On-chain data suggests that the much-feared post-halving miner capitulation, which has been blamed for large sell-offs in the past, is now over as miners begin to favor accumulation.

The blockchain analytics platform CryptoQuant says that its Miners’ Position Index (MPI), a metric that offers insight on whether BTC miners are selling or holding onto their coins, has plummeted nearly a month after the third Bitcoin halving.

A high MPI reading indicates that miners are selling while a low MPI value marks miner accumulation. On May 10th, the day before the third halving, the MPI soared to its 2020 high of -0.275. By June 1st, the metric plunged nearly 200% to -0.752.

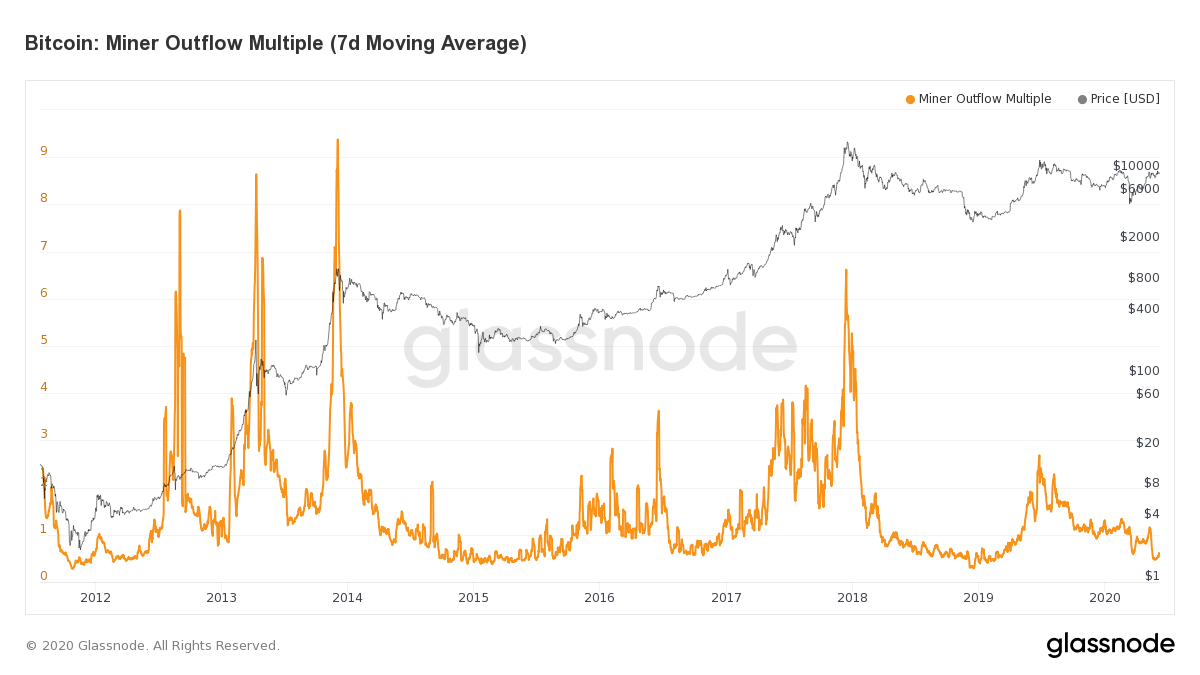

Meanwhile, data from crypto intelligence firm Glassnode supports the notion that BTC miners are in accumulation mode. Glassnode’s Miner Outflow Multiple reads at 0.613, a value that mirrors the bear market bottom of December 2018 when miners accumulated Bitcoin at $3,000.

BTC miners are some of the biggest whales in the market and their activity can have a significant impact on the value of the leading cryptocurrency.

A month after the second halving in 2016, Bitcoin’s value dropped by over 30%. Coming into the third halving, many feared that history will repeat itself but so far, BTC has avoided a significant retracement.