daily volume from spot markets of $4.3 billion would need fewer than 4 years of growth to exceed daily volume of all U.S. equities. Fewer than 5 years of growth are needed to exceed daily volume of all U.S. bonds.”

Coin Metrics says current market conditions appear favorable to the top cryptocurrency, concluding store-of-value assets such as Bitcoin are likely to hold up in the current macro environment.

“On the margin, the policy response to the coronavirus, the protest-related civil unrest in the United States, and the potential for a re-escalation of the trade war between the United States and China should be supportive for store-of-value assets such as Bitcoin.”

The report also points out the high level of correlation between gold and Bitcoin.