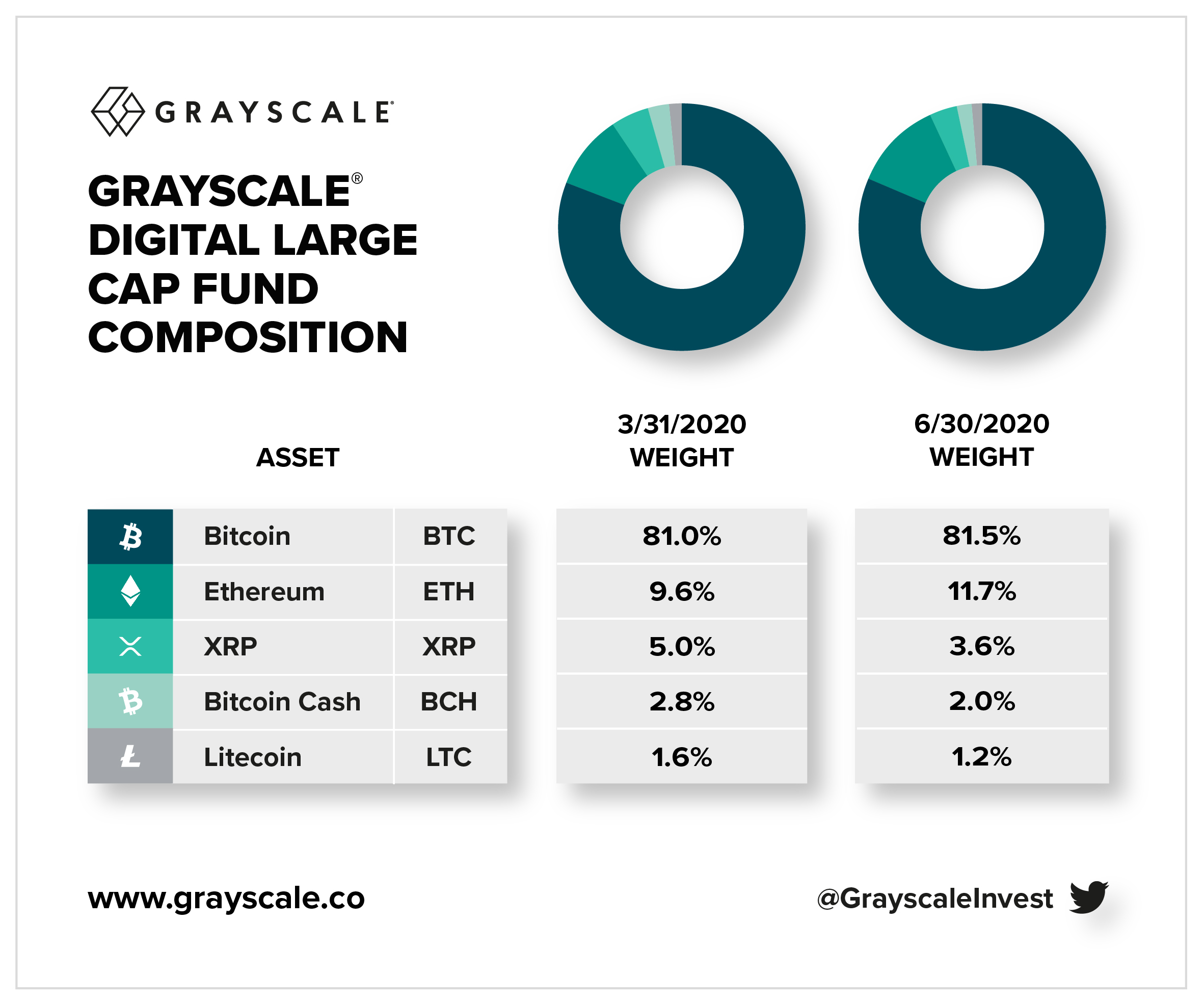

Crypto asset management firm Grayscale Investment is increasing the weights of Bitcoin (BTC) and Ethereum (ETH) in its digital large-cap fund (DLC) product at the expense of XRP, Bitcoin Cash (BCH), and Litecoin (LTC).

In a series of tweets, Grayscale illustrates the new composition of its DLC fund – an investment option product that offers exposure to Bitcoin, Ethereum, XRP, Bitcoin Cash, and Litecoin.

The world’s leading crypto asset manager reveals that between March 31st to June 30th, it tweaked its DLC holdings and added 0.5% weight in BTC and 2.1% weight in Ethereum. Meanwhile, the investment firm decreased the shares of XRP by 1.4%, Bitcoin Cash by 0.8%, and Litecoin by 0.6% over the same period.

The digital asset investment firm announced the updated weightings for its DLC after releasing the fund’s latest quarterly review on June 30th. The firm’s net assets under management (AUM) in its digital large-cap fund stands at $33 million.

As of July 10th, Grayscale manages $4.1 billion worth of crypto investments, which include $3.55 billion in Grayscale Bitcoin Trust (GBTC) and $410.1 million in Grayscale Ethereum Trust (ETHE).

07/10/20 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $4.1 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $XRP $ZEC pic.twitter.com/bJEObTjJj1

— Grayscale (@Grayscale) July 10, 2020

Grayscale’s current AUM of $4.1 billion represents a whopping 250% increase from its total crypto investments of $1.17 billion at the end of 2019.

The influx of investment capital in Grayscale’s crypto products in the first six months of this year significantly outweighs all the investments from 2013 – 2019 combined.