Tether (USDT) could soon replace Bitcoin as the dominant currency on public blockchains, says Ryan Watkins, a research analyst at the crypto analytics firm Messari.

Watkins highlights the fact that the overall stablecoin monetary base significantly grew in the first half of 2020. In the first quarter, the stablecoin monetary base surged by $2.4 billion and another $3.8 billion in the second quarter to bring the base to a total of over $12 billion.

The Messari researcher notes that Tether grew by $3.5 billion en route to becoming the first stablecoin to move above $10 billion.

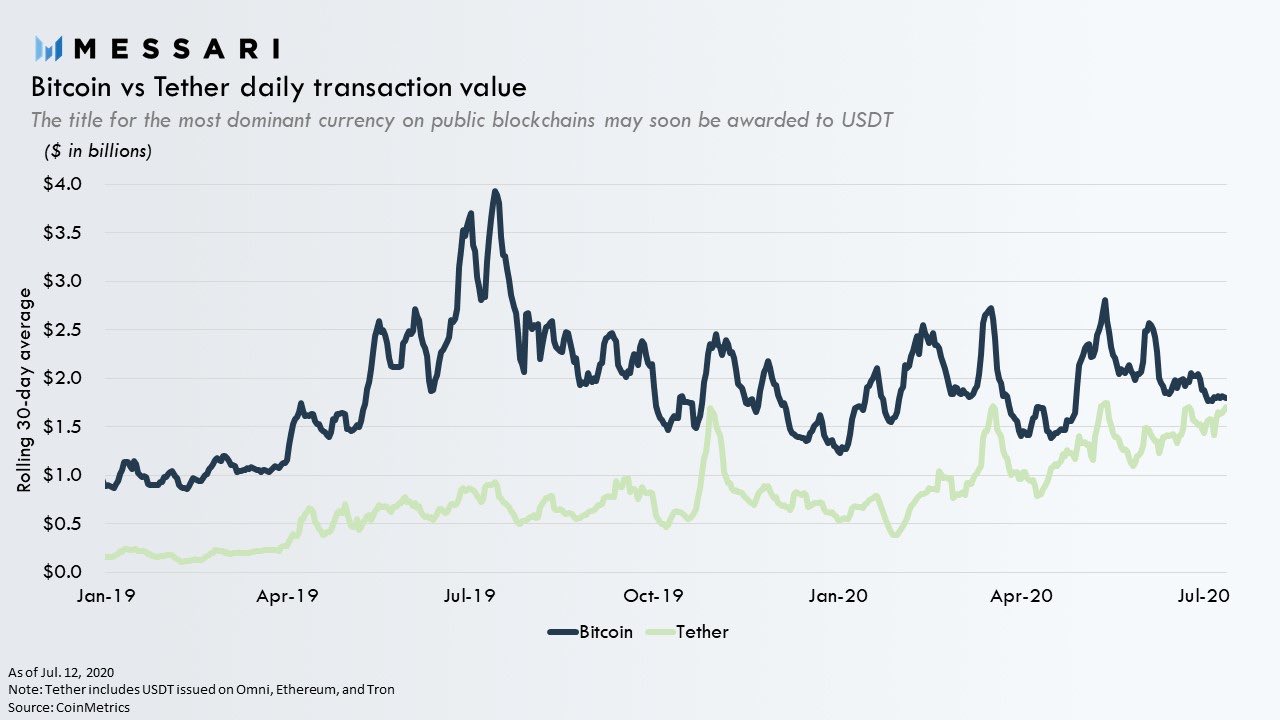

The dominant stablecoin is also closing in on Bitcoin in terms of daily transaction value.

Tether isn’t the only stablecoin to see gains. Watkins says sUSD (synthetic US dollar) has the fastest relative growth in the pegged-asset market. The so-called “synths” allow traders to place market bets on Synthetix, a derivatives trading platform built on the Ethereum blockchain. According to Watkins, sUSD benefited from the growth of decentralized finance (DeFi) and a low starting base.

The research analyst also says that, overall, stablecoins are on pace to transact $508 billion in 2020, which would be more than double the total transaction volume in 2019.

In Q2 2020 public blockchains settled $144 billion in stablecoin transactions.

— Ryan Watkins (@RyanWatkins_) July 20, 2020

Including the 12 extra days after the quarter ended, public blockchains have settled $270 billion in stablecoin transactions YTD, implying a 2020 run-rate transaction volume of $508 billion. pic.twitter.com/Z8KWXNsk6t

Tether and other stablecoins have exploded in 2020, particularly in the wake of the economic woes caused by the coronavirus pandemic.